Get the free HUD FHA Approved Reverse Mortgage Lenders - HECM

Show details

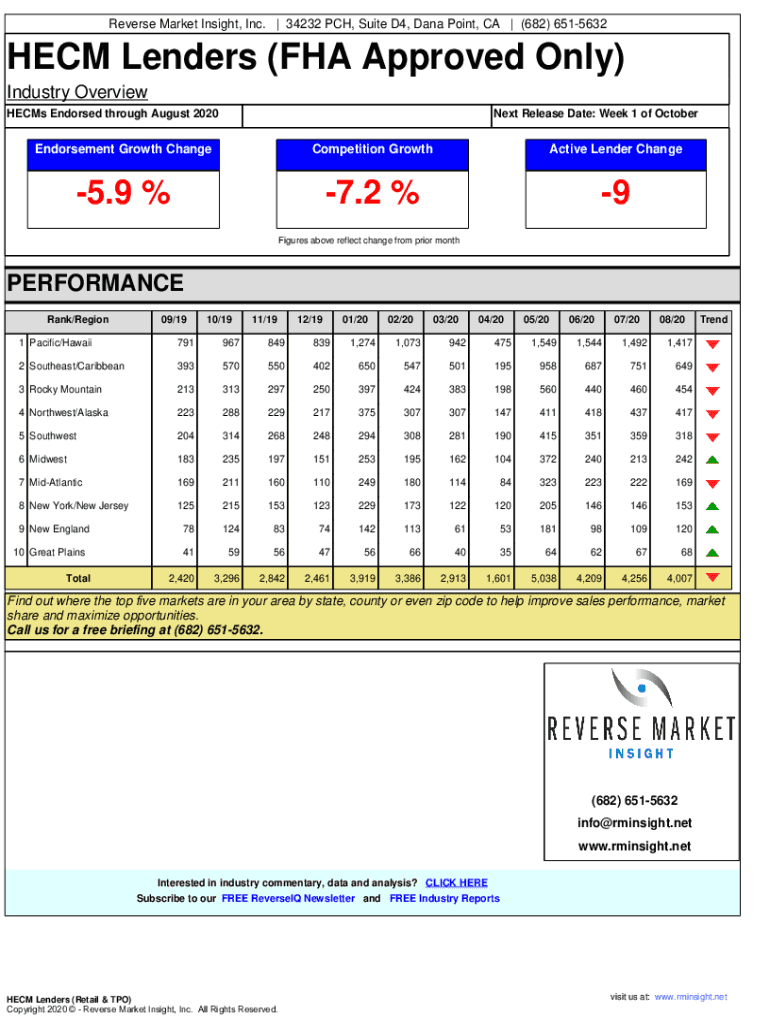

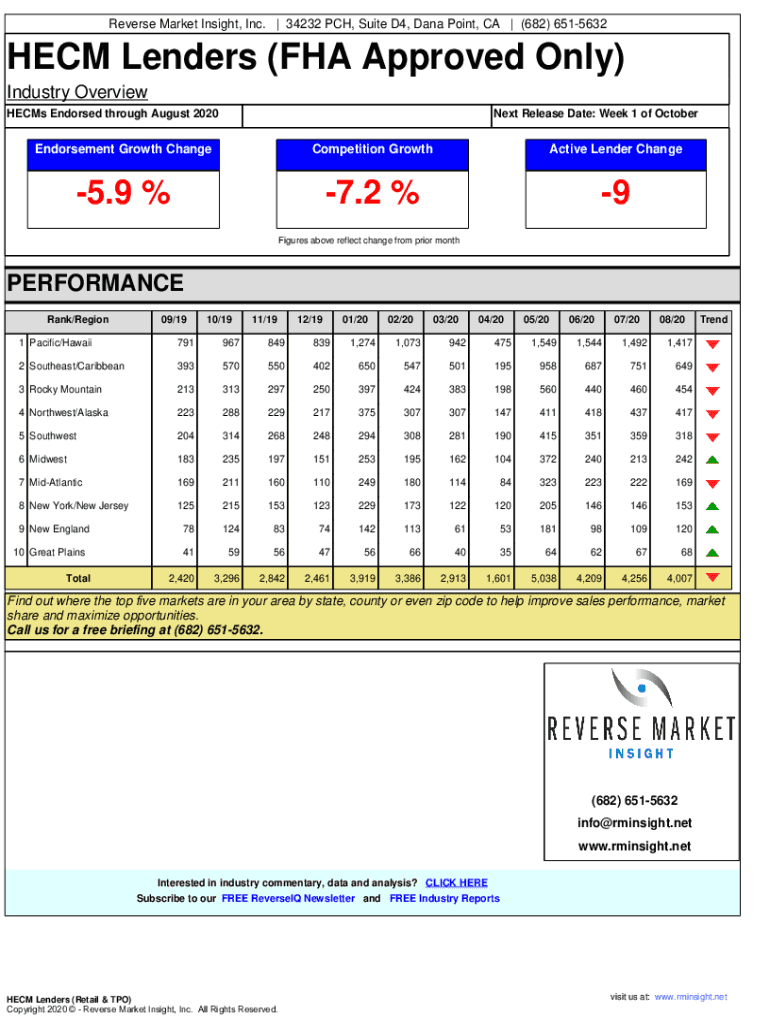

Reverse Market Insight, Inc. | 34232 PC, Suite D4, Dana Point, CA | (682) 6515632HECM Lenders (FHA Approved Only)

Industry Overview

Helms Endorsed through August 2020Next Release Date: Week 1 of OctoberEndorsement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hud fha approved reverse

Edit your hud fha approved reverse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hud fha approved reverse form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hud fha approved reverse online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hud fha approved reverse. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hud fha approved reverse

How to fill out hud fha approved reverse

01

Contact a HUD-approved lender to apply for a reverse mortgage

02

Fill out the necessary paperwork provided by the lender

03

Provide all required documentation, including proof of income and property taxes

04

Undergo a credit check and financial assessment

05

Attend a counseling session with a HUD-approved counselor

06

Review and sign the final loan documents

Who needs hud fha approved reverse?

01

Individuals who are 62 years or older

02

Homeowners who want to access the equity in their home without having to make monthly mortgage payments

03

Borrowers who meet the eligibility requirements set by the Federal Housing Administration (FHA)

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find hud fha approved reverse?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific hud fha approved reverse and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute hud fha approved reverse online?

pdfFiller has made filling out and eSigning hud fha approved reverse easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my hud fha approved reverse in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your hud fha approved reverse and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is hud fha approved reverse?

The HUD FHA approved reverse refers to a reverse mortgage program insured by the Federal Housing Administration (FHA) that allows homeowners aged 62 and older to convert part of their home equity into cash.

Who is required to file hud fha approved reverse?

Borrowers who participate in the HUD FHA approved reverse mortgage program are required to file specific documentation, including the loan application and relevant disclosures.

How to fill out hud fha approved reverse?

To fill out the HUD FHA approved reverse mortgage application, homeowners must complete an application form, provide documentation of income and assets, and undergo a financial assessment as part of the process.

What is the purpose of hud fha approved reverse?

The purpose of the HUD FHA approved reverse mortgage is to provide eligible seniors with access to cash from their home equity, helping them cover living expenses, medical costs, or other financial needs.

What information must be reported on hud fha approved reverse?

Information that must be reported includes the homeowner's age, property address, mortgage balance, income details, and other financial information as required by the FHA reverse mortgage guidelines.

Fill out your hud fha approved reverse online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hud Fha Approved Reverse is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.