Get the free Doctrine of intergovernmental tax immunity Worcester, MA ...

Show details

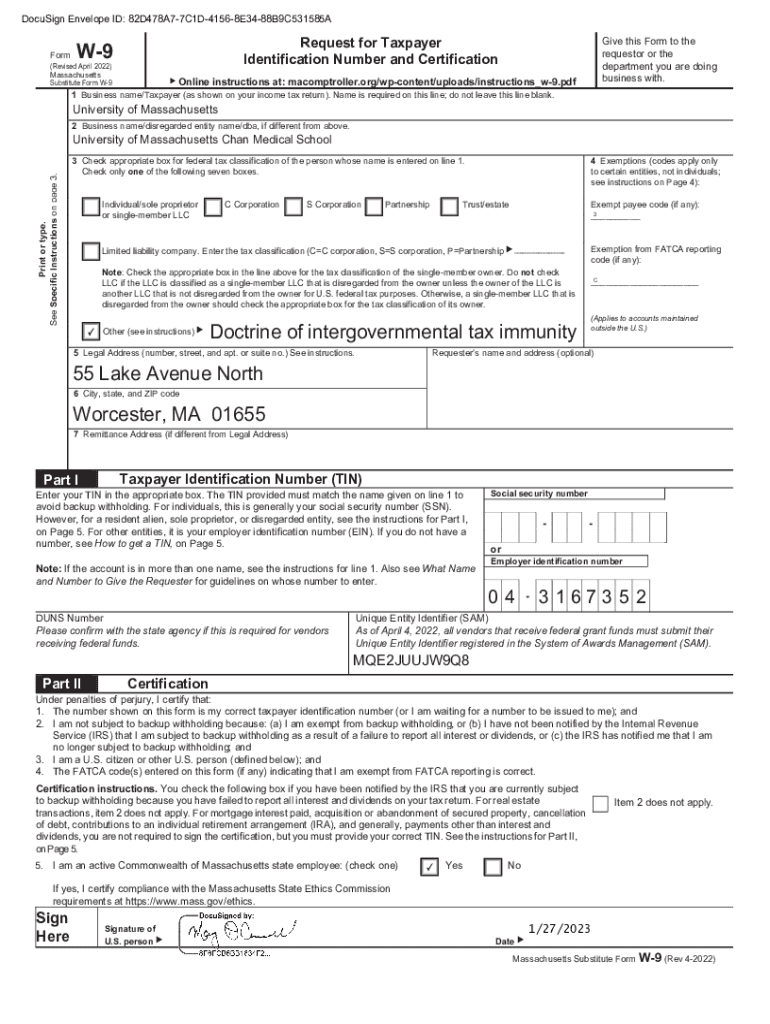

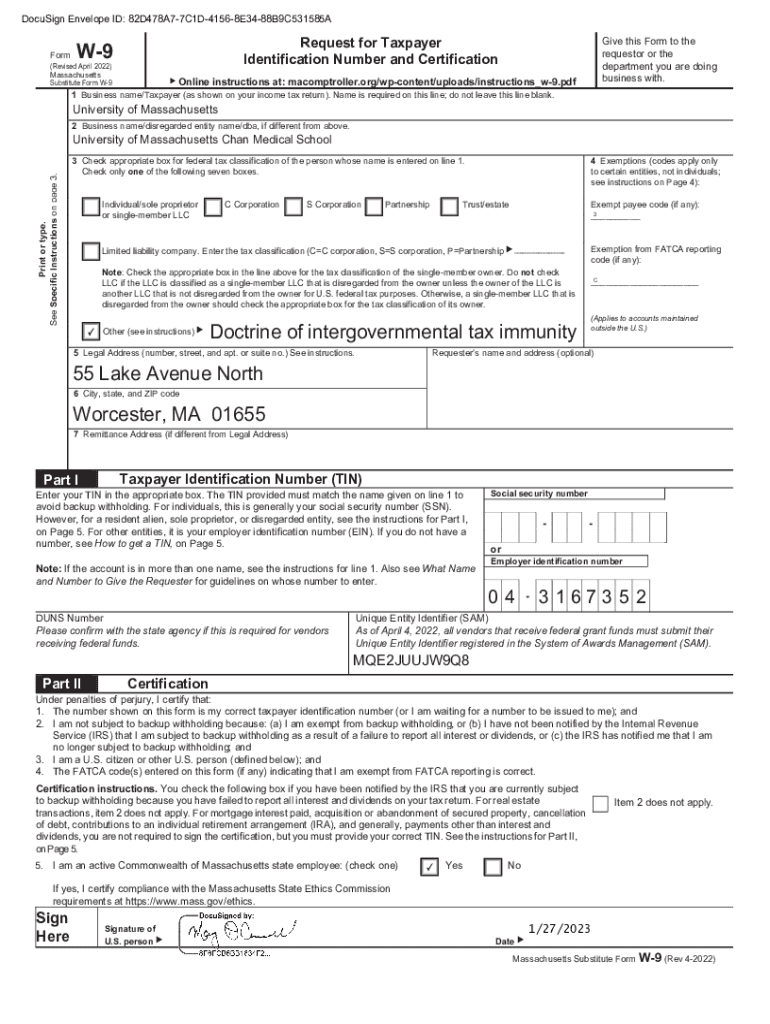

DocuSign Envelope ID: 82D478A77C1D41568E3488B9C531585A FormRequest for Taxpayer Identification Number and CertificationW9(Revised April 2022) Massachusetts Substitute Form W9Give this Form to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign doctrine of intergovernmental tax

Edit your doctrine of intergovernmental tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your doctrine of intergovernmental tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit doctrine of intergovernmental tax online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit doctrine of intergovernmental tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out doctrine of intergovernmental tax

How to fill out doctrine of intergovernmental tax

01

Understand the purpose and requirements of the doctrine of intergovernmental tax.

02

Gather all relevant information pertaining to the tax agreements between different levels of government.

03

Fill out the necessary fields in the doctrine by providing accurate and up-to-date information.

04

Review the completed form for any errors or missing information.

05

Submit the filled out doctrine of intergovernmental tax to the appropriate authorities for review and approval.

Who needs doctrine of intergovernmental tax?

01

Government officials involved in tax policy and administration.

02

Tax professionals and lawyers specializing in intergovernmental tax agreements.

03

Businesses operating in multiple jurisdictions that are affected by various levels of government taxation.

04

Citizens concerned with understanding how taxes are shared and coordinated between different levels of government.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit doctrine of intergovernmental tax from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your doctrine of intergovernmental tax into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit doctrine of intergovernmental tax online?

The editing procedure is simple with pdfFiller. Open your doctrine of intergovernmental tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete doctrine of intergovernmental tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your doctrine of intergovernmental tax. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is doctrine of intergovernmental tax?

The doctrine of intergovernmental tax refers to the principles governing taxation in a system where multiple levels of government have the authority to levy taxes.

Who is required to file doctrine of intergovernmental tax?

Government agencies or entities that are responsible for collecting taxes at different levels of government are required to file the doctrine of intergovernmental tax.

How to fill out doctrine of intergovernmental tax?

The doctrine of intergovernmental tax is typically filled out by providing detailed information about the taxes collected by each level of government, as well as any intergovernmental agreements regarding tax sharing or coordination.

What is the purpose of doctrine of intergovernmental tax?

The purpose of the doctrine of intergovernmental tax is to ensure transparency and accountability in the collection and distribution of tax revenue across different levels of government.

What information must be reported on doctrine of intergovernmental tax?

The doctrine of intergovernmental tax typically requires information on the types of taxes levied, tax revenues collected, any tax-sharing agreements, and details of any intergovernmental tax coordination.

Fill out your doctrine of intergovernmental tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Doctrine Of Intergovernmental Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.