Get the Tax-Free Savings Account (TFSA) Successor Holder or Other Beneficiary Designation Form

Show details

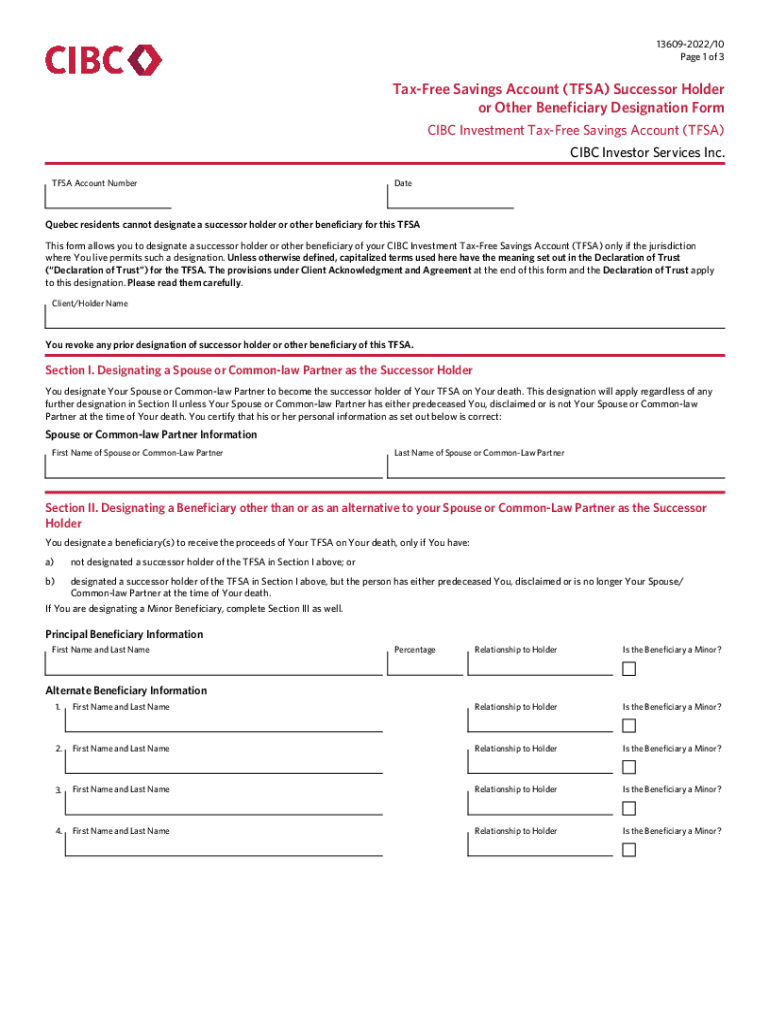

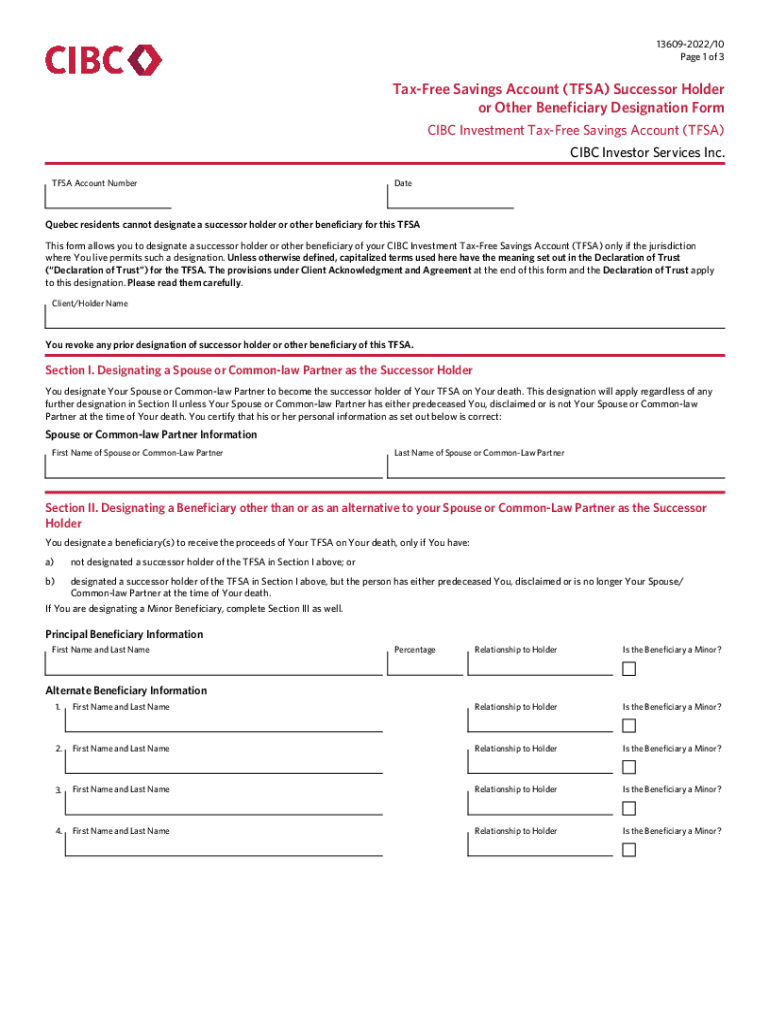

136092022/10-Page 1 of 3TaxFree Savings Account (FSA) Successor Holder

or Other Beneficiary Designation Form

CIBC Investment Three Savings Account (FSA)

CIBC Investor Services Inc.

FSA Account NumberDateQuebec

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- savings account tfsa

Edit your tax- savings account tfsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- savings account tfsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax- savings account tfsa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax- savings account tfsa. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax- savings account tfsa

How to fill out tax- savings account tfsa

01

Determine your current contribution room for the tax- savings account TFSA by checking your CRA account or contacting the Canada Revenue Agency.

02

Decide on the type of investments you want to hold in your TFSA, such as stocks, bonds, or mutual funds.

03

Open a TFSA account with a financial institution that offers this type of savings account.

04

Fill out the required forms to open the account, providing your personal information and designating beneficiaries if desired.

05

Make contributions to your TFSA account within the annual limits set by the government.

06

Monitor your investments regularly and consider consulting a financial advisor for guidance on maximizing your savings.

Who needs tax- savings account tfsa?

01

Any Canadian resident over the age of 18 who wants to save money tax-free can benefit from a tax-savings account TFSA.

02

Individuals looking to grow their savings without being taxed on the earnings can utilize a TFSA.

03

Those who have already maximized their RRSP contributions may find a TFSA to be a useful additional savings tool.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax- savings account tfsa directly from Gmail?

tax- savings account tfsa and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find tax- savings account tfsa?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tax- savings account tfsa in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit tax- savings account tfsa on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing tax- savings account tfsa right away.

What is tax- savings account tfsa?

A Tax-Free Savings Account (TFSA) is a registered account that allows Canadians to save money tax-free.

Who is required to file tax- savings account tfsa?

Any Canadian individual who is 18 years of age or older and has a valid social insurance number is eligible to open and contribute to a TFSA.

How to fill out tax- savings account tfsa?

To open a TFSA, you can visit a financial institution such as a bank, credit union, or investment firm. You will need to provide personal information and complete the necessary paperwork.

What is the purpose of tax- savings account tfsa?

The purpose of a TFSA is to help Canadians save money tax-free for various financial goals, such as retirement, a down payment on a home, or emergency savings.

What information must be reported on tax- savings account tfsa?

You must report the total contributions made to your TFSA each year, any withdrawals made from the account, and the fair market value of the investments held in the account.

Fill out your tax- savings account tfsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Savings Account Tfsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.