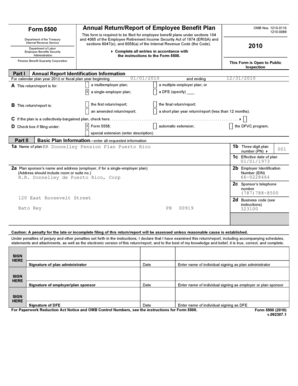

Get the free department of taxation and finance 05 cbt form - state nj

Show details

DEPARTMENT OF THE TREASURY ... CBT-100 or CBT-100S) filed by any corporation seeking to treat income, expenses or assets as ... intention of the New Jersey Division of Taxation to consider.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department of taxation and

Edit your department of taxation and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department of taxation and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing department of taxation and online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit department of taxation and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out department of taxation and

How to fill out department of taxation and?

01

Read the instructions carefully: Before filling out the department of taxation and form, it is crucial to thoroughly read and understand the instructions provided. The instructions will guide you through the process and ensure that you provide accurate and complete information.

02

Gather all necessary documents: Make sure you have all the required documents and information readily available. This may include your financial records, identification documents, tax statements, and any other relevant paperwork.

03

Complete personal information: Start by filling out your personal information accurately. This usually includes your full name, address, social security number, and other details as required by the form.

04

Provide income details: The department of taxation and form will typically require you to provide details about your income. This may include wages, self-employment income, dividends, rental income, or any other sources of income you have.

05

Deductions and credits: If applicable, claim any deductions or credits that you are eligible for. This could include deductions for mortgage interest, student loan interest, medical expenses, or education credits, among others. Make sure to provide the necessary supporting documentation for these deductions or credits.

06

Review and double-check: Once you have completed filling out the form, review it thoroughly to ensure accuracy. Double-check all the information provided, including calculations, to avoid any errors or omissions.

07

Sign and submit: Finally, sign the form as required and submit it to the department of taxation. Check the instructions on how to submit the form – whether it's via mail, electronically, or in person. Keep a copy of the filled-out form for your records.

Who needs department of taxation and?

01

Individuals filing taxes: Anyone who is required to file taxes in their jurisdiction will need to fill out the department of taxation and form. This typically includes employed individuals, self-employed individuals, and those with various sources of income.

02

Businesses and corporations: Businesses and corporations also need to fill out the department of taxation and form as part of their tax obligations. This includes providing information about their income, expenses, deductions, and other relevant details.

03

Non-profit organizations: Non-profit organizations may have tax obligations and will need to fill out the department of taxation and form to report their finances and determine their tax-exempt status.

Note: The specific requirements for filling out the department of taxation and form may vary depending on the jurisdiction and the type of taxpayer. It is always advisable to consult with a tax professional or reference the official guidelines provided by the relevant tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the department of taxation and in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your department of taxation and in minutes.

How can I fill out department of taxation and on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your department of taxation and. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out department of taxation and on an Android device?

Complete department of taxation and and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is department of taxation and?

The department of taxation and refers to the government agency responsible for collecting taxes.

Who is required to file department of taxation and?

Individuals or businesses who have taxable income or transactions are required to file department of taxation and.

How to fill out department of taxation and?

Department of taxation and forms can typically be filled out online or through mail, depending on the specific requirements of the agency.

What is the purpose of department of taxation and?

The purpose of department of taxation and is to ensure that individuals and businesses comply with tax laws and regulations, and to collect taxes owed to the government.

What information must be reported on department of taxation and?

Information such as income, expenses, deductions, and credits must be reported on department of taxation and forms.

Fill out your department of taxation and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Of Taxation And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.