AZ CCA-0218A 2019-2026 free printable template

Show details

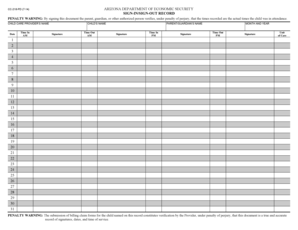

ARIZONA DEPARTMENT OF ECONOMIC SECURITYCCA0218A LORNA (1019)Page 1 of 2SIGNIN/SNOUT RECORD

PENALTY WARNING: By signing this document the parent, guardian, or other authorized person verifies, under

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ CCA-0218A

Edit your AZ CCA-0218A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ CCA-0218A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ CCA-0218A online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ CCA-0218A. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ CCA-0218A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ CCA-0218A

How to fill out AZ CCA-0218A

01

Obtain the AZ CCA-0218A form from the official website or relevant office.

02

Provide your personal information in the designated fields, including your name, address, and contact information.

03

Fill out the section regarding your business details if applicable, including legal business name and tax identification number.

04

Complete the income details section, ensuring you accurately report your income sources.

05

Review all filled sections for accuracy and completeness.

06

Sign and date the form at the specified section.

07

Submit the form by the deadline, either in person or via the specified mailing address.

Who needs AZ CCA-0218A?

01

Individuals or businesses that are required to report specific tax information to the Arizona Department of Revenue.

02

Tax professionals assisting clients with tax submissions for Arizona tax obligations.

03

Any entity seeking to comply with Arizona tax laws regarding income reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is des for the government?

DES administers a broad range of programs related to children's services, guardianship and adoption, child support enforcement, developmental disabilities, vocational rehabilitation, domestic violence, adult protective services, medical assistance eligibility, nutritional assistance, independent living, employment

How do I contact Arizona unemployment?

Call Center Phone Numbers Toll Free: 1 (877) 600-2722. Phoenix: (602) 364-2722. Tucson: (520) 791-2722. Telecommunications Relay Service for the Deaf/Hard of Hearing: 711 Toll-Free.

How can I check the status of my food stamp case Arizona?

To leave a message regarding the status of a request, please call (602) 771-2047.

How do I contact Arizona Department of Economic Security?

If you have any questions, you may call 1-855-432-7587, Monday through Friday 7:00 a.m. - 6:00 p.m.

What does DES mean in government?

The Department of Economic Security (DES) is the safety net agency for the State of Arizona. As one of the largest agencies in state government, DES serves more than 2 million Arizonans annually through more than 40 programs that address the social and economic needs of those we serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AZ CCA-0218A without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AZ CCA-0218A, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in AZ CCA-0218A?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your AZ CCA-0218A to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my AZ CCA-0218A in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your AZ CCA-0218A and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is AZ CCA-0218A?

AZ CCA-0218A is a form used by businesses in Arizona to report transaction privilege taxes, specifically related to the sale of taxable goods and services.

Who is required to file AZ CCA-0218A?

Businesses that engage in taxable sales of goods or services in Arizona are required to file AZ CCA-0218A if they meet the threshold for reporting transaction privilege taxes.

How to fill out AZ CCA-0218A?

To fill out AZ CCA-0218A, businesses must provide details such as their business name, tax identification number, total taxable sales, and the amount of tax due, along with any deductions claimed.

What is the purpose of AZ CCA-0218A?

The purpose of AZ CCA-0218A is to facilitate the collection of transaction privilege taxes owed to the state of Arizona from businesses operating within its jurisdiction.

What information must be reported on AZ CCA-0218A?

AZ CCA-0218A requires reporting information such as business details, gross sales, adjusted taxable sales, tax rates applicable, tax calculations, and any exemptions or deductions applied.

Fill out your AZ CCA-0218A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ CCA-0218a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.