Get the free Schedule NR Michigan Nonresident MI-1040 2014

Show details

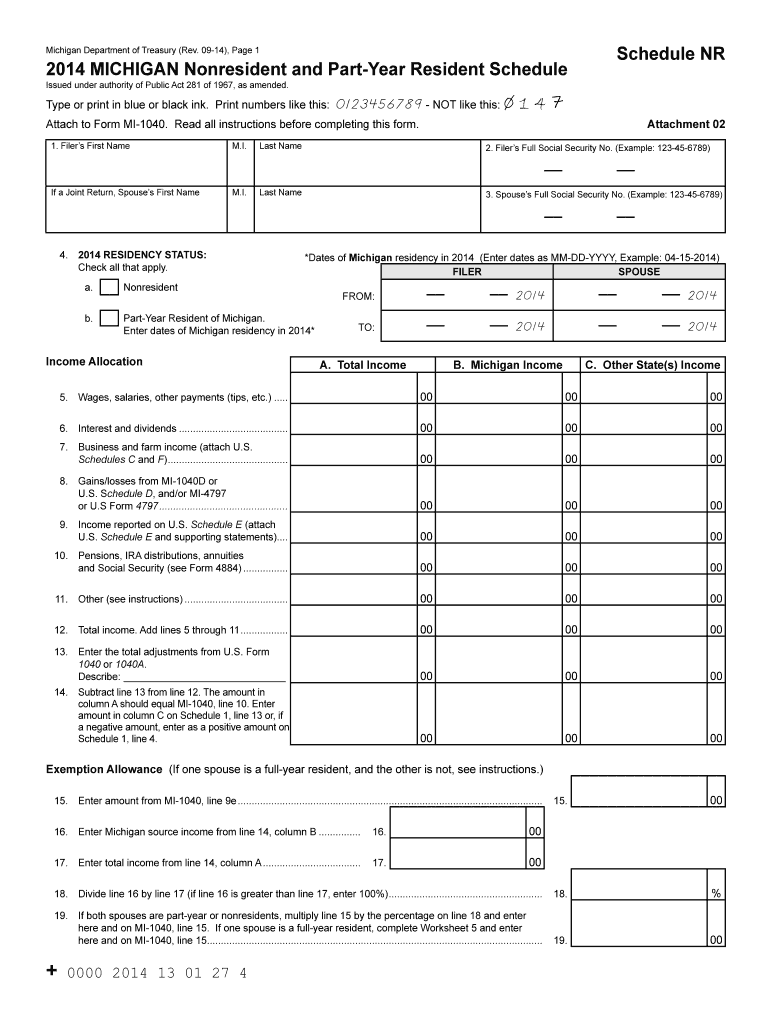

Schedule NR Michigan Nonresident MI-1040 2014

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule nr michigan nonresident

How to edit schedule nr michigan nonresident

How to fill out schedule nr michigan nonresident

Instructions and Help about schedule nr michigan nonresident

How to edit schedule nr michigan nonresident

Edit the schedule nr michigan nonresident by obtaining a digital copy of the form. Use pdfFiller’s platform features, such as the editing tools, to make necessary changes. This may include correcting personal information, adjusting income figures, or updating deductions. Ensure that any alterations comply with Michigan tax regulations and accurately reflect your financial situation.

How to fill out schedule nr michigan nonresident

Filling out the schedule nr michigan nonresident involves several steps. Begin by entering your identifying information, including your name, Social Security number, and address. Next, report your income earned in Michigan and any adjustments applicable to nonresidents. It is essential to review the instructions carefully to ensure compliance with all requirements.

Latest updates to schedule nr michigan nonresident

Latest updates to schedule nr michigan nonresident

Recent changes to the schedule nr michigan nonresident may involve tax rate adjustments or updates in the qualifying income thresholds. Always refer to the Michigan Department of Treasury's website to stay informed about the latest requirements and revisions that could impact your filing.

All You Need to Know About schedule nr michigan nonresident

What is schedule nr michigan nonresident?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule nr michigan nonresident

What is schedule nr michigan nonresident?

Schedule nr michigan nonresident is a tax form designed for individuals who earn income from Michigan sources but reside in another state. This form helps determine the tax liability for nonresidents and ensures that taxes are appropriately accounted for and remitted to the state of Michigan.

What is the purpose of this form?

The purpose of schedule nr michigan nonresident is to calculate the amount of Michigan income tax owed by nonresident taxpayers. By completing this form, individuals can report income earned in Michigan and claim any available deductions or credits relevant to their tax situation. It is crucial for ensuring compliance with Michigan tax laws.

Who needs the form?

Nonresidents who earn income from sources within Michigan need to file the schedule nr michigan nonresident. This includes individuals working or conducting business in Michigan who do not have a permanent residence there. Additionally, partners, shareholders, and members of pass-through entities earning Michigan-source income are also required to file this form.

When am I exempt from filling out this form?

You may be exempt from filing the schedule nr michigan nonresident if your total income from Michigan sources is below a certain threshold. Additionally, if you qualified for certain exemptions or deductions that alleviate your tax obligations, you may not need to submit this form. Always verify with current Michigan tax regulations to confirm your eligibility for exemption.

Components of the form

The schedule nr michigan nonresident consists of several key components. You will find sections for reporting personal information, income amounts, tax calculations, and applicable deductions or credits. Each component is designed to gather the necessary information to accurately assess your tax liability for your Michigan-sourced income.

Due date

The due date for submitting the schedule nr michigan nonresident is the same as the federal income tax filing deadline, typically April 15th. If the due date falls on a weekend or holiday, it may be extended to the following business day. It is essential to file on time to avoid penalties and interest on any owed taxes.

What are the penalties for not issuing the form?

Failing to file the schedule nr michigan nonresident by the due date can result in penalties imposed by the Michigan Department of Treasury. These penalties may include a fine equal to a percentage of the unpaid tax amount, plus interest on any overdue taxes. Timely submission is crucial to avoid these financial repercussions.

What information do you need when you file the form?

When filing the schedule nr michigan nonresident, you will need several pieces of information. This includes your Social Security number, income details from Michigan sources, any applicable deductions or credits you intend to claim, and your personal identification information. Collecting all necessary data beforehand can streamline the filing process.

Is the form accompanied by other forms?

Yes, the schedule nr michigan nonresident may need to be filed alongside other relevant tax forms. This could include the Michigan Individual Income Tax Return (Form MI-1040) or supporting documentation related to income and deductions. Always verify the requirements to ensure all necessary forms are submitted together.

Where do I send the form?

The completed schedule nr michigan nonresident must be sent to the Michigan Department of Treasury. Typically, the mailing address is specified on the form or in the instructions provided. Ensure that your form is sent to the correct address to facilitate prompt processing and acknowledgment of your submission.

See what our users say