Get the free Tax Refund Offset - Bureau of the Fiscal Service

Show details

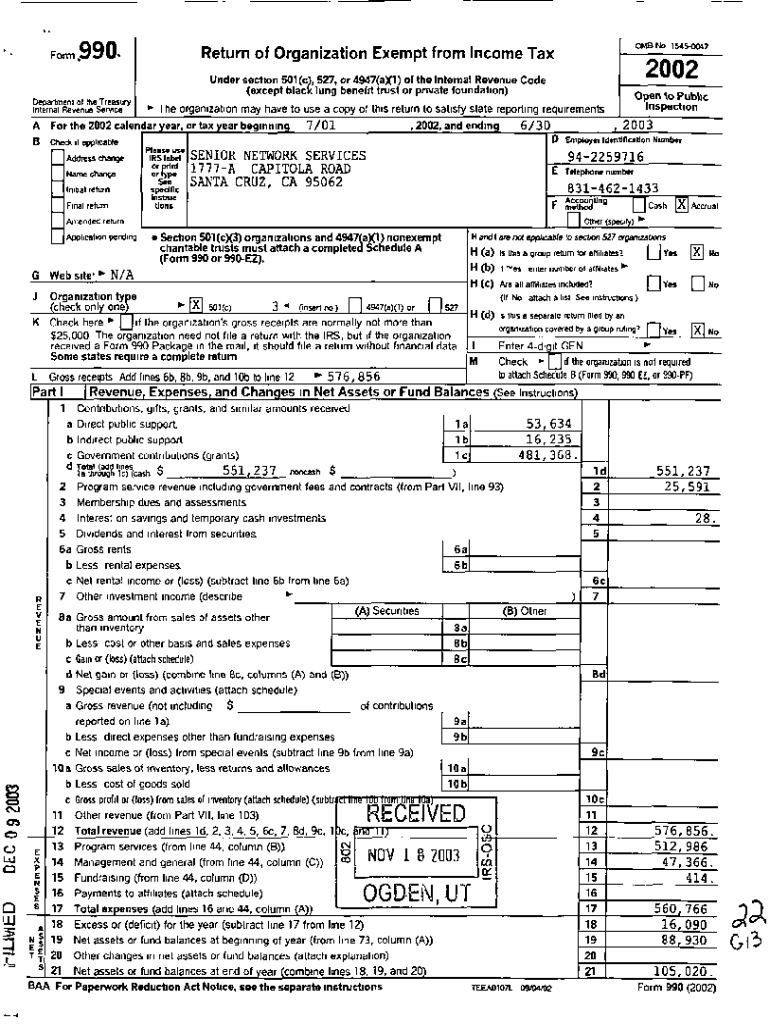

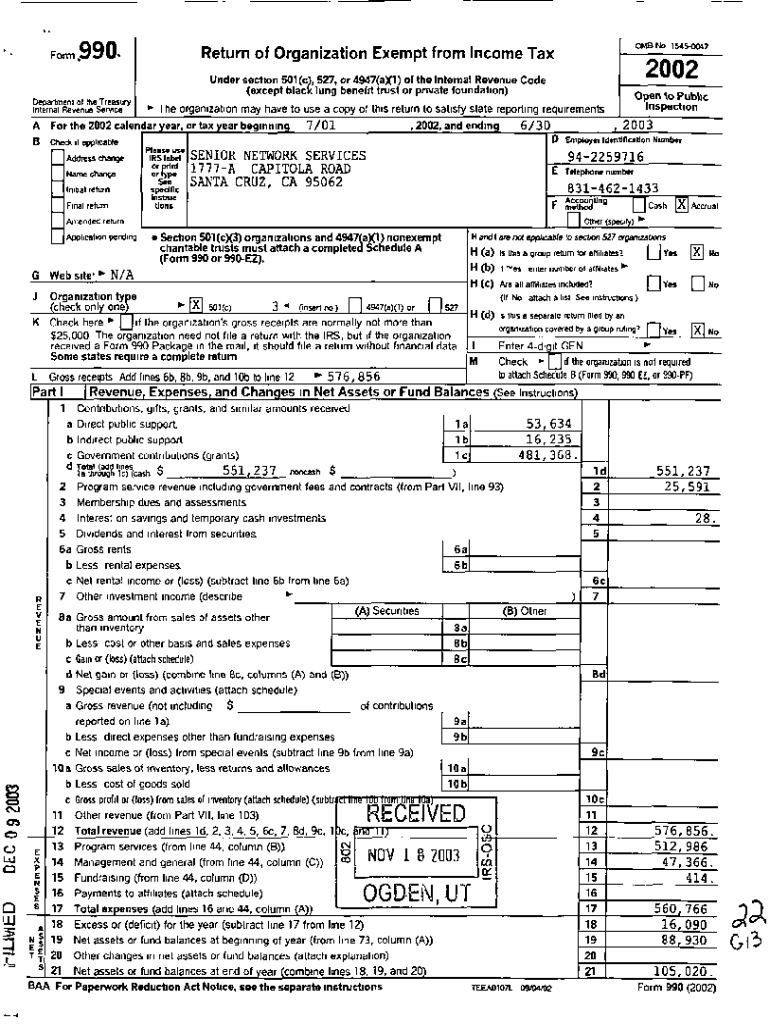

Form,990. Department of the Treasury Internal Revenue semé A B The organization may have to use a copy of this return to satisfy state reporting requirements or tax Y ear beginning g7/01, 2002, andendingSENIOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax refund offset

Edit your tax refund offset form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax refund offset form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax refund offset online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax refund offset. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax refund offset

How to fill out tax refund offset

01

Calculate the amount of your tax refund that is being offset

02

Contact the agency that is offsetting your refund to understand the reason for the offset

03

Provide any required documentation or information to the agency to resolve the offset

04

Make arrangements to pay any outstanding debts or penalties that resulted in the offset

05

Keep track of your tax refund offset and ensure it has been resolved

Who needs tax refund offset?

01

Individuals who owe money to government agencies or creditors

02

Individuals who have outstanding debts or penalties that are being collected through tax refund offsets

03

Individuals who want to resolve their tax refund offset in order to receive their full refund

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax refund offset for eSignature?

tax refund offset is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find tax refund offset?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific tax refund offset and other forms. Find the template you need and change it using powerful tools.

How do I fill out the tax refund offset form on my smartphone?

Use the pdfFiller mobile app to fill out and sign tax refund offset. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is tax refund offset?

Tax refund offset is a process where a taxpayer's refund is intercepted to pay off a debt owed to a government agency.

Who is required to file tax refund offset?

Individuals who owe a debt to a government agency are required to have their tax refund offset to repay the debt.

How to fill out tax refund offset?

To fill out a tax refund offset, individuals must contact the appropriate government agency to report the debt and authorize the offset.

What is the purpose of tax refund offset?

The purpose of tax refund offset is to collect debts owed to government agencies by intercepting taxpayer refunds.

What information must be reported on tax refund offset?

Individuals must report their debt to the government agency, provide authorization for the offset, and ensure that the refund amount is sufficient to cover the debt.

Fill out your tax refund offset online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Refund Offset is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.