Get the free 940 2015 - irs

Show details

Jul 28, 2016 ... Almost every form and publication also has its own easily ... Schedule A (Form 940) instructions or visit IRS.gov. ..... (PDF) forms on IRS.gov have fillable fields with acceptable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 940 2015 - irs

Edit your 940 2015 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 940 2015 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 940 2015 - irs online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 940 2015 - irs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 940 2015 - irs

How to fill out 940 2015:

01

Obtain the necessary form: The Form 940 for the year 2015 can be downloaded from the official website of the Internal Revenue Service (IRS) or obtained from a local IRS office.

02

Provide your employer identification number (EIN): Enter your EIN at the top of the form. This is a unique nine-digit number assigned to your business by the IRS.

03

Fill in your business information: Provide your business name, address, and contact details in the designated fields on the form.

04

Report your taxable wages: Enter the total taxable wages paid to your employees during the calendar year 2015 in Line 3. This includes regular wages, bonuses, and other compensations subject to federal employment taxes.

05

Calculate your federal unemployment tax: Multiply the total taxable wages by the current federal unemployment tax rate, which can be found in the instructions for Form 940. Then, enter the calculated amount in Line 4.

06

Take any adjustments into account: If you are eligible for any adjustments or reductions in your federal unemployment tax, follow the instructions provided to calculate the adjusted amount and enter it in Line 6.

07

Determine your total tax liability: Add Line 4 and Line 6 together to calculate your total federal unemployment tax liability (Line 7).

08

Report any deposits made: If you have made any deposits of federal unemployment tax throughout the year, enter the total amount in Line 8.

09

Calculate your balance due or overpayment: Subtract Line 8 from Line 7 to determine whether you owe a balance or have overpaid. If you owe a balance, ensure to include payment with your completed Form 940. If you have overpaid, you may be able to request a refund or apply the overpayment to your next year's tax liability.

10

Sign and date the form: As the employer, sign and date the completed form at the bottom to certify its accuracy.

Who needs 940 2015?

01

Employers subject to federal unemployment tax: Businesses that paid wages of $1,500 or more in any calendar quarter during 2015 or employed one or more individuals for part of the day in any 20 or more different calendar weeks are generally required to file Form 940 for the year 2015. This includes most employers classified as either for-profit or nonprofit.

02

Agricultural employers: If you paid wages of $20,000 or more to farmworkers during any calendar quarter in 2015, you are also required to file Form 940 for the year 2015, regardless of the days worked or the number of employees.

03

Household employers: If you employed household workers, such as nannies or caregivers, and paid wages of $1,000 or more in any calendar quarter of 2015, you may need to file Form 940.

Remember to consult the specific instructions provided with the form or seek professional assistance to ensure accurate completion and submission of Form 940 for the year 2015.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate 940 tax payment?

The form asks for total wages, exempt wages, and salary payments made to each employee earning over $7,000 (you can check the Form 940 Instructions for other taxable FUTA wages). Then, multiply the total amount by 0.6% (0.006) to determine your base amount.

Do I need to file 940 if no payroll?

If you normally have employees but didn't pay employees during a particular calendar year, you still are responsible for filing Form 940 and stating you didn't make employee payments.

What was the FUTA tax in 2015?

Tax YearEffective FUTA RateFUTA Tax Charge*20121.2%$8420131.5%$10520141.8%$12620152.1%$1472 more rows

What is the 940 deposit rule?

Deposits for FUTA Tax (Form 940) are required for the quarter within which the tax due exceeds $500. The tax must be deposited by the end of the month following the end of the quarter. You must use electronic funds transfer (EFTPS) to make all federal tax deposits.

What is the difference between a 940 and a 941?

The primary difference between Form 940 and Form 941 is the tax liability reported. Form 940 reports FUTA taxes, while Form 941 reports income tax, Social Security tax, and Medicare tax withholdings. Additionally, Form 940 is filed annually, while Form 941 is filed quarterly.

What is the 940 payment rule?

Although Form 940 covers a calendar year, you may have to deposit your FUTA tax before you file your return. If your FUTA tax liability is more than $500 for the calendar year, you must deposit at least one quarterly payment. If your FUTA tax liability is $500 or less in a quarter, carry it forward to the next quarter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 940 2015 - irs from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 940 2015 - irs into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit 940 2015 - irs online?

The editing procedure is simple with pdfFiller. Open your 940 2015 - irs in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete 940 2015 - irs on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 940 2015 - irs. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is 940?

940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return form.

Who is required to file 940?

Employers who paid wages of $1,500 or more in any calendar quarter or had at least one employee for at least some part of a day in any 20 or more different weeks during the year are required to file Form 940.

How to fill out 940?

Form 940 can be filled out manually or electronically through the IRS website or approved software. Employers need to provide information about their business, wages paid, and taxes owed.

What is the purpose of 940?

The purpose of Form 940 is to report and pay the federal unemployment tax to the IRS, which provides funds for unemployment benefits to eligible workers.

What information must be reported on 940?

Employers must report their total wages, federal unemployment tax owed, payments made, and any adjustments to the tax amount.

Fill out your 940 2015 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

940 2015 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

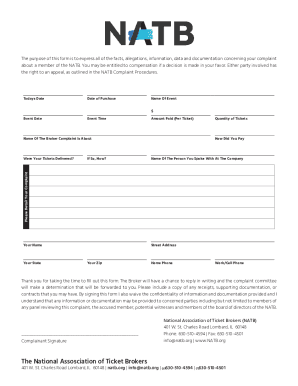

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.