Get the free Deferred Compensation 401(k) Plan - treasury tn

Show details

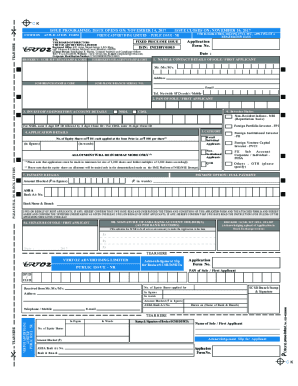

State of Tennessee Deferred Compensation 401(k) Plan SEND COMPLETED FORM TO: Great-West 545 Mainstream Drive, Suite 407 Nashville, TN 37228 HARDSHIP WITHDRAWAL REQUEST Please read instructions on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred compensation 401k plan

Edit your deferred compensation 401k plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred compensation 401k plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred compensation 401k plan online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deferred compensation 401k plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred compensation 401k plan

How to Fill Out Deferred Compensation 401k Plan:

01

Start by gathering all necessary documents, including your employee identification number, employment contract or agreement, and any other relevant forms provided by your employer.

02

Review the terms and conditions of the deferred compensation plan and the specific options available to you. Understand the contribution limits, investment choices, and any additional features such as employer matching or profit-sharing.

03

Determine your contribution amount. Decide how much you want to contribute to the 401k plan and calculate whether you can maximize your contribution to take advantage of tax benefits or employer matching.

04

Complete the enrollment form provided by your employer. Fill in your personal information, including your name, address, Social Security number, and beneficiary designations.

05

Indicate your contribution amount and frequency of contributions. Specify whether you want a fixed dollar amount or a percentage of your income to be deducted. You may choose to contribute on a pre-tax basis or after-tax through a Roth 401k.

06

Select your investment choices. Review the investment options available to you and allocate your contributions according to your risk tolerance and retirement goals. Consider diversifying your investments to spread the risk.

07

Designate your beneficiaries. Decide who will receive your 401k funds in the event of your death and provide their contact information. Consider naming contingent beneficiaries in case your primary beneficiaries are unable to receive the funds.

08

Review the completed enrollment form for accuracy and sign it. Keep a copy for your records and submit the original form to your employer as instructed.

09

Monitor your 401k account regularly. Stay informed about any changes or updates to the plan and review your investment performance. Adjust your contribution amount and investment allocations as needed to align with your changing financial circumstances and goals.

Who Needs Deferred Compensation 401k Plan:

01

Employees who wish to save for retirement and benefit from tax advantages may consider a deferred compensation 401k plan.

02

Individuals who want to supplement their Social Security benefits and create a retirement nest egg may find 401k plans advantageous.

03

Employees who have the financial capacity to contribute and have a long-term outlook for their retirement may benefit from a deferred compensation 401k plan.

04

Individuals who have a higher income and want to maximize their retirement savings beyond the limits of traditional individual retirement accounts (IRAs) may find a 401k plan beneficial.

05

Employees who work for organizations that offer employer matching or profit-sharing contributions can take advantage of additional funds to boost their retirement savings.

06

Individuals who want to take control of their retirement investments and have the flexibility to choose from various investment options available in a 401k plan may choose to utilize a deferred compensation plan.

07

Employees who are eligible for a 401k plan through their employer and want to take advantage of the convenience and automatic contributions may opt for deferred compensation options.

08

Individuals who anticipate being in a lower tax bracket during retirement may opt for a pre-tax contribution to reduce their taxable income now and potentially pay lower taxes in the future.

09

Employees who prioritize long-term financial security and want to take advantage of the compound growth potential of their retirement savings may benefit from participating in a deferred compensation 401k plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is deferred compensation 401k plan?

Deferred compensation 401k plan is a retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax basis, with the contributions being invested for growth until retirement.

Who is required to file deferred compensation 401k plan?

Employers who offer a deferred compensation 401k plan to their employees are required to file the plan with the appropriate authorities.

How to fill out deferred compensation 401k plan?

Deferred compensation 401k plans are typically filled out by the employer, who must provide information about the plan, including details about employee contributions, investment options, and vesting schedules.

What is the purpose of deferred compensation 401k plan?

The purpose of a deferred compensation 401k plan is to help employees save for retirement by allowing them to contribute a portion of their salary on a pre-tax basis and invest it for long-term growth.

What information must be reported on deferred compensation 401k plan?

Information that must be reported on a deferred compensation 401k plan includes details about employee contributions, investment options, vesting schedules, and any employer matching contributions.

How can I modify deferred compensation 401k plan without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including deferred compensation 401k plan, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find deferred compensation 401k plan?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific deferred compensation 401k plan and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the deferred compensation 401k plan in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your deferred compensation 401k plan and you'll be done in minutes.

Fill out your deferred compensation 401k plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Compensation 401k Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.