Get the free Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)

Show details

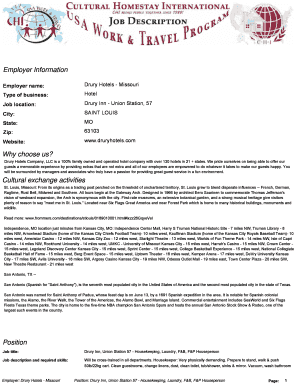

This document outlines the requirements and guidelines for partnership firms and Limited Liability Partnerships (LLPs) to obtain membership in the Ace Derivatives and Commodity Exchange Limited, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign membership documentation for partnership

Edit your membership documentation for partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your membership documentation for partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit membership documentation for partnership online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit membership documentation for partnership. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out membership documentation for partnership

How to fill out Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)

01

Begin by gathering all necessary details about the partnership firm or LLP, including names of partners, addresses, and the nature of the business.

02

Fill out the required forms provided by the respective regulatory authority or service provider handling the documentation.

03

Ensure that you have all partnership deeds or agreements readily available as they may be needed for reference.

04

Clearly outline the roles and responsibilities of each partner in the documentation.

05

Specify the profit-sharing ratio among partners as well as any provisions for capital contributions.

06

Review the documentation for accuracy and completeness before submission.

07

Submit the filled membership documentation along with any necessary supporting documents to the relevant authority.

08

Keep copies of all submitted documents for your records and any follow-up communications.

Who needs Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

01

All individuals or groups forming a Partnership Firm or Limited Liability Partnership (LLP) require Membership Documentation.

02

Business partners looking to formalize their partnership under the law need this documentation.

03

Investors who are looking to understand the structure and agreements of their investment in a Partnership Firm or LLP will also require this documentation.

04

Legal entities or professionals assisting in the registration and compliance process will need this documentation as well.

Fill

form

: Try Risk Free

People Also Ask about

What documents does a limited partnership have?

The Certificate of Limited Partnership must include: (1) the limited partnership's name, (2) its place of formation, (3) its principal office and mailing address (if different), (4) the names and addresses of each general partner, (5) and the name and address of the limited partnership's registered agent for service of

What is the downside of an LLP?

Disadvantages of an LLP Public disclosure is the main disadvantage of an LLP. Financial accounts have to be submitted to Companies House for the public record. The accounts may declare income of the members which they may not wish to be made public. Income is personal income and is taxed ingly.

Who are the members of the LLP?

An LLP has a separate legal entity under the law. A partnership firm has no separate legal status apart from its partners. The partner's liability of an LLP is limited to the extent of their capital contribution to the LLP. The partner's liability of a partnership firm has unlimited liability.

Is an LLP better than an LLC?

Limited Liability Partnership (LLP) A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

When to use an LLP?

LLPs are popular for larger partnerships and especially for professionals, and some states only allow professionals to use the LLP format. Like with general partnerships, an LLP must have two or more partners, but an LLP has flexibility in structuring how the amount of control and proceeds each partner retains.

What is the difference between an LLC and LLP?

Business activities: LLPs are suitable for professional services like law, while LLCs usually suit general small businesses. Ownership: Single owners need an LLC; multiple owners can choose either. Tax implications: LLPs only offer pass-through taxation. For more options, choose an LLC.

Which is better limited partnership or LLC?

LLCs may find it easier to attract investors due to their flexible profit distribution and management options. However, LPs might appeal to investors seeking a more passive role, as limited partners are not involved in day-to-day operations but still benefit from profits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

Membership Documentation for a Partnership Firm or Limited Liability Partnership (LLP) refers to the official records and documents that outline the details of the partnership agreement, the rights and responsibilities of each partner, and the financial contributions made by members to the firm or LLP.

Who is required to file Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

All partners in a Partnership Firm or members in a Limited Liability Partnership (LLP) are required to file Membership Documentation. This typically includes the designated partners, those with authority to act on behalf of the LLP, and any partners listed in the partnership agreement.

How to fill out Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

To fill out Membership Documentation for a Partnership Firm or LLP, one must collect relevant information such as the names of all partners or members, their contact details, the partnership agreement details, capital contributions, profit-sharing ratios, and any amendments to the agreement. This information should then be organized according to the specific forms required by the regulatory authority and submitted following the prescribed format.

What is the purpose of Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

The purpose of Membership Documentation for a Partnership Firm or LLP is to formalize the operational structure of the business, delineate the roles and responsibilities of partners or members, ensure regulatory compliance, and protect the rights and obligations of all parties involved.

What information must be reported on Membership Documentation for Partnership Firm/ Limited Liability Partnership (LLP)?

The information that must be reported on Membership Documentation for a Partnership Firm or LLP typically includes the names and addresses of all partners or members, the date of establishment of the partnership or LLP, the registered office address, capital contributions from each partner, profit-sharing ratios, and other key terms of the partnership agreement.

Fill out your membership documentation for partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Membership Documentation For Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.