Get the free 2704, ET AL - insurance arkansas

Show details

SERFS Tracking Number: AMFA-127293690 State: Arkansas Filing Company: Americas Life Insurance Corp. State Tracking Number: 49590 Company Tracking Number: 2704, ET AL. TO: A02I Individual Annuities-

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2704 et al

Edit your 2704 et al form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2704 et al form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2704 et al online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2704 et al. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2704 et al

How to fill out 2704 et al:

01

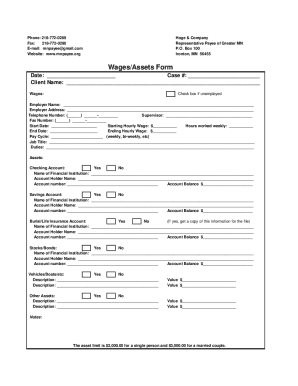

Start by obtaining the necessary documents: Before filling out Form 2704 et al, gather all the relevant information and supporting documents required to complete the form accurately. This may include financial details, asset valuations, and any other specific information needed.

02

Understand the purpose of the form: Familiarize yourself with the purpose and intent of Form 2704 et al. This form is typically used for reporting certain transactions or events that may have estate or gift tax implications. It is crucial to comprehend the specific requirements and guidelines associated with this form.

03

Carefully review the instructions: Read through the instructions provided with Form 2704 et al to ensure you understand each section and the information required. Take note of any special considerations or prerequisites for particular sections of the form.

04

Complete the form accurately: Fill in the necessary information in each section of Form 2704 et al. Double-check all entries for accuracy, as even minor errors can lead to complications or delays. Provide all requested details and make sure to attach any required supporting documentation.

05

Seek professional guidance if needed: Completing tax forms, especially those with potential estate or gift tax implications, can be complex. If you are uncertain about any aspect of Form 2704 et al, consider consulting a tax professional or an attorney experienced in estate planning to ensure compliance with relevant laws and regulations.

Who needs 2704 et al:

01

Individuals engaged in estate planning: Form 2704 et al is commonly needed by individuals involved in estate planning. If you are intending to transfer assets, make gifts, or plan for the future distribution of your estate, this form may be necessary to report certain transactions or events of significance.

02

Executors or administrators of estates: Executives responsible for administering an estate or managing assets may also require Form 2704 et al. The form may be needed to report certain transactions or events related to the estate, such as the transfer of assets or distribution of assets to beneficiaries.

03

Tax professionals or attorneys: Tax professionals and attorneys who provide estate planning services often work with Form 2704 et al on behalf of their clients. They use this form to accurately report relevant transactions or events to ensure compliance with estate and gift tax laws.

It is important to note that individual circumstances may vary, and the need for Form 2704 et al depends on specific situations. Consulting with a professional familiar with estate planning and tax matters can help determine if this form is necessary for your particular case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2704 et al without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 2704 et al, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I fill out 2704 et al on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2704 et al, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit 2704 et al on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 2704 et al on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is 2704 et al?

2704 et al refers to a section of the Internal Revenue Code that deals with restrictions on estate valuation discounts.

Who is required to file 2704 et al?

Those who own interests in a business or entity that may be subject to estate tax are required to file 2704 et al.

How to fill out 2704 et al?

To fill out 2704 et al, you will need to provide information about the business or entity, the ownership interests, and any relevant valuation discounts.

What is the purpose of 2704 et al?

The purpose of 2704 et al is to prevent the undervaluation of assets for estate tax purposes through the use of valuation discounts.

What information must be reported on 2704 et al?

On 2704 et al, you must report details about the business or entity, ownership interests, and any valuation discounts applied.

Fill out your 2704 et al online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2704 Et Al is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.