PA REV-1737-1 2015 free printable template

Show details

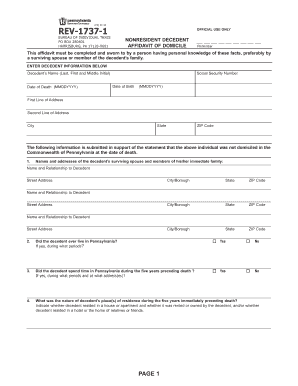

EX (03-15) REV-1737-1 Bureau of Individual Taxes OFFICIAL USE ONLY NONRESIDENT DECEDENT AFFIDAVIT OF DOMICILE PO BOX 280601 Harrisburg, PA 17128-0601 County Code Year File Number This affidavit must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-1737-1

Edit your PA REV-1737-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1737-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-1737-1 online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA REV-1737-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1737-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1737-1

How to fill out PA REV-1737-1

01

Step 1: Obtain a copy of PA REV-1737-1 form from the Pennsylvania Department of Revenue website.

02

Step 2: Start filling out the taxpayer identification information in the provided sections.

03

Step 3: Specify the type of income that is being reported on the form.

04

Step 4: Calculate any deductions or credits applicable to the income by following the instructions attached to the form.

05

Step 5: Review all entered information to ensure accuracy and completeness.

06

Step 6: Sign and date the form at the designated area.

07

Step 7: Submit the completed PA REV-1737-1 form by the specified deadline, either electronically or by mail.

Who needs PA REV-1737-1?

01

Individuals or entities filing for tax credits or exemptions in Pennsylvania.

02

Taxpayers who require adjustments on their tax accounts or seek to report changes in their income.

03

Business owners needing to report business income or apply for specific tax incentives.

Fill

form

: Try Risk Free

People Also Ask about

Do non residents pay Pennsylvania inheritance tax?

In the case of a nonresident decedent, all real property and tangible personal property located in Pennsylvania at the time of the decedent's death is taxable. Intangible personal property of a nonresident decedent is not taxable.

How do I avoid Pennsylvania inheritance tax?

How To Avoid Inheritance Tax. One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

What assets are not subject to pa inheritance tax?

The most important exemption is for property that is owned jointly by a husband and wife. Therefore, if you and your spouse own all of your property jointly, upon death of the first spouse there will be no Pennsylvania inheritance tax.

Where do I mail my pa inheritance tax return?

Inheritance tax forms are due within 9 months from date of death. Two copies must be sent back to ROW at 55 East Court Street, 6th Floor, Doylestown, PA, 18901.

Who has to pay inheritance tax in PA?

The rates for Pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

Who has to file pa inheritance tax return?

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA REV-1737-1 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your PA REV-1737-1 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete PA REV-1737-1 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your PA REV-1737-1. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete PA REV-1737-1 on an Android device?

Use the pdfFiller mobile app to complete your PA REV-1737-1 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is PA REV-1737-1?

PA REV-1737-1 is a form used by taxpayers in Pennsylvania to report specific tax-related information as required by the Pennsylvania Department of Revenue.

Who is required to file PA REV-1737-1?

Individuals and businesses that are required to report certain tax information or claim specific tax benefits in Pennsylvania must file PA REV-1737-1.

How to fill out PA REV-1737-1?

To fill out PA REV-1737-1, taxpayers must provide their personal or business information, detail the applicable tax information, and follow the instructions provided on the form.

What is the purpose of PA REV-1737-1?

The purpose of PA REV-1737-1 is to facilitate the reporting and processing of tax information used by the Pennsylvania Department of Revenue for tax assessment and compliance purposes.

What information must be reported on PA REV-1737-1?

The information that must be reported on PA REV-1737-1 includes taxpayer identification, details of income, deductions, credits, and any other relevant tax-related data as outlined by the form's instructions.

Fill out your PA REV-1737-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1737-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.