Get the free Voluntary Payroll Deductions - State of Oklahoma

Show details

TITLE 530. OFFICE OF PERSONNEL MANAGEMENT CHAPTER 15. VOLUNTARY PAYROLL DEDUCTION RULES Subchapter Section 1. General Provisions 530 15-1-1 3. Administrative Provisions 530 15-3-1 5. Complaints and Hearings 530 15-5-1 Authority 62 O. S* 7. 10 of Title 62 and 75 302 305 and 307 SUBCHAPTER 1. GENERAL PROVISIONS Section 530 15-1-1. Purpose 530 15-1-2. Definitions 530 15-1-3. RESERVED 530 15-1-5. Construction 530 15-1-6. Determinations of fact and conclusions of law 530 15-1-7. Filing and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary payroll deductions

Edit your voluntary payroll deductions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary payroll deductions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary payroll deductions online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit voluntary payroll deductions. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary payroll deductions

Point by point, here is how to fill out voluntary payroll deductions:

01

Begin by reviewing your employer's policies and procedures regarding voluntary payroll deductions. Familiarize yourself with the types of deductions available and any specific requirements or limitations.

02

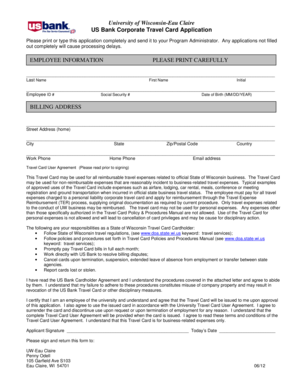

Obtain the necessary forms from your employer or human resources department. These forms typically include information such as your personal details, the type of deduction you wish to make, and the amount or percentage of your wages you want to contribute.

03

Carefully read and complete all sections of the form, ensuring that you provide accurate information. This may include specifying the start and end dates of the deduction, selecting the appropriate deduction category, and indicating whether you want the deduction to be a one-time occurrence or recurring.

04

If necessary, consult with a financial advisor or tax professional to understand the potential implications of the voluntary payroll deduction on your overall financial situation or tax obligations. They can provide guidance on how the deduction may affect your income and any potential tax advantages or disadvantages.

05

Once you have completed the form, submit it to your employer or follow the specific instructions provided by your organization. Make sure to retain a copy of the form for your records and keep track of any confirmation or acknowledgement received from your employer regarding the deduction.

Regarding who needs voluntary payroll deductions, it can apply to various individuals or situations. Some common examples include:

01

Employees who want to contribute towards retirement savings, such as a 401(k) plan or an Individual Retirement Account (IRA).

02

Individuals who wish to make charitable donations directly from their paycheck to support a specific cause or organization.

03

Employees who want to purchase additional benefits or services through their employer, such as health insurance coverage, life insurance, or flexible spending accounts.

04

People who are repaying loans or debts through automatic deductions from their wages, such as student loan payments or credit card balances.

05

Individuals who participate in employee stock purchase plans, where voluntary deductions are used to regularly invest in company stocks.

It is important to note that the need for voluntary payroll deductions can vary depending on personal circumstances and the specific offerings provided by employers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the voluntary payroll deductions in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your voluntary payroll deductions.

Can I edit voluntary payroll deductions on an iOS device?

Create, edit, and share voluntary payroll deductions from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out voluntary payroll deductions on an Android device?

Use the pdfFiller Android app to finish your voluntary payroll deductions and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is voluntary payroll deductions?

Voluntary payroll deductions are deductions taken from an employee's paycheck at their request. These deductions are not required by law and are typically used for things like retirement savings, health insurance premiums, and charitable donations.

Who is required to file voluntary payroll deductions?

Employers are required to file voluntary payroll deductions if they offer these options to their employees and deduct the requested amounts from their paychecks.

How to fill out voluntary payroll deductions?

To fill out voluntary payroll deductions, employers need to provide their employees with the necessary forms to indicate the desired deductions. Employees then complete the forms and submit them back to the employer for processing.

What is the purpose of voluntary payroll deductions?

The purpose of voluntary payroll deductions is to allow employees to have specific amounts withheld from their paychecks for various purposes, such as retirement savings, healthcare expenses, or charitable contributions.

What information must be reported on voluntary payroll deductions?

The information that must be reported on voluntary payroll deductions typically includes the employee's name, identification number, the type of deduction, the amount withheld, and the effective date of the deduction.

Fill out your voluntary payroll deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Payroll Deductions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.