Get the free CONTEMPORARY ISSUES IN TAX RESEARCH Y ISSUES H - grib co

Show details

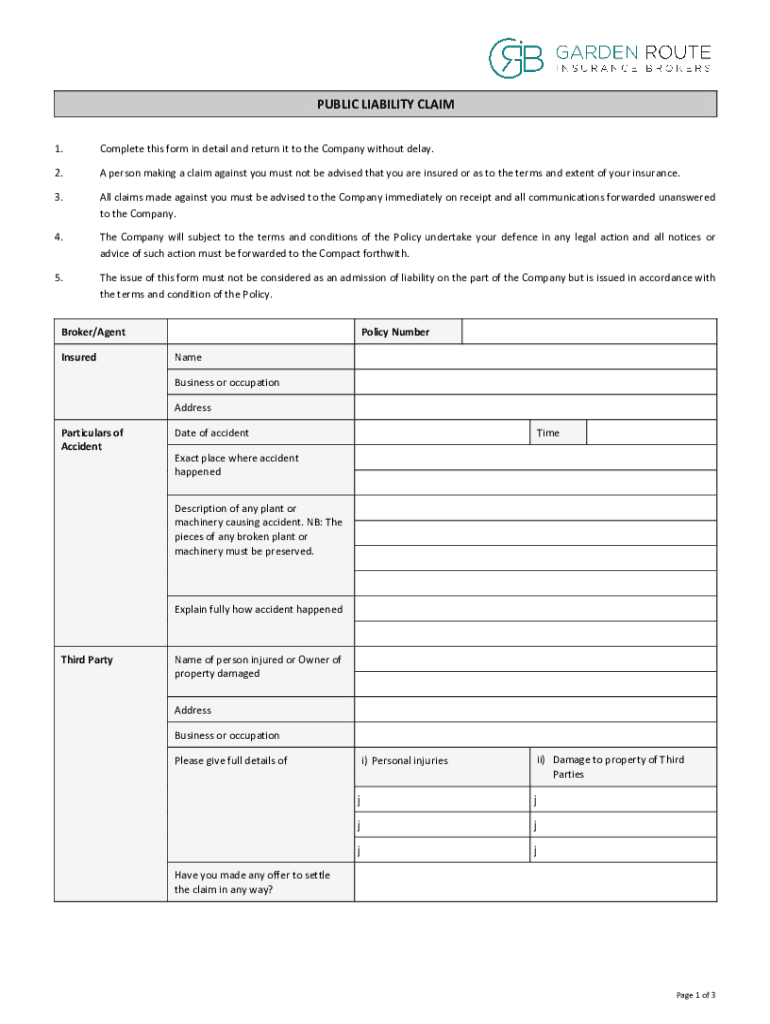

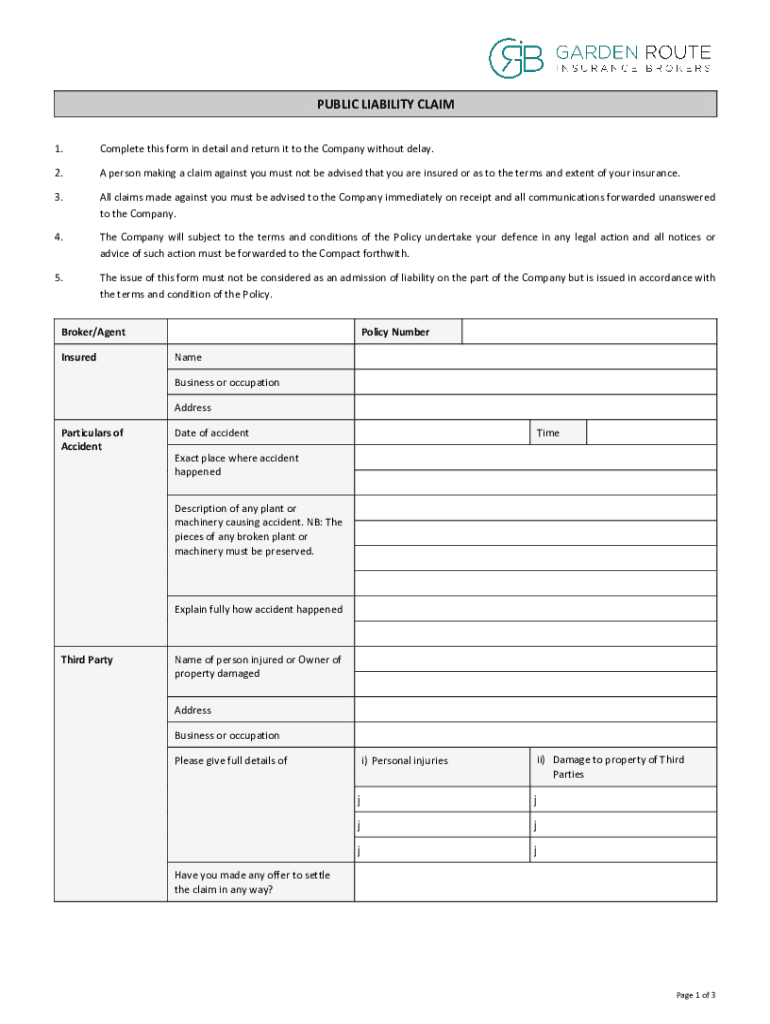

PUBLIC LIABILITY CLAIM 1. Complete this form in detail and return it to the Company without delay.2. A person making a claim against you must not be advised that you are insured or as to the terms

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contemporary issues in tax

Edit your contemporary issues in tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contemporary issues in tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contemporary issues in tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit contemporary issues in tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contemporary issues in tax

How to fill out contemporary issues in tax

01

Research and understand the current tax laws and regulations.

02

Identify any recent changes or updates in tax policies.

03

Gather relevant data and information on tax issues affecting your area of expertise.

04

Analyze the potential impact of these contemporary tax issues on your organization or clients.

05

Develop strategies to address and manage these tax concerns effectively.

Who needs contemporary issues in tax?

01

Tax professionals such as accountants, tax advisors, and consultants.

02

Businesses looking to stay compliant with tax laws and minimize their tax liabilities.

03

Individuals seeking to understand and navigate complex tax issues.

04

Government agencies and policymakers involved in tax legislation and reform.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contemporary issues in tax for eSignature?

Once you are ready to share your contemporary issues in tax, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get contemporary issues in tax?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the contemporary issues in tax in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the contemporary issues in tax electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your contemporary issues in tax.

What is contemporary issues in tax?

Contemporary issues in tax refer to current challenges, problems or debates surrounding tax laws and regulations.

Who is required to file contemporary issues in tax?

Tax professionals, accountants, and individuals working in the field of taxation are required to file contemporary issues in tax.

How to fill out contemporary issues in tax?

Contemporary issues in tax can be filled out by researching current tax laws and regulations, analyzing their impact, and providing insights or recommendations.

What is the purpose of contemporary issues in tax?

The purpose of contemporary issues in tax is to stay informed about current tax developments, potential changes in tax laws, and their implications.

What information must be reported on contemporary issues in tax?

Information on current tax laws, tax planning strategies, tax compliance issues, and tax policy debates must be reported on contemporary issues in tax.

Fill out your contemporary issues in tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contemporary Issues In Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.