CA AR 2 2012 free printable template

Show details

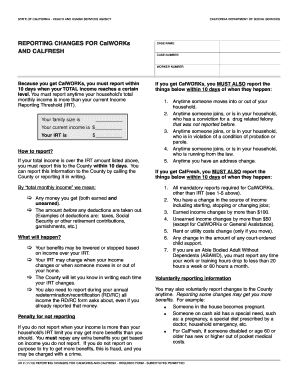

STATE OF CALIFORNIA HEALTH AND HUMAN SERVICES AGENCY REPORTING CHANGES FOR Gasworks AND AFRESH CALIFORNIA DEPARTMENT OF SOCIAL SERVICES CASE NAME: CASE NUMBER: WORKER NUMBER: Because you get Gasworks,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA AR 2

Edit your CA AR 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA AR 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA AR 2 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA AR 2. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA AR 2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA AR 2

How to fill out CA AR 2

01

Gather necessary information: Collect all relevant financial data required for the CA AR 2 form.

02

Start with the identification section: Fill out your name, address, and contact information accurately.

03

Input financial details: Enter the total amount of accounts receivable and any adjustments needed.

04

Report income: Document any income related to the accounts receivable as required.

05

Double-check entries: Review all filled information for accuracy and completeness.

06

Sign and date the form: Ensure you sign and date the document before submission.

Who needs CA AR 2?

01

Individuals or businesses that are required to report their accounts receivable for California tax purposes.

02

Tax preparers who assist clients in filing California tax returns.

03

Auditors and accountants who need to evaluate financial statements of California-based entities.

Fill

form

: Try Risk Free

People Also Ask about

Does CalWORKs ask for bank statements?

Proof that countable property is below the $2,250 limit (or $3,500 limit if a family member applying for aid is age 60 or older), such as: Statements for bank accounts, and. Trust funds.

What is CalWORKs application?

CalWORKs is a public assistance program that provides cash aid and services to eligible families that have a child(ren) in the home. The program serves all 58 counties in the state and is operated locally by county welfare departments.

What documents are needed to apply for CalWORKs?

CalWORKs Required Documents. Current statements of all bank accounts and trust funds and IRA's. Statements. Statements are considered proof that countable property is below the $2,250 limit. Vehicle Registration. Your Home. Income Limits. Proof of Citizenship.

How long does it take to get approved for CalWORKs?

How long does it take to get CalWORKs benefits? CalWORKs applications must be approved or denied within 45 days of submission, and the county must set up an intake appointment within seven days of receiving your application.

How fast can I get CalWORKs?

How long does it take to get CalWORKs benefits? CalWORKs applications must be approved or denied within 45 days of submission, and the county must set up an intake appointment within seven days of receiving your application.

What is CalWORKs requirements?

To be eligible for California CalWORKs, you must be a resident of California, and a U.S. citizen, legal alien or qualified alien. You must be unemployed or underemployed and have low or very low income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA AR 2?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the CA AR 2 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute CA AR 2 online?

pdfFiller makes it easy to finish and sign CA AR 2 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my CA AR 2 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your CA AR 2 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is CA AR 2?

CA AR 2 is a form required by the California Department of Tax and Fee Administration (CDTFA) for certain businesses to report their taxable sales and use tax liabilities.

Who is required to file CA AR 2?

Businesses that have a sales tax permit in California and are responsible for collecting and remitting sales tax are required to file CA AR 2.

How to fill out CA AR 2?

To fill out CA AR 2, businesses need to provide information on their total sales, sales tax collected, and any deductions or exemptions that apply. Specific instructions are available on the form itself and the CDTFA website.

What is the purpose of CA AR 2?

The purpose of CA AR 2 is to ensure compliance with California sales tax laws by collecting accurate sales data from businesses, which is then used to determine tax liabilities.

What information must be reported on CA AR 2?

Information that must be reported on CA AR 2 includes total sales, taxable sales, sales tax collected, any exemptions claimed, and the business's identifying information.

Fill out your CA AR 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA AR 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.