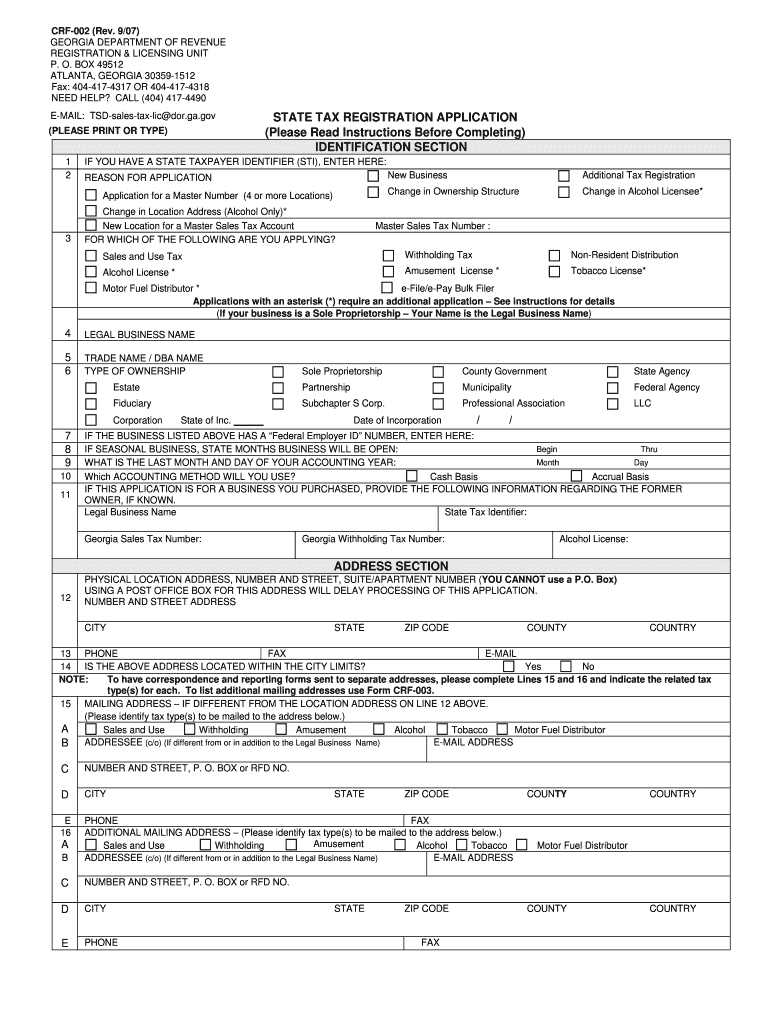

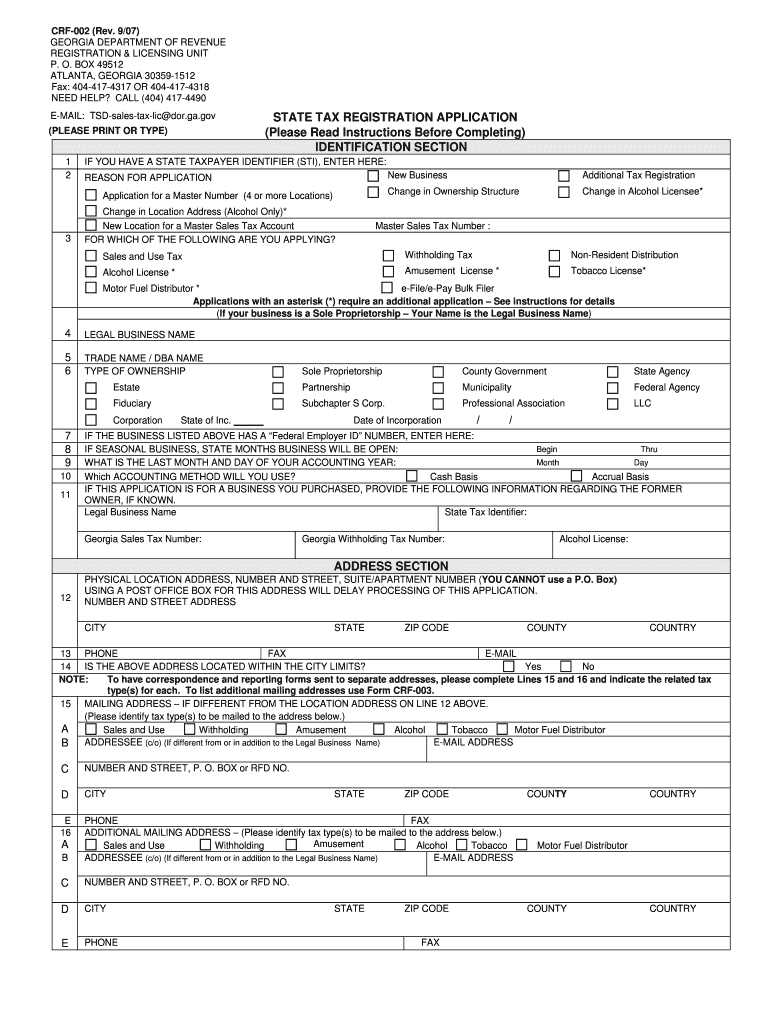

Get the free STATE TAX REGISTRATION APPLICATION

Show details

A form for businesses to register for state taxes in Georgia, including options for sales tax, withholding tax, and various licenses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state tax registration application

Edit your state tax registration application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state tax registration application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state tax registration application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state tax registration application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state tax registration application

How to fill out STATE TAX REGISTRATION APPLICATION

01

Obtain a copy of the STATE TAX REGISTRATION APPLICATION form from the state’s tax department website or office.

02

Provide your legal business name, address, and contact information in the designated fields.

03

Select the type of business entity you are registering (e.g., sole proprietorship, partnership, corporation).

04

List the owners or responsible parties, including their names, addresses, and Social Security numbers or federal tax identification numbers.

05

Specify the type of tax you are registering for (e.g., sales tax, income tax, employment tax).

06

Complete any additional sections or questions as required by your state’s application form.

07

Review the completed application for accuracy and completeness.

08

Submit the application via mail or online, depending on your state’s requirements, along with any applicable fees.

Who needs STATE TAX REGISTRATION APPLICATION?

01

Any business entity operating within the state that intends to sell goods or services subject to state tax.

02

Self-employed individuals who need to collect taxes on their services.

03

Companies with employees that need to withhold state income tax from wages.

04

Businesses expanding their operations into a new state.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to register a business in Wisconsin?

By default, LLCs don't pay taxes. Instead, the LLC Members are responsible for reporting the income (or losses) on their personal 1040 tax return.

Where do I get a tax registration number?

A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS.

Do I have to register my business in Wisconsin?

Permit/Certificate Descriptions: Seller's Permit: A seller's permit is required for every individual, partnership, corporation, or other organization making retail sales, leases, or rentals of taxable products or providing taxable services in Wisconsin, unless all sales are exempt from sales or use tax.

What is a Missouri tax registration application?

This is a joint application between the Missouri Department of Revenue and the Missouri Department of Labor and Industrial Relations to register businesses for sales tax and employee withholding taxes. This streamlined process allows you to fulfill multiple registration requirements in one application.

Do I need to register for sales tax in every state?

In the US, you are required to register for sales tax in each state in which you have met the physical or economic nexus standards or any other requirement of the state. For out-of-state sellers, economic nexus is generally the applicable standard for determining when to register to collect sales tax.

What is Wisconsin business tax registration?

A Business Tax Registration (BTR) is required for most new employers in Wisconsin. The registration is completed using Form BTR-101, which covers withholding tax and other state tax obligations. Without obtaining a BTR, employers cannot report or pay state payroll taxes.

How do I get a Kansas sales tax registration number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

What taxes does an LLC pay in Wisconsin?

You need an EIN if you: Have employees. Will need to pay employment, excise or alcohol, tobacco, and firearms taxes. Withhold taxes on income, other than wages, paid to a non-resident alien.

How to get a Kansas sales tax registration number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

Do I need a business tax registration in Wisconsin?

Although there is no statewide business license, most businesses will need to complete the Business Tax Registration (BTR) with the Wisconsin Department of Revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STATE TAX REGISTRATION APPLICATION?

The STATE TAX REGISTRATION APPLICATION is a formal document that businesses and individuals use to register with the state tax authority for the purpose of collecting and remitting state taxes.

Who is required to file STATE TAX REGISTRATION APPLICATION?

Individuals and businesses that intend to sell goods or services subject to state taxes, such as sales tax or income tax, are required to file a STATE TAX REGISTRATION APPLICATION.

How to fill out STATE TAX REGISTRATION APPLICATION?

To fill out a STATE TAX REGISTRATION APPLICATION, you need to provide basic information such as your business name, address, type of business, ownership details, and the types of taxes you will collect or pay.

What is the purpose of STATE TAX REGISTRATION APPLICATION?

The purpose of the STATE TAX REGISTRATION APPLICATION is to officially register a business with the state to ensure compliance with tax obligations and to enable the collection of state taxes.

What information must be reported on STATE TAX REGISTRATION APPLICATION?

The information that must be reported on the STATE TAX REGISTRATION APPLICATION typically includes the business name, business address, owner's name, Social Security number or Employer Identification Number (EIN), type of business entity, and the type of taxes the business will be responsible for.

Fill out your state tax registration application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Tax Registration Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.