Get the free FFIEC 101 Risk-Based Capital Reporting

Show details

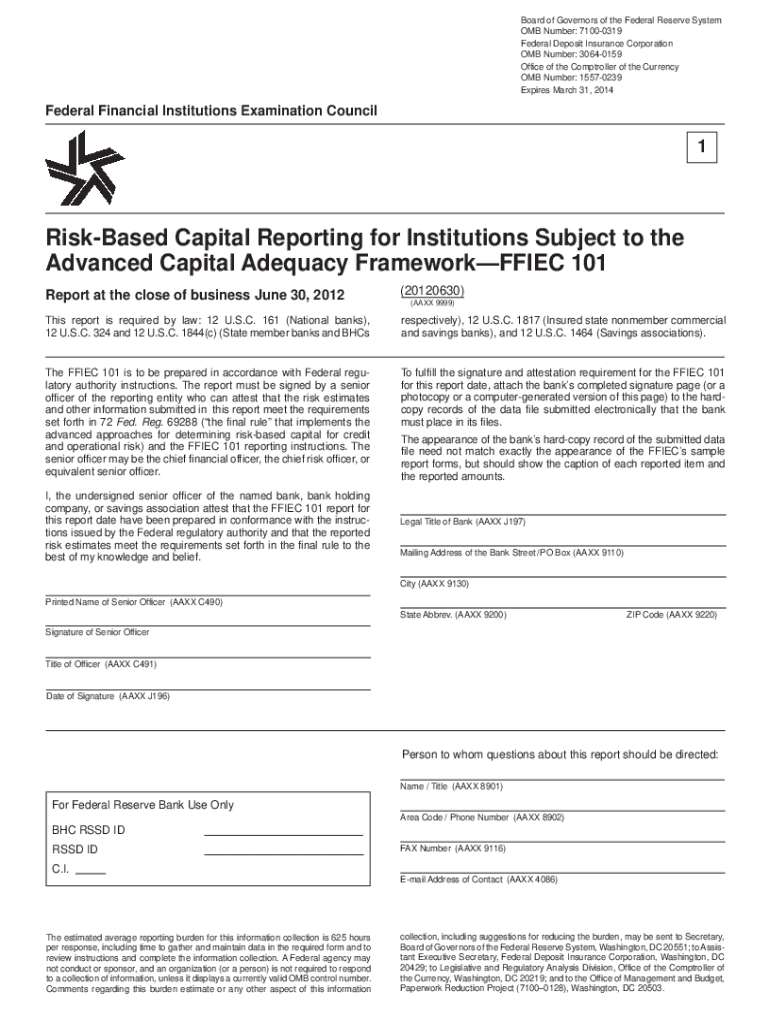

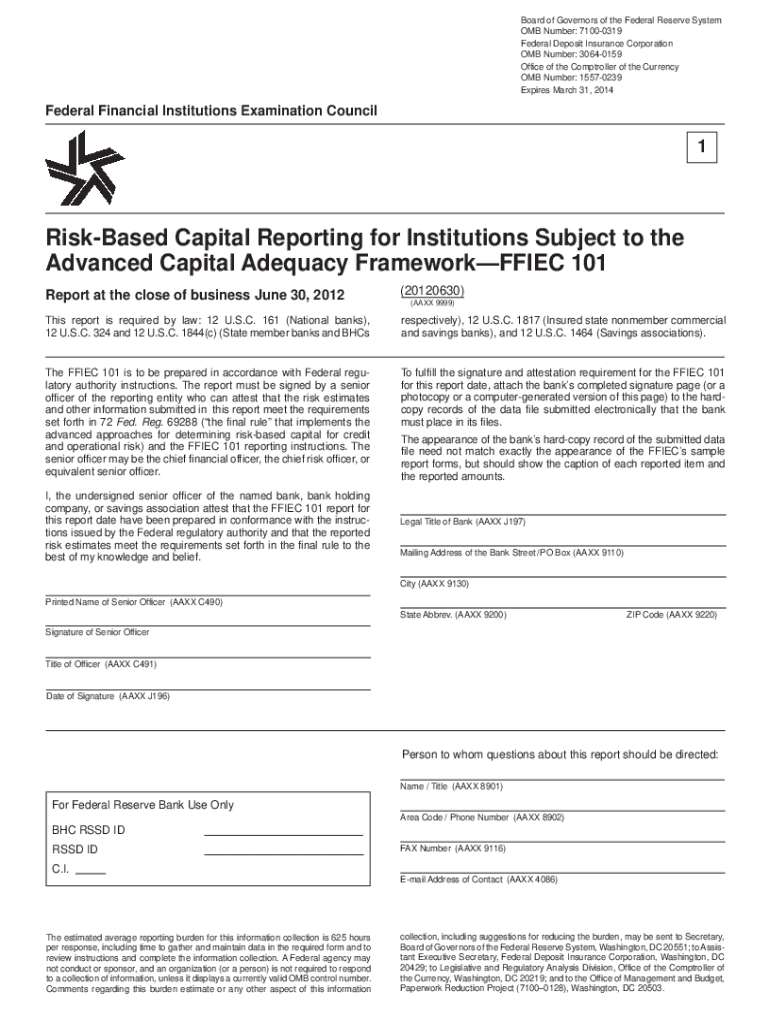

The FFIEC 101 form is used for reporting risk-based capital requirements by financial institutions following federal regulation and guidelines. It captures details on capital adequacy and risk-weighted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ffiec 101 risk-based capital

Edit your ffiec 101 risk-based capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ffiec 101 risk-based capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ffiec 101 risk-based capital online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ffiec 101 risk-based capital. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ffiec 101 risk-based capital

How to fill out FFIEC 101 Risk-Based Capital Reporting

01

Gather necessary financial information and documents.

02

Identify the reporting institution's risk-based capital requirements.

03

Complete sections on capital elements, including Tier 1 and total capital.

04

Calculate risk-weighted assets using prescribed methodologies.

05

Fill out the asset and off-balance sheet items appropriately.

06

Provide calculations for regulatory capital ratios.

07

Review the completed report for accuracy and completeness.

08

Submit the completed FFIEC 101 form to the appropriate regulatory authority.

Who needs FFIEC 101 Risk-Based Capital Reporting?

01

State-chartered banks and thrifts.

02

National banks.

03

Bank holding companies.

04

Financial institutions that are subject to risk-based capital requirements.

Fill

form

: Try Risk Free

People Also Ask about

What are risk-based standards?

Risk-based cleanup standards consider the risks that contamination poses to human health and the environment, taking into account the site's anticipated future use (such as residential, recreational, industrial, or commercial), rather than requiring that cleanups meet the standards required for “unrestricted” use.

What are examples of risk capital?

Risk capital is typically used for speculative investments in penny stocks, angel investing, private lending, futures and options trading, private equity, day trading and swing trading of stocks and commodities. Many of these markets indirectly influence who can put risk capital in them.

What is a risk-based capital regime?

The RBC regime adopts a three-pillar framework and an assessment approach which is sensitive to an insurer's asset and liability matching, risk appetite and mix of products.

What are risk-based capital guidelines?

Risk-based capital requirements are minimum capital requirements for banks set by regulators. There is a permanent floor for these requirements—8% for total risk-based capital (tier 2) and 4% for tier 1 risk-based capital. Tier 1 capital includes common stock, reserves, retained earnings, and certain preferred stock.

What is the risk capital rule?

Risk-based capital requirements are regulatory rules that establishe minimum regulatory capital for financial institutions such as banks. The goal is to keep banks stable, even during financial crises and prevent bank runs.

What is the FFIEC 101 report?

The Federal Reserve uses the reported data to assess and monitor the levels and components of each reporting entity's risk-based capital requirements and the adequacy of the entity's capital under the Advanced Capital Adequacy Framework; to evaluate the impact and competitive implications of the Advanced Capital

What are the requirements for Cculr?

Qualifying Criteria for the CCULR Rule To qualify for the CCULR framework, a complex credit union must meet the following criteria: Has a CCULR of 9% or greater. Total off-balance sheet exposures are 25% or less of its total assets. The sum of total trading assets and liabilities are 5% or less of its total assets.

What are the risk-based capital risks?

Risk-based capital is the theoretical amount of capital needed to absorb the risks involved in the operation of a business. Different companies face different risks and, therefore, should have different levels of capital based on those different risks, rather than on some arbitrary basis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FFIEC 101 Risk-Based Capital Reporting?

FFIEC 101 Risk-Based Capital Reporting is a standardized reporting framework used by financial institutions to assess their capital adequacy in relation to their risk exposure. It provides a consistent approach for institutions to report their regulatory capital and risk-weighted assets to the federal banking regulators.

Who is required to file FFIEC 101 Risk-Based Capital Reporting?

All institutions that are classified as advanced approaches banking organizations, including large bank holding companies and certain national banks, are required to file FFIEC 101 Risk-Based Capital Reporting.

How to fill out FFIEC 101 Risk-Based Capital Reporting?

To fill out FFIEC 101 Risk-Based Capital Reporting, institutions must gather data on their total risk-based capital, risk-weighted assets, and any other relevant financial metrics. They need to follow the specific instructions provided in the reporting form and ensure accuracy in their calculations before submitting the report to the appropriate regulatory authorities.

What is the purpose of FFIEC 101 Risk-Based Capital Reporting?

The purpose of FFIEC 101 Risk-Based Capital Reporting is to ensure that financial institutions maintain sufficient capital to cover their risks and protect depositors and the financial system. It helps regulators monitor the capital adequacy of institutions and promotes stability in the financial sector.

What information must be reported on FFIEC 101 Risk-Based Capital Reporting?

The information reported on FFIEC 101 includes details on tier 1 capital, total capital, risk-weighted assets, credit risk exposures, market risk exposures, and operational risk exposures, among other relevant data that reflects the financial institution's risk profile.

Fill out your ffiec 101 risk-based capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ffiec 101 Risk-Based Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.