Get the free Dependents (in column B, enter &quot - dor ms

Instructions and Help about dependents in column b

How to edit dependents in column b

How to fill out dependents in column b

Latest updates to dependents in column b

All You Need to Know About dependents in column b

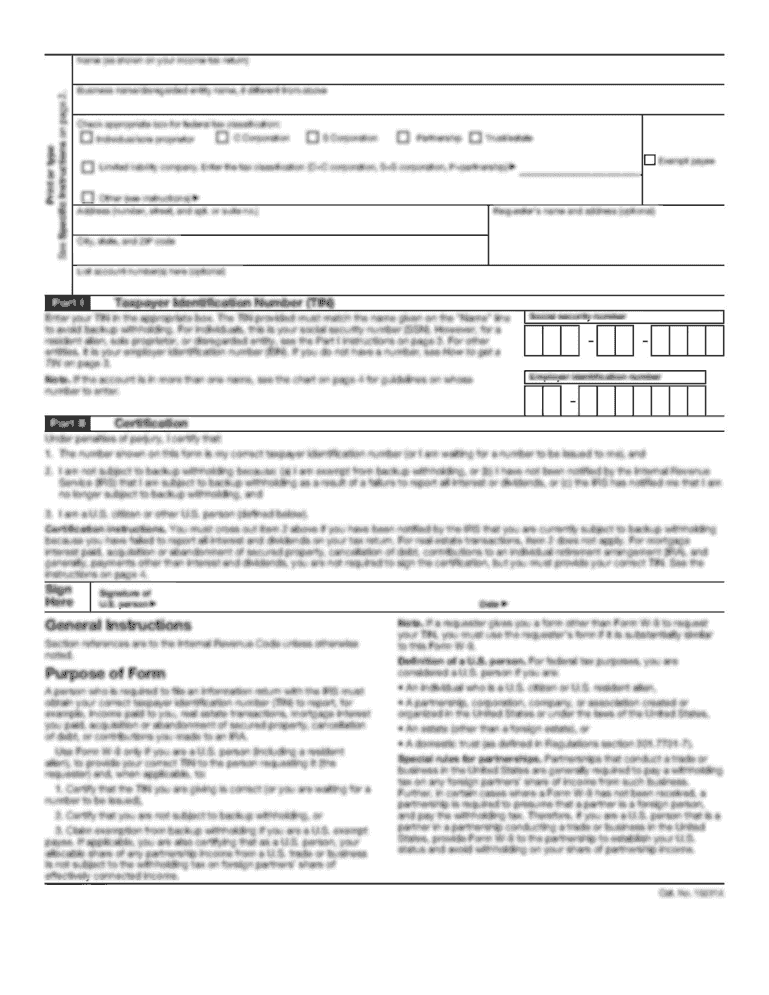

What is dependents in column b?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about dependents in column b

How can I correct mistakes in my dependents in column b form?

To correct mistakes in your dependents in column b, you must submit an amended form. It’s crucial to clearly mark it as corrected and include a brief explanation of the changes. Ensure you file this correction as soon as you identify the error to maintain compliance.

What steps can I take to verify the receipt or processing of my dependents in column b submission?

To verify the receipt of your dependents in column b submission, you can check your filing status through the IRS online portal or contact their support. If e-filing, watch out for common rejection codes that may indicate issues that need resolution before proceeding.

Are there any special considerations for filing dependents in column b for nonresidents?

Yes, nonresidents may have different filing requirements for dependents in column b. It's essential to ensure you're aware of specific regulations that apply, including any treaties that might affect your filings. Consulting a tax professional can provide tailored guidance for these situations.

What should I do if I receive a notice regarding my dependents in column b filing?

If you receive a notice about your dependents in column b, carefully read the correspondence to understand the issue. Prepare any necessary documentation and respond within the specified timeframe, to clarify or support your original submission.

Can I e-file my dependents in column b using mobile devices?

E-filing your dependents in column b is possible on mobile devices, provided you use compatible software or apps that facilitate such filings. Ensure your device meets all technical requirements for a smooth submission process.