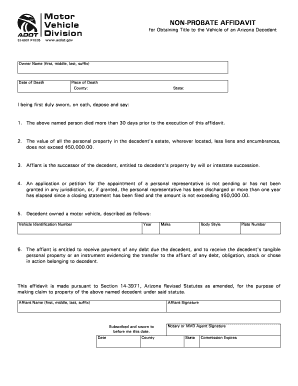

AZ 32-6901 2014 free printable template

Get, Create, Make and Sign non probate affidavit arizona form

Editing arizona non probate affidavit form online

Uncompromising security for your PDF editing and eSignature needs

AZ 32-6901 Form Versions

How to fill out arizona transfer vehicle title after death form

How to fill out AZ 32-6901

Who needs AZ 32-6901?

Video instructions and help with filling out and completing az 32 6901 form

Instructions and Help about arizona non probate affidavit

Hello hi brand off Wolf son the managing member of insight estate planning excellence we're in Sun City Arizona I want to discuss with you very brief segment regarding small estates and probate proceedings under Arizona law it is may not be news to you, but it is to many that you can get around you can avoid probate in Arizona depending on whether we're involving a real estate or just personal property meaning things other than real estate and depending on the value of the property involved Arizona will permit an inheritor to claim certain property merely by filing an affidavit is simply a statement in writing sworn to its truth in front of a notary public now if the value of the assets of the deceased are less than $75,000 now again we're just talking about personal property here not real estate after 30-day waiting period the person who's entitled to inherit those assets may prepare a short document that they sign under oath in front of a notary call it the affidavit and then submit that or present to the person or institution that possesses these items, and you should be able to recover it, so these small estates are as I said for non-real estate this process permits the complete avoidance of the probate court process, but again it's limited for use by only estates that are solely composed of personal property real estate must be handled with a different process so for example if you presented an affidavit from a bank indicating that you're the inheritor of certain personal property such as a bank, and you went to a bank with this affidavit in hand along with a certified copy of the death certificate of that loved one well you should with those two documents be able to accomplish getting the funds released from that account I've indicated down below here the Arizona statute that makes that possible you are well advised by the way to seek counsel of a qualified estate planning attorney tread very carefully before you decide to go forward with these because you may not be in a position to lawfully use an affidavit and therefore may not lawfully get title to the property that you're hoping to get, so I always recommend at con salt competent legal counsel in estate planning and probate of course if there are some issues within the family within the heirs that because this month to be contested such as well the will isn't the last well it's not the actual will of the deceased or there was pressure or threats made or the will was constructed under duress then those such kinds of issues those are the things that litigation are made about and those must take place and be resolved untangled and managed by a probate court which of course means involving attorneys it increased expenses perhaps fees from CPA's other people involved in being able to advise the court as to the issues involved including the whole and writing experts just the money from other people those kinds of issues so although you can transfer property to an inheritor by way of an...

People Also Ask about non probate affidavit form

Does Arizona require small estate affidavit?

What is the threshold for small estate affidavit in Arizona?

How much does an estate have to be worth to go to probate in Arizona?

What is a small estate exemption in Arizona?

How do I file a small estate affidavit in Arizona?

What is the limit for a small estate affidavit in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my adot non probate affidavit in Gmail?

How can I send adot non probate affidavit form for eSignature?

How do I make edits in arizona affidavit of title correction without leaving Chrome?

What is AZ 32-6901?

Who is required to file AZ 32-6901?

How to fill out AZ 32-6901?

What is the purpose of AZ 32-6901?

What information must be reported on AZ 32-6901?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.