Get the free making tax incentives

Show details

#IAAO2015INVESTIGATING EXEMPTION FRAUD Best Practices for Detecting, Investigating, and Curtailing Exemption Fraud in Your Jurisdiction Presented by : Ana C. Torres, Esq. Chief Legal and Legislative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign making tax incentives

Edit your making tax incentives form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your making tax incentives form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing making tax incentives online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit making tax incentives. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out making tax incentives

How to fill out making tax incentives

01

Research the specific tax incentives available in your area or industry.

02

Determine if your business qualifies for the tax incentives based on eligibility requirements.

03

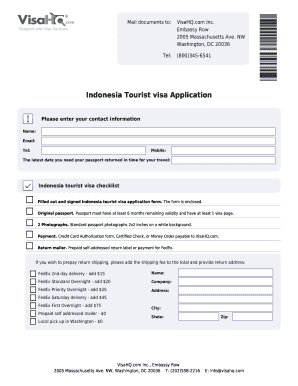

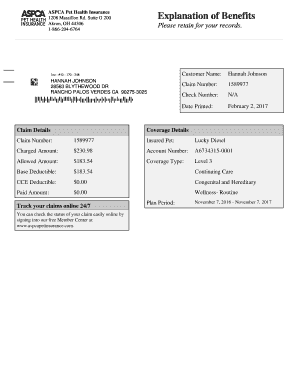

Gather all necessary documentation and information needed to apply for the tax incentives.

04

Fill out the application form accurately and completely, making sure to provide all required details.

05

Submit the application along with any supporting documents to the appropriate government agency or organization.

06

Follow up on the status of your application and provide any additional information requested by the agency.

07

If approved, make sure to comply with any reporting or compliance requirements to continue receiving the tax incentives.

Who needs making tax incentives?

01

Businesses looking to reduce their tax burden and increase their cash flow.

02

Entrepreneurs seeking to incentivize new investments or expansions.

03

Non-profit organizations aiming to maximize their financial resources.

04

Startups trying to offset initial costs and attract investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute making tax incentives online?

Filling out and eSigning making tax incentives is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the making tax incentives in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your making tax incentives and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit making tax incentives on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit making tax incentives.

What is making tax incentives?

Making tax incentives are financial benefits provided by the government to encourage specific behaviors or investments.

Who is required to file making tax incentives?

Individuals or businesses who have participated in activities that qualify for tax incentives are required to file for them.

How to fill out making tax incentives?

To fill out making tax incentives, individuals or businesses must provide information about the qualifying activities or investments they have made.

What is the purpose of making tax incentives?

The purpose of making tax incentives is to stimulate economic growth, drive investment in specific sectors, and incentivize certain behaviors.

What information must be reported on making tax incentives?

Information such as the amount invested, the specific activity or behavior being incentivized, and any supporting documentation may need to be reported on making tax incentives.

Fill out your making tax incentives online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Making Tax Incentives is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.