Get the free barriers to revenue collection affecting municipal financial

Show details

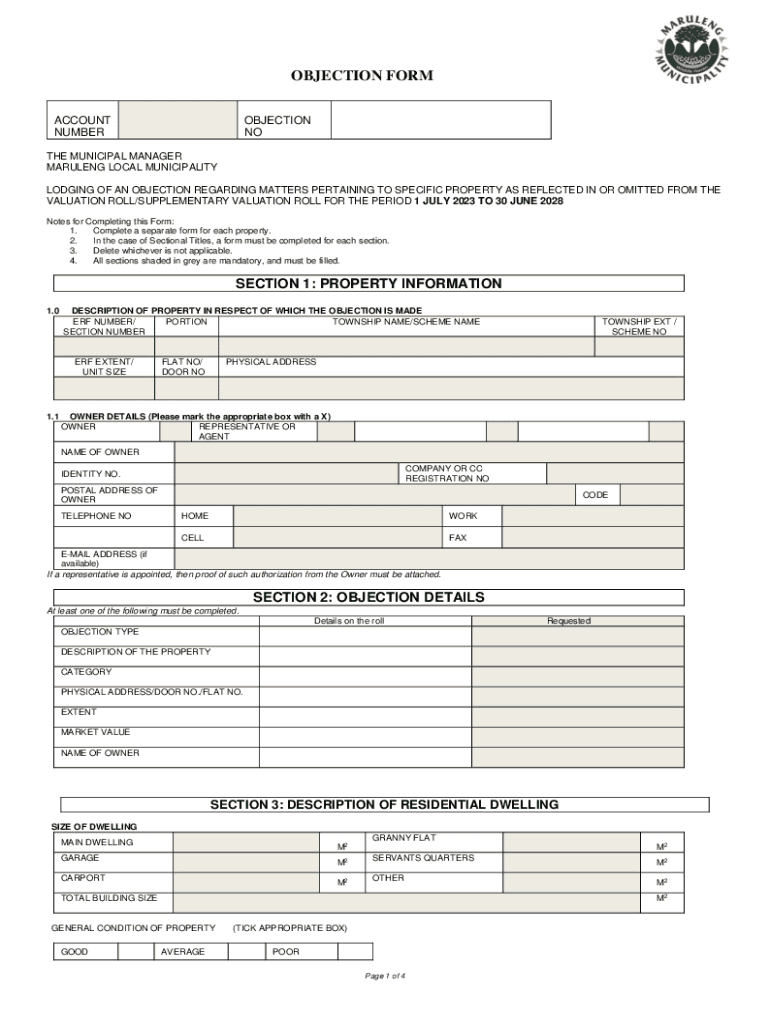

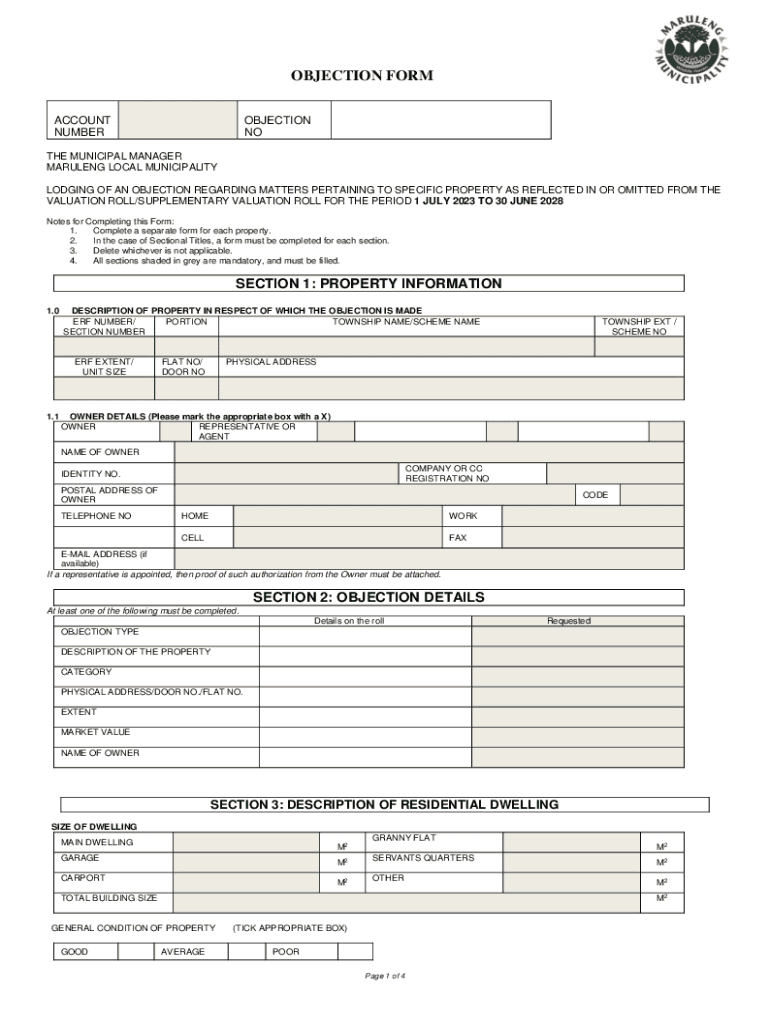

OBJECTION FORM ACCOUNT NUMBEROBJECTION NOTE MUNICIPAL MANAGER MARLENE LOCAL MUNICIPALITY LODGING OF AN OBJECTION REGARDING MATTERS PERTAINING TO SPECIFIC PROPERTY AS REFLECTED IN OR OMITTED FROM THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign barriers to revenue collection

Edit your barriers to revenue collection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your barriers to revenue collection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit barriers to revenue collection online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit barriers to revenue collection. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out barriers to revenue collection

How to fill out barriers to revenue collection

01

Identify potential barriers to revenue collection such as outdated billing processes, lack of staff training, or ineffective communication with customers.

02

Develop a plan to address each barrier, including implementing new technology, providing training for employees, and improving customer communication strategies.

03

Monitor progress regularly and make adjustments as needed to ensure successful revenue collection.

04

Continuously evaluate the effectiveness of the barriers to revenue collection and make improvements where necessary.

Who needs barriers to revenue collection?

01

Businesses of all sizes that rely on revenue to sustain operations and grow.

02

Organizations with complex billing systems or a large customer base that require efficient revenue collection processes.

03

Companies looking to improve cash flow and maximize profitability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my barriers to revenue collection in Gmail?

Create your eSignature using pdfFiller and then eSign your barriers to revenue collection immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out barriers to revenue collection on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your barriers to revenue collection from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit barriers to revenue collection on an Android device?

You can make any changes to PDF files, such as barriers to revenue collection, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is barriers to revenue collection?

Barriers to revenue collection refer to obstacles or challenges that may prevent a company or organization from effectively collecting money owed to them.

Who is required to file barriers to revenue collection?

Any organization or business that faces challenges or obstacles in collecting revenue is required to file barriers to revenue collection.

How to fill out barriers to revenue collection?

Barriers to revenue collection can be filled out by providing detailed information about the specific challenges or obstacles faced in collecting revenue, along with any relevant supporting documentation.

What is the purpose of barriers to revenue collection?

The purpose of barriers to revenue collection is to help organizations identify and address specific issues that may be impacting their ability to collect revenue, and to develop strategies to overcome these challenges.

What information must be reported on barriers to revenue collection?

Information that must be reported on barriers to revenue collection includes details about the specific challenges faced, the impact on revenue collection, and any actions taken or planned to address these challenges.

Fill out your barriers to revenue collection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Barriers To Revenue Collection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.