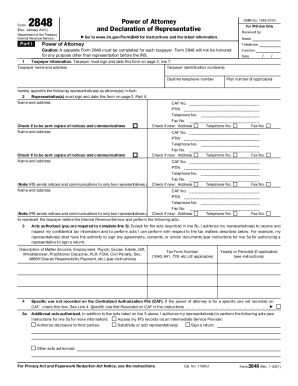

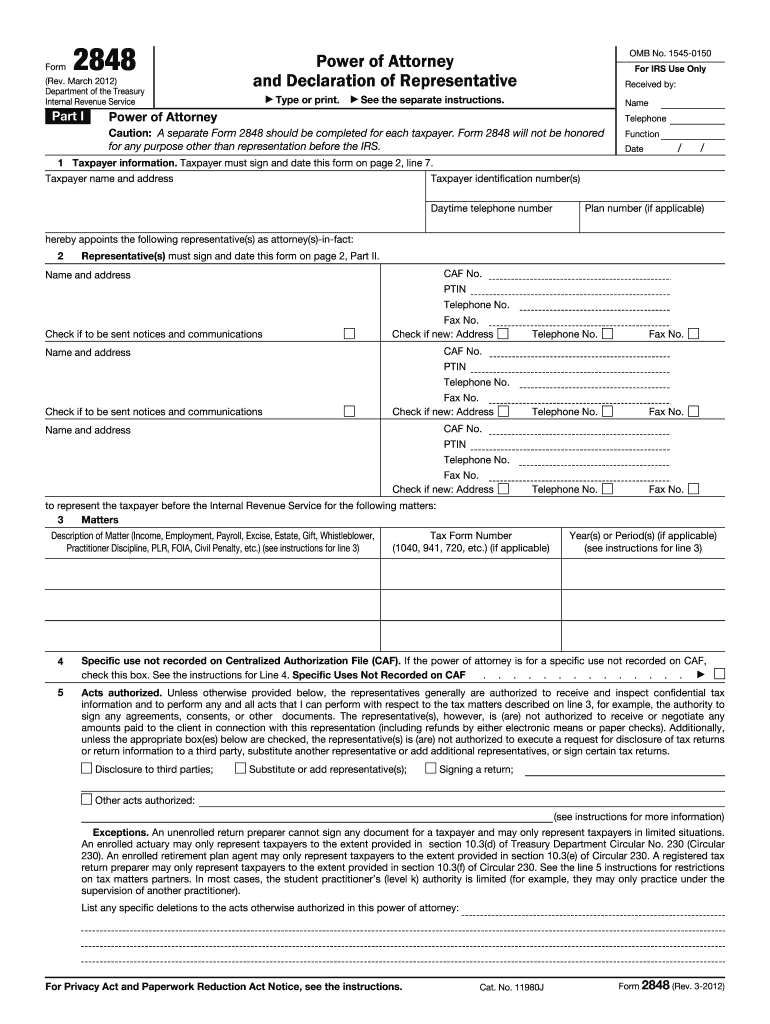

IRS 2848 2012 free printable template

Instructions and Help about IRS 2848

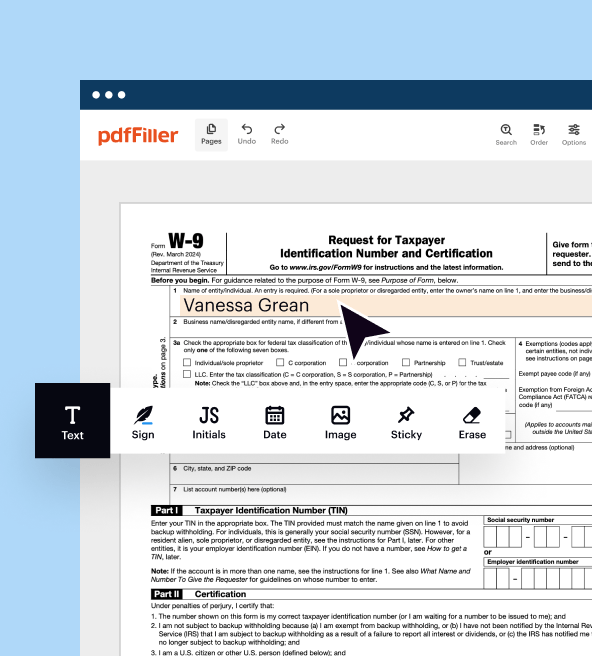

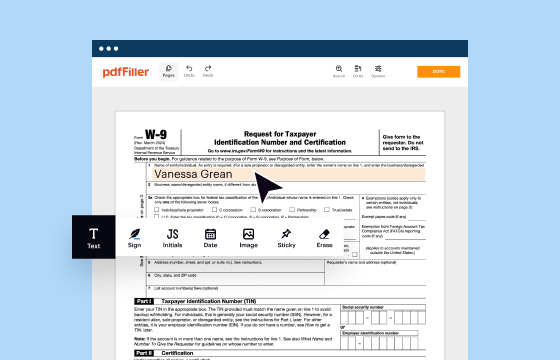

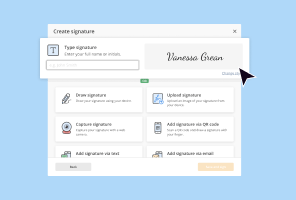

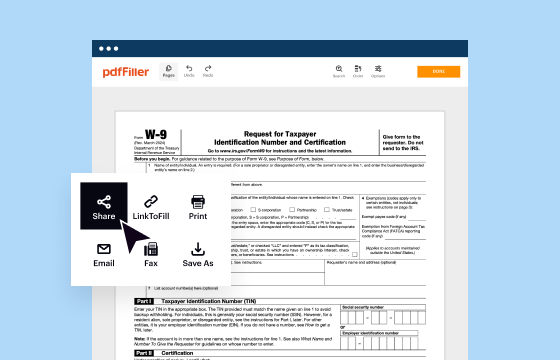

How to edit IRS 2848

How to fill out IRS 2848

About IRS 2 previous version

What is IRS 2848?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

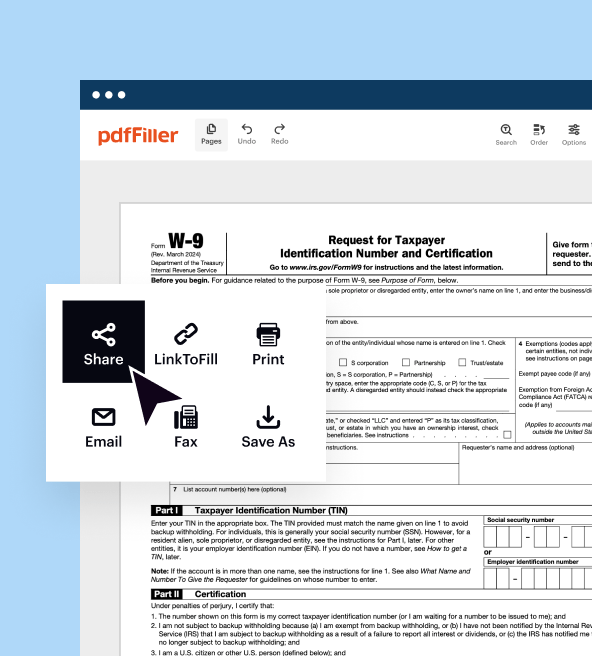

Where do I send the form?

FAQ about IRS 2848

What should I do if I need to correct mistakes on my 2848 form 2012 after submission?

To correct mistakes on your previously submitted 2848 form 2012, you will need to file an amended form. Ensure that you clearly indicate that it is a correction and provide accurate information to prevent any processing issues. It’s advisable to attach a cover letter explaining the changes made, which will help in tracking your correction.

How can I verify the status of my 2848 form 2012 after I file it?

You can verify the status of your submitted 2848 form 2012 by contacting the IRS directly or utilizing their online tools if available. It's essential to have your confirmation number ready if you filed electronically, as this will assist in tracking the receipt and processing of your form.

What common errors should I avoid when filing the 2848 form 2012?

Common errors when filing the 2848 form 2012 include missing signatures, incorrect identification numbers, and forgetting to include all necessary information about the representative. Double-checking entries before submission can vastly reduce the chance of rejection or delays.

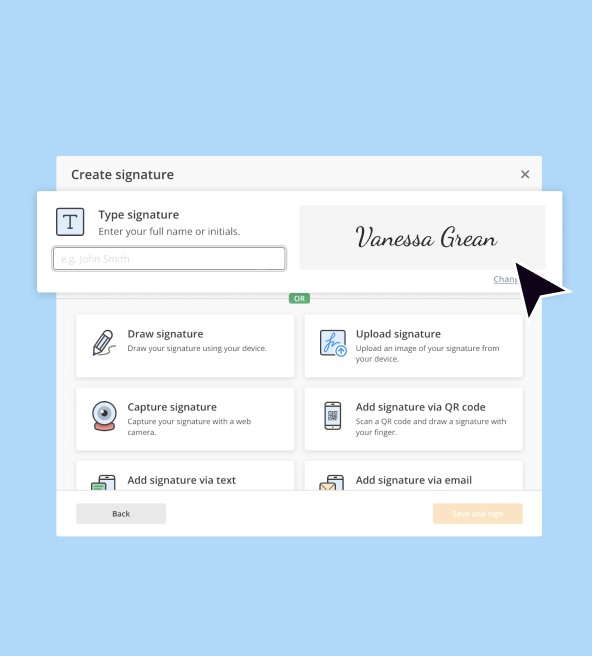

Can I use an electronic signature for my 2848 form 2012?

Yes, the IRS accepts electronic signatures on the 2848 form 2012 as long as the signature complies with their guidelines. It is crucial to ensure that the electronic method used adheres to the security and authenticity parameters set by the IRS to prevent complications.

What should I do if I receive a notice from the IRS regarding my 2848 form 2012?

If you receive a notice from the IRS regarding your 2848 form 2012, carefully read the notice for specific instructions on how to respond. It's important to gather all related documentation and address any issues outlined in the notice to effectively resolve the matter with the IRS.

See what our users say