CA VN201 2008 free printable template

Show details

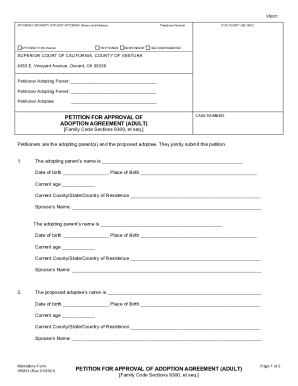

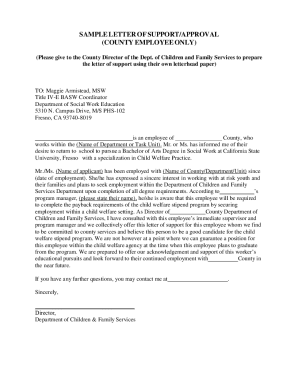

VN201 ATTORNEY OR PARTY WITHOUT ATTORNEY (Name and Address) Telephone Number FOR COURT USE ONLY ATTORNEY FOR (Name): SUPERIOR COURT OF CALIFORNIA, COUNTY OF VENTURA 4353 E. VINEYARD AVE, OXNARD, CA.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA VN201

Edit your CA VN201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA VN201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA VN201 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA VN201. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA VN201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA VN201

How to fill out CA VN201

01

Obtain the CA VN201 form from the California Department of Motor Vehicles website or a local DMV office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including your name, address, and phone number.

04

Indicate the reason for submitting the form, selecting the appropriate option.

05

If applicable, provide details about the vehicle including the make, model, and VIN (Vehicle Identification Number).

06

Sign and date the form where indicated.

07

Double-check all information for accuracy before submitting.

08

Submit the completed form either online, by mail, or in person at a DMV office as instructed.

Who needs CA VN201?

01

Individuals who need to report the sale, transfer, or disposal of a vehicle.

02

People looking to update their vehicle's status with the DMV.

03

Owners needing to notify the DMV about a change in vehicle ownership.

Fill

form

: Try Risk Free

People Also Ask about

How much can a landlord raise rent in California 2022?

ing to AB-1482, the Tenant Protection Act of 2019, the maximum that landlords can raise rents in California is 5% per year, plus the percentage change in the cost of living ing to the consumer price index, or 10% of the lowest rent increase at any time during the 12 months (whichever is less).

Is a text message considered written notice in California?

California's Statute of Frauds expressly excludes text messages and similar forms of electronic messages from those writings which may serve as evidence of an agreement.

How often can a landlord raise rent in California 2022?

Effective 8/23/22 landlords may increase rent once every 12 months, limited to 60 percent of the local CPI or 3%, whichever is less. Single-family homes without accessory units, condominiums and cooperatives are exempt as are units first certified for occupancy after 2/1/95.

What is the rental increase for 2022?

Rent increase explained In September 2021 inflation was 3.1%, and by January 2022 it had risen to 5.5%. This year the government formula allows us to increase rents by up to 4.1%. This is equivalent to the inflation rate in September plus 1%.

What is the rent increase for 2022 in California?

How much can a landlord raise rent in California in 2022? As explained by real estate agent Jeff Johnson of Simple Homebuyers, “In 2022, landlords are allowed to raise rents on existing tenants between 3% and 8% annually. The fluctuation depends on whether the rental property is in the city or suburbs.

Can landlords evict tenants in California 2022?

Tenants cannot be evicted unlawfully in the state of California. However, a landlord has the right to evict a tenant after failing to pay rent on time. In California's housing law, the rent is considered late the day after its due date.

Do I have to give 60-day notice in California?

In California, 30-day notice to vacate the rental property is permitted for tenants that have lived in properties for less than a year or have a month-to-month tenancy agreement. In California, a 60-day notice to vacate is required for tenants residing for a year or more at the property.

How do I evict a tenant in California during Covid 2022?

From October 1, 2021 through March 31, 2022, the law requires any landlord wanting to evict a tenant for failing to pay rent as a result of COVID-19 hardship to first apply for rental assistance before proceeding with an eviction lawsuit.

Is eviction still on hold in California?

After more than two years and multiple extensions, most remaining elements of California's COVID-19 eviction moratorium have come to an end. June 30 was the last day for both the COVID-19 Tenant Relief Act (CTRA) and the COVID-19 Rental Housing Recovery Act.

What is the fastest way to evict a tenant in California?

How to Evict a Tenant in California Make sure that you have legal grounds to evict the tenant. Serve tenant with an appropriate notice. Wait for the notice to expire. File all legal documents with the court. Serve the tenant with the proper legal documents. Wait for the tenant to respond to the lawsuit.

Can I be evicted right now in California 2022?

Tenants cannot be evicted unlawfully in the state of California. However, a landlord has the right to evict a tenant after failing to pay rent on time.

Can I be evicted in California right now 2022?

Tenants cannot be evicted unlawfully in the state of California. However, a landlord has the right to evict a tenant after failing to pay rent on time.

Can you evict a tenant in California right now?

Now as the Pandemic winds down, many of these protections have as well. The main Federal eviction moratorium expired in July 2021, and California's eviction moratorium ended for almost all tenants in June, 2022.

What is the current CPI in California for rent increase 2022?

Effective July 1, 2022, the annual rent adjustment maximum rate will be 10%. The Tenant Protection Program annual rent adjustment is based on 5% plus the percentage of the annual increase in the California Consumer Price Index (CPI) for All Urban Consumers for all items, if any.

Is the California eviction moratorium still in effect 2022?

On October 4, 2022, the LA city council voted to wind down the eviction moratorium that has been in place since March 2020, making it one of the longest COVID tenant protections in the country. Non-payment of rent cases will be allowed to resume in February 2023.

Can a landlord require 60-day notice to vacate California?

Under California state law, a landlord can terminate a month-to-month tenancy by serving a 30-day written notice if the tenancy has lasted less than one year, or a 60-day notice if the tenancy has lasted more than one year.

Can a landlord evict you immediately California?

A landlord can terminate a tenancy early and evict the tenant for a variety of reasons, including failure to pay rent, violating the lease or rental agreement, or committing an illegal act. The landlord must terminate the tenancy by giving the tenant a written notice.

What happens after 60-day notice to vacate California?

If the tenants haven't moved at the end of the 30/60 days, they will be unlawfully occupying the rental unit, and the landlord can file an unlawful detainer (eviction) lawsuit to evict them.

How much notice do you need to give your landlord when you move out in California?

Giving proper notice It should also include a forwarding address to where your security deposit can be mailed. If you have a month-to-month rental agreement, a 30-day notice should be provided to the landlord.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA VN201 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CA VN201 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in CA VN201 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your CA VN201, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the CA VN201 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign CA VN201 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is CA VN201?

CA VN201 is a tax form used in California for reporting certain types of income or changes in tax status related to vehicles.

Who is required to file CA VN201?

Individuals or businesses that have experienced a change in vehicle ownership, use, or tax status are typically required to file CA VN201.

How to fill out CA VN201?

To fill out CA VN201, provide personal identification details, accurate descriptions of the vehicle, and any relevant information regarding changes in ownership or usage.

What is the purpose of CA VN201?

The purpose of CA VN201 is to ensure accurate reporting of tax obligations related to vehicles and to facilitate proper calculation of vehicle taxes.

What information must be reported on CA VN201?

CA VN201 requires reporting information such as personal identification details, vehicle identification number (VIN), make and model of the vehicle, and details of any ownership changes.

Fill out your CA VN201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA vn201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.