Get the free Mortgage Banker vs. Mortgage BrokerWhat's the ...

Show details

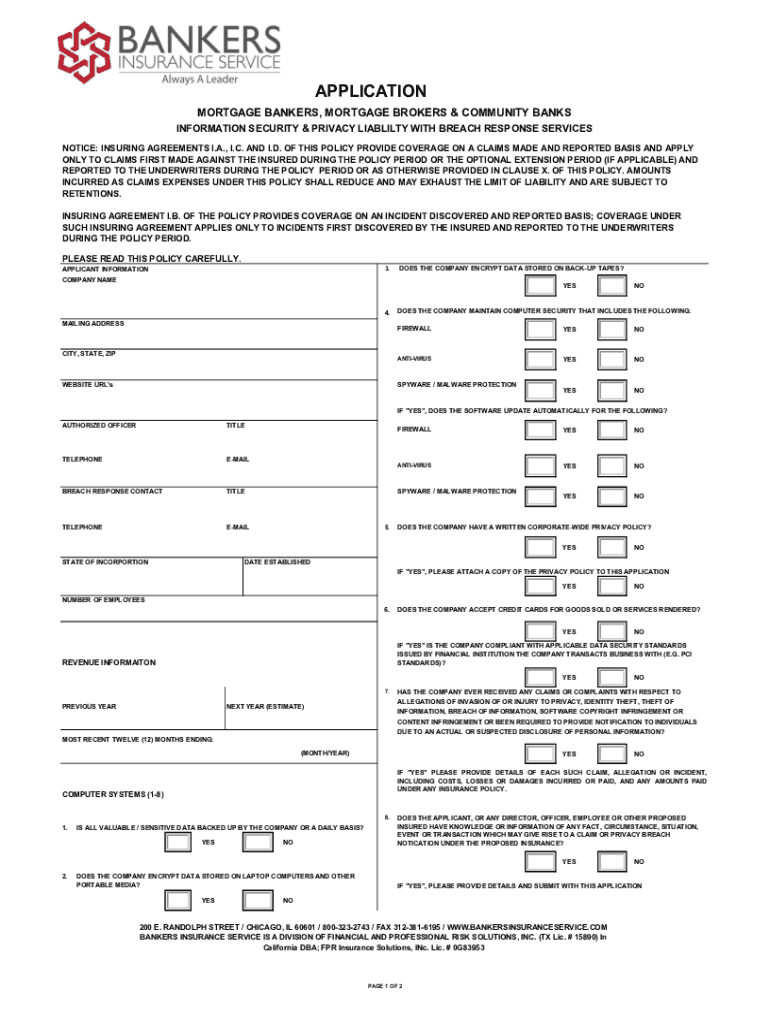

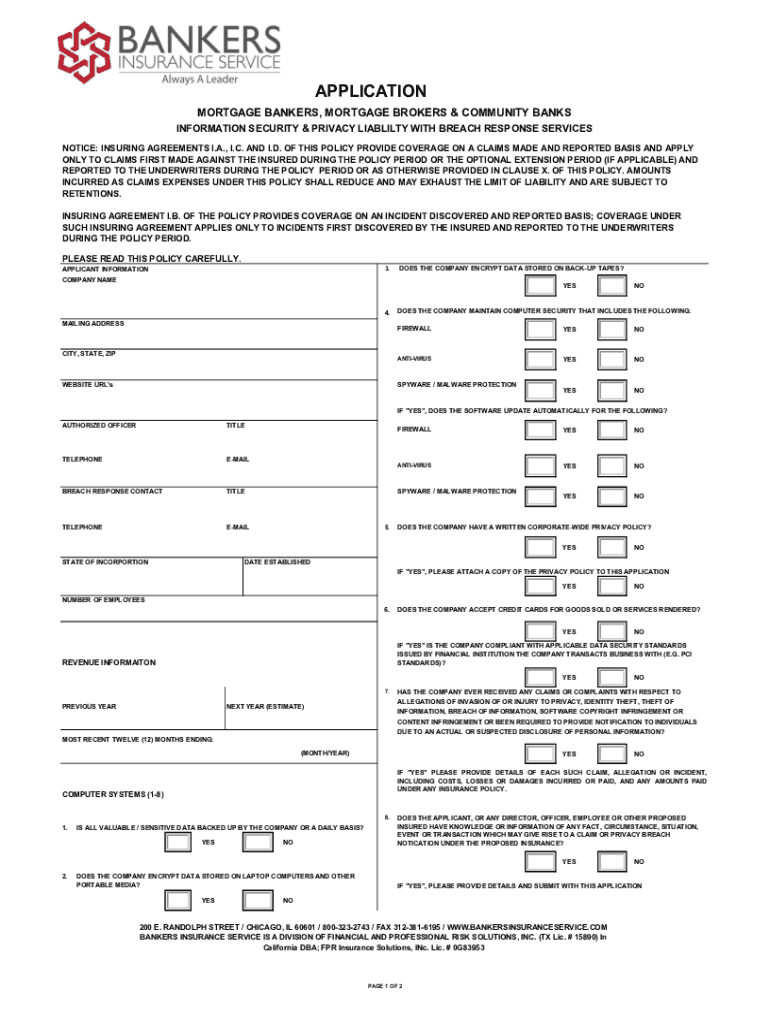

APPLICATION MORTGAGE BANKERS, MORTGAGE BROKERS & COMMUNITY BANKS INFORMATION SECURITY & PRIVACY LIABILITY WITH BREACH RESPONSE SERVICES NOTICE: INSURING AGREEMENTS I.A., I.C. AND I.D. OF THIS POLICY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage banker vs mortgage

Edit your mortgage banker vs mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage banker vs mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage banker vs mortgage online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage banker vs mortgage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage banker vs mortgage

How to fill out mortgage banker vs mortgage

01

Understand the difference between a mortgage banker and a mortgage broker. Mortgage bankers work for a specific financial institution and lend their institution's funds for mortgages. Mortgage brokers work with multiple lenders to find the best mortgage for their clients.

02

Research various mortgage bankers and brokers in your area. Look for reputable and experienced professionals with a track record of success.

03

Gather necessary financial documents such as pay stubs, tax returns, and bank statements to provide to the mortgage banker or broker.

04

Meet with the mortgage banker or broker to discuss your financial situation and goals. Be prepared to answer questions about your income, debts, and credit history.

05

Compare mortgage options offered by different bankers and brokers. Consider factors such as interest rates, fees, and loan terms before making a decision.

06

Choose the mortgage banker or broker that best meets your needs and proceed with filling out the necessary paperwork to apply for the mortgage.

Who needs mortgage banker vs mortgage?

01

Individuals who are looking to purchase a home and need financing to do so.

02

Individuals who want to refinance their existing mortgage to lower their interest rate or change the terms of their loan.

03

Real estate investors who are looking to finance the purchase of investment properties.

04

Business owners who need financing to purchase or refinance commercial properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mortgage banker vs mortgage without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing mortgage banker vs mortgage and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the mortgage banker vs mortgage in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your mortgage banker vs mortgage directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out mortgage banker vs mortgage on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your mortgage banker vs mortgage. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is mortgage banker vs mortgage?

A mortgage banker is a professional or a company that provides loans to borrowers for purchasing real estate, while a mortgage is the actual loan agreement that allows a borrower to finance the purchase of property.

Who is required to file mortgage banker vs mortgage?

Mortgage bankers are typically required to file reports and comply with regulations, whereas individuals obtaining a mortgage do not file in the same manner as mortgage bankers.

How to fill out mortgage banker vs mortgage?

Mortgage bankers fill out specific forms and reports according to regulatory requirements, while borrowers fill out mortgage applications to apply for loans.

What is the purpose of mortgage banker vs mortgage?

The purpose of a mortgage banker is to facilitate financing for homebuyers, while the purpose of a mortgage is to provide the terms under which the loan is extended to the borrower.

What information must be reported on mortgage banker vs mortgage?

Mortgage bankers must report financial and loan origination data, while mortgage applications require personal information, employment details, and the terms of the loan.

Fill out your mortgage banker vs mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Banker Vs Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.