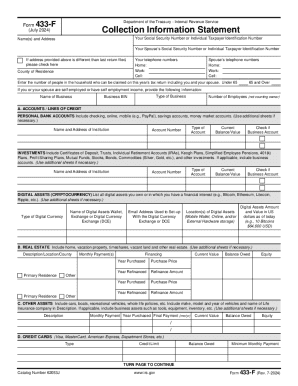

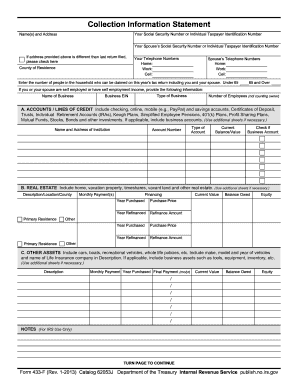

IRS 433-F 2010 free printable template

Instructions and Help about IRS 433-F

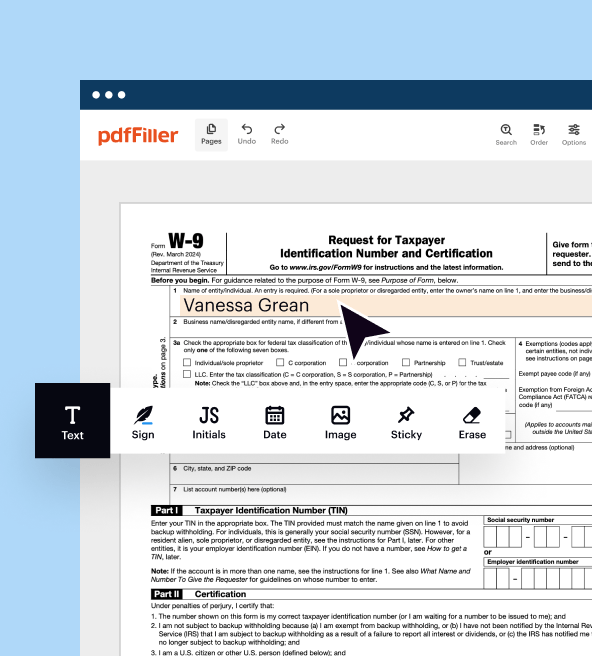

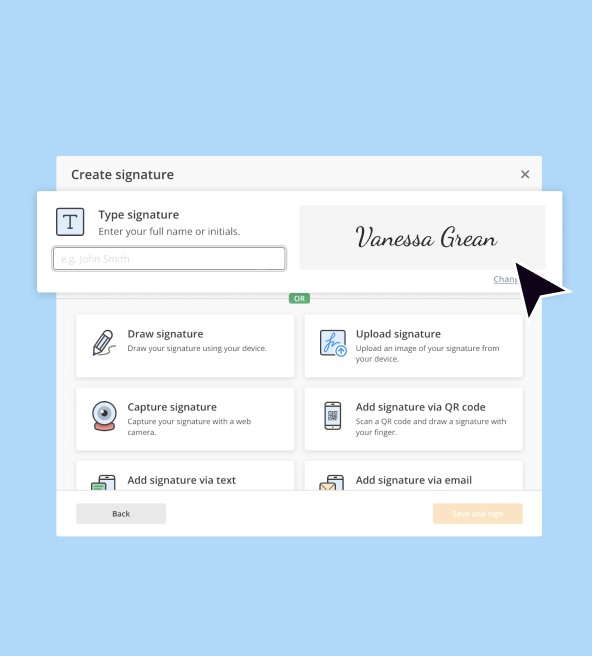

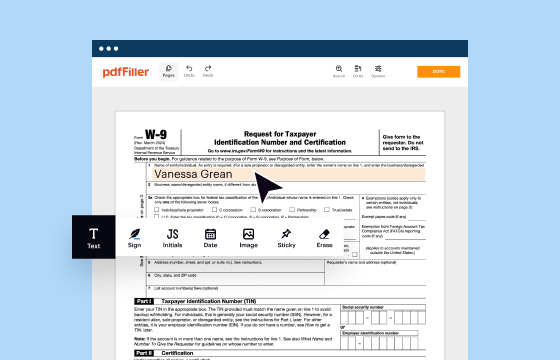

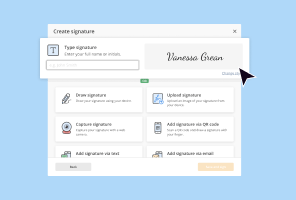

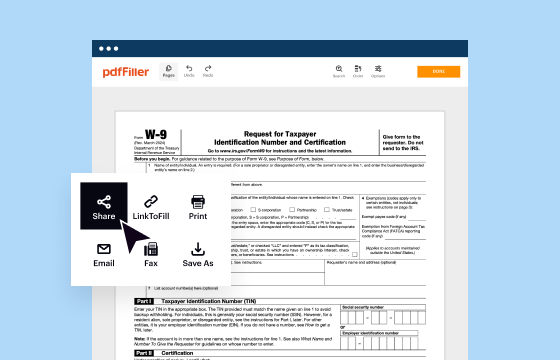

How to edit IRS 433-F

How to fill out IRS 433-F

About IRS 433-F 2010 previous version

What is IRS 433-F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

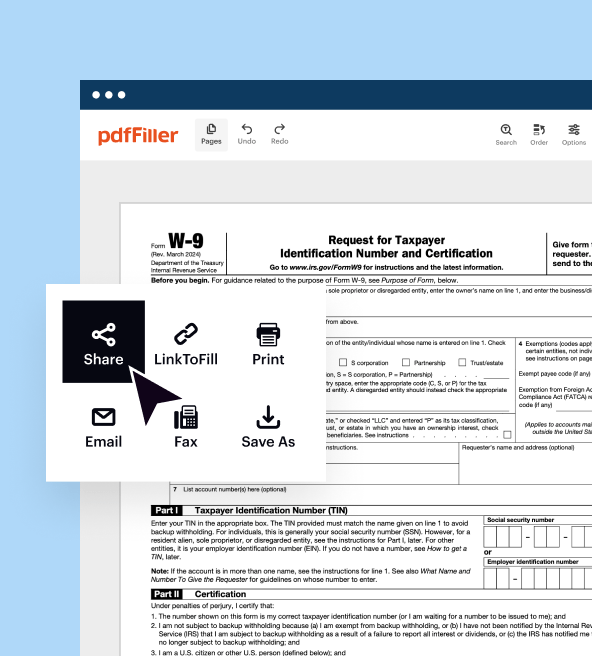

Where do I send the form?

FAQ about IRS 433-F

What should I do if I realize I made a mistake after submitting the join instruction form five?

If you discover an error after submitting, you can submit an amended join instruction form five to correct the mistake. Ensure that you clearly state the reason for the correction and include any necessary supporting documentation. It's advisable to keep records of all submissions for future reference.

How can I verify the status of my join instruction form five submission?

To track the status of your submitted join instruction form five, you can contact the relevant department or use their online tracking tool if available. Make sure to have your submission details ready. If your submission was e-filed and rejected, check for common rejection codes that can help identify the issue.

Are e-signatures acceptable when filing the join instruction form five?

Yes, e-signatures are generally accepted for the join instruction form five, provided they comply with relevant legal standards. Ensure that the e-signature method you're using meets the requirements outlined by the filing authority. Always keep a signed copy for your records.

What common mistakes should I avoid when filing the join instruction form five?

Common mistakes include incorrect taxpayer identification numbers, missing signatures, or failure to attach required documentation. Carefully reviewing your join instruction form five before submission can help prevent these errors. Additionally, ensure that all calculations are accurate to avoid processing delays.

What should I do if I receive a notice regarding my join instruction form five submission?

Upon receiving a notice related to your join instruction form five, read it carefully to understand the issue raised. Prepare any requested documentation and respond within the specified timeframe. If further clarification or information is needed, contact the filing authority for guidance.

See what our users say