Get the free Form 3519 (PIT)

Instructions and Help about form 3519 pit

How to edit form 3519 pit

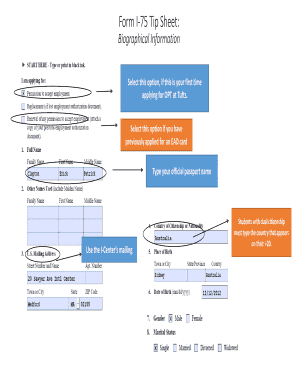

How to fill out form 3519 pit

Latest updates to form 3519 pit

All You Need to Know About form 3519 pit

What is form 3519 pit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about form 3519 pit

What should I do if I realize I've made a mistake after submitting form 3519 pit?

If you discover an error after submitting form 3519 pit, you can correct it by filing an amended version of the form. Ensure you reference the original submission and clearly indicate the changes made. It's best practice to keep a copy of both the original and amended forms for your records.

How can I track the status of my form 3519 pit submission?

To verify the status of your form 3519 pit submission, you'll need to check with the relevant tax authority. Many provide online tracking tools where you can input your details to see if the form has been received and processed. If you encounter issues, be aware of common e-file rejection codes that may require your attention.

Are e-signatures acceptable when submitting form 3519 pit?

Yes, e-signatures are accepted for form 3519 pit submissions. However, it's essential to ensure the e-signature complies with any regulatory requirements. Always verify that your electronic filing method adequately safeguards your data to maintain privacy and security.

What should I do if I receive an inquiry or notice regarding my form 3519 pit submission?

If you receive a notice or inquiry about your form 3519 pit, it is crucial to respond promptly. Review the notice carefully, gather any necessary documentation, and provide a clear explanation or additional information as required. Consulting with a tax professional can also be beneficial in these situations.