Get the free New Markets Tax Credit: An Introduction

Show details

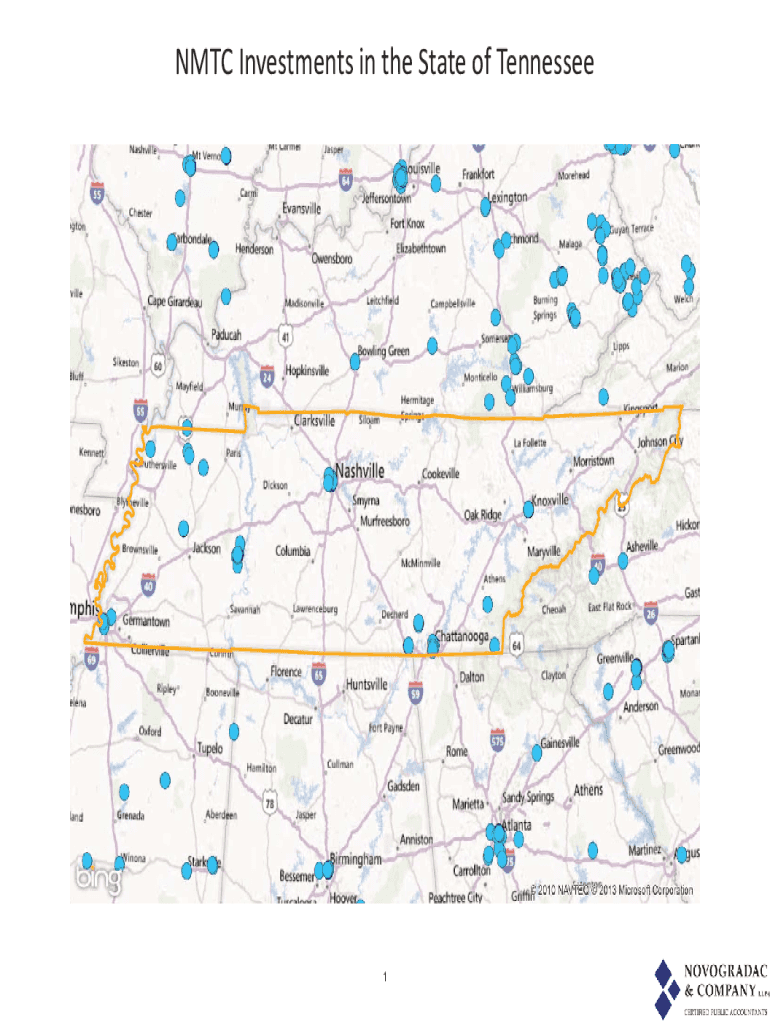

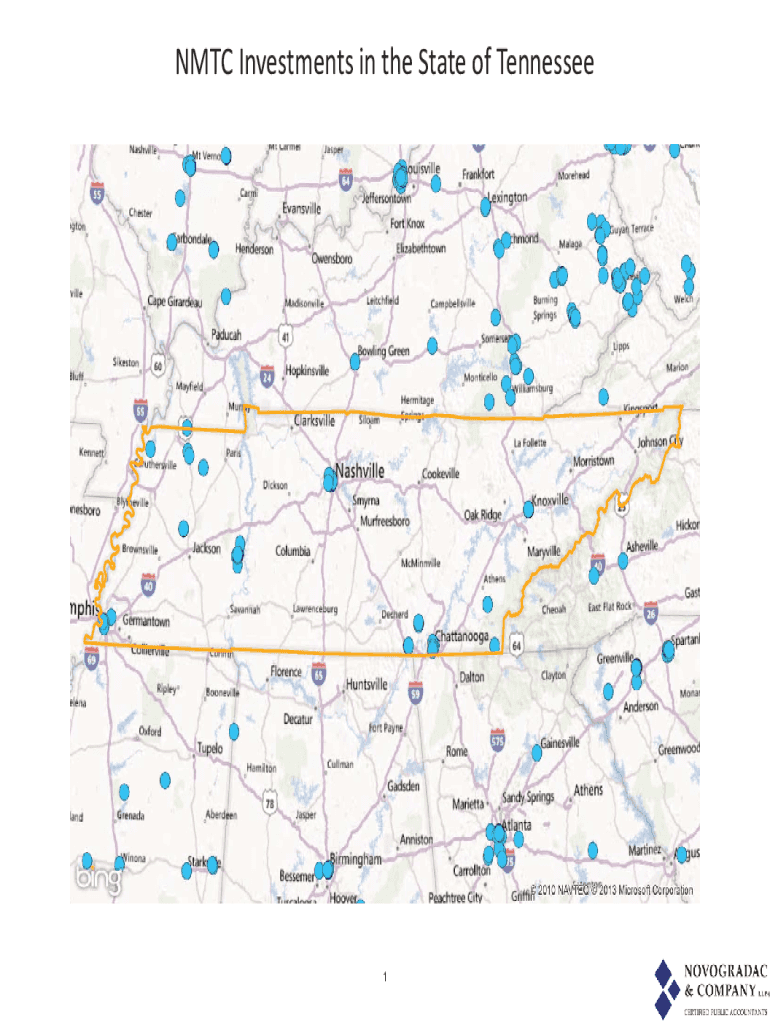

MTC Investments in the State of TennesseeRIC600V999NMTC Investments in Tennessee Through 2010Project Project Zip Project Year of State Code Census Tract Allocation TN 37408 47065002000 2004Loan/Investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new markets tax credit

Edit your new markets tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new markets tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new markets tax credit online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new markets tax credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new markets tax credit

How to fill out new markets tax credit

01

Determine if your project is located in a qualified low-income community.

02

Apply for certification as a Qualified Community Development Entity.

03

Identify potential investors who are looking to invest in low-income communities.

04

Prepare and submit an application for the New Markets Tax Credit program.

05

Once approved, allocate the tax credits to your investors based on their investments in the project.

Who needs new markets tax credit?

01

Developers and businesses looking to invest in projects located in low-income communities.

02

Investors looking for tax incentives for investing in low-income communities.

03

Qualified Community Development Entities seeking to support economic development in distressed areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new markets tax credit to be eSigned by others?

When you're ready to share your new markets tax credit, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I fill out new markets tax credit on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your new markets tax credit. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out new markets tax credit on an Android device?

Complete new markets tax credit and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is new markets tax credit?

The New Markets Tax Credit (NMTC) is a federal tax credit for investors who make qualified equity investments in designated Community Development Entities (CDEs).

Who is required to file new markets tax credit?

Investors who make qualified equity investments in designated Community Development Entities (CDEs) are required to file for the new markets tax credit.

How to fill out new markets tax credit?

To fill out the new markets tax credit, investors need to report information about their qualified equity investments in designated Community Development Entities (CDEs) on IRS form 8874.

What is the purpose of new markets tax credit?

The purpose of the new markets tax credit is to incentivize investments in low-income communities to stimulate economic development and create jobs.

What information must be reported on new markets tax credit?

On the new markets tax credit form (IRS form 8874), investors must report details about their qualified equity investments in designated Community Development Entities (CDEs), including the amount invested and the impact on low-income communities.

Fill out your new markets tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Markets Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.