Get the free OAC 710:60

Show details

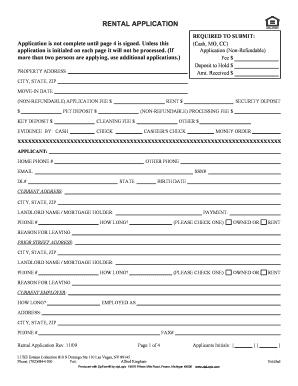

This chapter details the regulations and provisions related to the registration, licensing, and operation of motor vehicles in Oklahoma, including general provisions, registration and licensing procedures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oac 71060

Edit your oac 71060 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oac 71060 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oac 71060 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oac 71060. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oac 71060

How to fill out OAC 710:60

01

Obtain the OAC 710:60 form from the appropriate authority or website.

02

Fill out your personal details at the top of the form, including your name, address, and contact information.

03

Provide any required identification numbers, such as social security or tax identification numbers.

04

Complete the sections related to the purpose of the form, ensuring you read the instructions carefully.

05

If applicable, attach the necessary documents that support your application.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either electronically or by mailing it to the specified address.

Who needs OAC 710:60?

01

Individuals or organizations seeking specific permissions, registrations, or compliance with regulations as outlined in the OAC 710:60.

Fill

form

: Try Risk Free

People Also Ask about

Do you pay sales tax and excise tax on vehicles in Oklahoma?

0:51 2:50 Tax this is a 3.25%. Tax on the price of the new vehicle. So if you buy a car for $30,000 you'd payMoreTax this is a 3.25%. Tax on the price of the new vehicle. So if you buy a car for $30,000 you'd pay $975. In excise tax this tax is also paid at the time of purchase. When you're at the dealership.

Do dealers charge sales tax on used cars?

If you buy a used car from a dealership, the dealer should include any city, county or state taxes you're responsible for into your car's final purchase price.

How do I calculate sales tax on a used car in Oklahoma?

The excise tax is 3 ¼ percent of the value of a new vehicle. For a used vehicle, the excise tax is $20 on the first $1,500 and 3 ¼ percent thereafter. The value of a vehicle is its actual sales price. The annual registration fee for non-commercial vehicles ranges from $15 to $85 depending on the age of the vehicle.

How much is the tax and tag on a car in Oklahoma?

Taxpayers pay an excise tax of 3.25 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles (depending on the sales price). There is also an annual registration fee of $26 to $96 depending on the age of the vehicle.

How much is the tax and tag on a car in Oklahoma?

Standard Vehicles Standard Vehicle Registration YearFull Year Fee 1st - 4th year$96.00 9th -12th year $66.00 13th - 16th year $46.00 17th year + $26.002 more rows

How much does it cost to transfer a title to Oklahoma?

Additional Registration Fees Additional Initial Registration Fee TypeFee Vehicle Title Fee $11.00 Boat Title Fee $2.25 Transfer Fee $17.00 Insurance Fee $1.502 more rows

How do I calculate sales tax in Oklahoma?

Oklahoma sales tax is levied at 4.5% of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. If you ship goods, you will need to collect at the rate(s) in effect at the location where delivery occurs. Find out if you need to pay sales tax or use tax.

How do taxes work when buying a used car?

Bottom line. Unless you live in a state without sales tax, you will pay sales tax on a used car purchase. And while some states may offer deductions on sales tax or different rates for a big purchase, it should be part of your car buying budget. Ideally, you should have savings to cover the taxes on a purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OAC 710:60?

OAC 710:60 refers to a specific regulation or requirement set forth by the Oklahoma Administrative Code regarding tax filings or reporting obligations.

Who is required to file OAC 710:60?

Entities or individuals who meet certain criteria outlined in the Oklahoma Administrative Code and have tax reporting obligations related to the specified regulations must file OAC 710:60.

How to fill out OAC 710:60?

To fill out OAC 710:60, one must follow the specific instructions provided by the Oklahoma Tax Commission, ensuring all required fields are completed accurately and any necessary documentation is attached.

What is the purpose of OAC 710:60?

The purpose of OAC 710:60 is to ensure compliance with tax regulations and to provide a standardized reporting process for businesses and individuals subject to Oklahoma tax laws.

What information must be reported on OAC 710:60?

Information required on OAC 710:60 typically includes details such as taxpayer identification, income details, deductions, credits, and any other pertinent financial information necessary for accurate tax reporting.

Fill out your oac 71060 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oac 71060 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.