Get the free Schedule E - Creditors Holding Unsecured Priority Claims

Show details

A legal document listing the creditors holding unsecured priority claims against a debtor, as part of a bankruptcy filing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule e - creditors

Edit your schedule e - creditors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule e - creditors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule e - creditors online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule e - creditors. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule e - creditors

How to fill out Schedule E - Creditors Holding Unsecured Priority Claims

01

Begin with your debtor information at the top of the form including your name and case number.

02

List the name and address of each creditor holding an unsecured priority claim.

03

Specify the type of claim and amount owed to each creditor.

04

Provide supporting documentation for each claim if necessary, such as bills or contracts.

05

Double-check the information for accuracy to ensure it matches other bankruptcy filings.

06

Sign and date the form where indicated before filing it with the bankruptcy court.

Who needs Schedule E - Creditors Holding Unsecured Priority Claims?

01

Individuals or businesses filing for bankruptcy protection under Chapter 7 or Chapter 13.

02

Debtors who have unsecured priority claims against them that need to be reported in their bankruptcy schedule.

03

Those who wish to formally list and address their unsecured priority debts as part of their bankruptcy case.

Fill

form

: Try Risk Free

People Also Ask about

What are priority unsecured claims?

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

What is the priority of creditor claims?

Generally, the priority of claims tends to be secured claims, unsecured priority claims, and then general unsecured claims. As always, this is dependent on certain circumstances within the case. A secured creditor's interest is guaranteed by collateral or a lien on property owned by the debtor.

What is considered a priority unsecured claim?

A priority unsecured claim is a type of unsecured claim that has a higher priority than other unsecured claims. This means that priority unsecured claims will be paid first, before non-priority unsecured claims.

What does creditors who have unsecured claims mean?

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

What is unsecured creditors with priority?

Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors. As their name suggests, unsecured priority creditors are higher in the pecking order than general unsecured creditors when it comes to claims over any assets in a bankruptcy filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

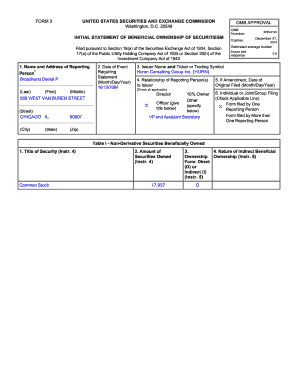

What is Schedule E - Creditors Holding Unsecured Priority Claims?

Schedule E is a form used in bankruptcy filings to report creditors who hold unsecured priority claims. These are debts that must be paid before other unsecured debts in the event of liquidation.

Who is required to file Schedule E - Creditors Holding Unsecured Priority Claims?

Individuals filing for bankruptcy under Chapter 7 or Chapter 13 are required to file Schedule E if they have creditors holding unsecured priority claims, such as certain tax obligations or child support.

How to fill out Schedule E - Creditors Holding Unsecured Priority Claims?

To fill out Schedule E, list each creditor with priority claims, provide their contact information, the nature of the claim, the amount owed, and any supporting documentation as required.

What is the purpose of Schedule E - Creditors Holding Unsecured Priority Claims?

The purpose of Schedule E is to provide the bankruptcy court and creditors with a clear picture of which creditors have priority claims that need to be addressed during bankruptcy proceedings.

What information must be reported on Schedule E - Creditors Holding Unsecured Priority Claims?

On Schedule E, you must report the name and address of each creditor, the total amount of the claim, the basis for the claim, and whether the claim is disputed or contingent.

Fill out your schedule e - creditors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule E - Creditors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.