Get the free Code of Conduct for Prohibition of Insider Trading

Show details

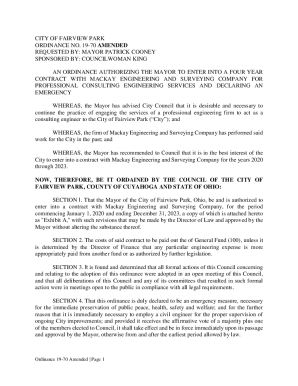

This document outlines the Code of Conduct for Shardul Securities Limited regarding the prohibition of insider trading, detailing definitions, objectives, compliance procedures, trading restrictions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign code of conduct for

Edit your code of conduct for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your code of conduct for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit code of conduct for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit code of conduct for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

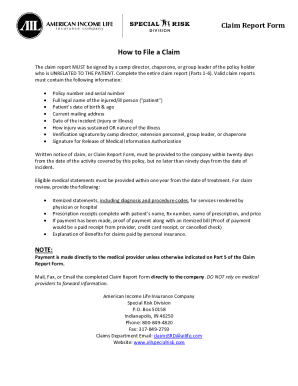

How to fill out code of conduct for

How to fill out Code of Conduct for Prohibition of Insider Trading

01

Understand the purpose of the Code of Conduct for Prohibition of Insider Trading.

02

Gather relevant materials such as the company's policies and applicable laws regarding insider trading.

03

Read and comprehend the definitions of key terms related to insider trading included in the document.

04

Identify the individuals and entities covered by the Code.

05

Review examples of what constitutes insider information and permissible trading activities.

06

Follow the guidelines for reporting any suspected violations of the Code.

07

Familiarize yourself with the consequences of non-compliance outlined in the document.

08

Complete any required training sessions or certifications as mentioned in the Code.

09

Sign and date the Code of Conduct to acknowledge your understanding and compliance.

Who needs Code of Conduct for Prohibition of Insider Trading?

01

All employees of the company.

02

Board members and executives.

03

Contractors and consultants who have access to confidential information.

04

Any stakeholders involved in the company's securities.

Fill

form

: Try Risk Free

People Also Ask about

What is the insider trading Prohibition Act?

To amend the Securities Exchange Act of 1934 to prohibit certain securities trading and related communications by those who possess material, nonpublic information. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, SECTION 1.

What is the code of conduct for insider trading?

No person shall procure from or cause the communication by any insider of unpublished price sensitive information, relating to the Bank or securities listed or proposed to be listed, except in furtherance of legitimate purposes, performance of duties or discharge of legal obligations.

What is the policy on prohibition of insider trading?

The dealing in securities by an 'insider' is illegal when it is predicated upon the utilization of 'inside' information to profit at the expense of other investors who do not have access to the same information. The prices of most securities generally reflect the available public information about listed entity.

What laws prohibit insider trading?

SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a loss) by trading in the Company's stock. This rule also prohibits “tipping” of confidential corporate information to third parties.

What is the law to stop insider trading?

The Stop Trading on Congressional Knowledge (STOCK) Act prohibits members and employees of Congress from using "any nonpublic information derived from the individual's position or gained from performance of the individual's duties, for personal benefit".

What are the 4 elements of insider trading?

The Supreme Court proscribed 4 elements to prove insider trading under the misappropriation theory, 1) a lie or deception 2) a transgression of a fiduciary obligation 3) the use of secret information in relation to a securities transaction 4) willfulness by the defendant.

What is the rule 10b-5 prohibition on insider trading?

Rule 10b-5 sets regulations against insider trading. The rule lays out the types of information considered material nonpublic information (MNPI) and outlines ways that insiders can violate SEC insider trading regulations and expose themselves to penalties and fines.

What is the policy against insider trading?

Federal and state securities laws prohibit the purchase or sale of a company's securities by anyone who is aware of material information about that company that is not generally known or available to the public.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Code of Conduct for Prohibition of Insider Trading?

The Code of Conduct for Prohibition of Insider Trading is a set of regulations designed to prevent insider trading by prohibiting individuals with access to non-public, material information from trading in the securities of a company based on that information.

Who is required to file Code of Conduct for Prohibition of Insider Trading?

Individuals who are considered insiders, such as directors, officers, employees, and certain affiliated individuals of a company, are required to file and adhere to the Code of Conduct for Prohibition of Insider Trading.

How to fill out Code of Conduct for Prohibition of Insider Trading?

To fill out the Code of Conduct for Prohibition of Insider Trading, individuals must provide their personal details, acknowledge their understanding of the guidelines, and disclose any relevant shareholdings or transactions in the securities of the company as required.

What is the purpose of Code of Conduct for Prohibition of Insider Trading?

The purpose of the Code of Conduct for Prohibition of Insider Trading is to maintain market integrity and fairness by preventing insider trading, ensuring that all investors have equal access to material information regarding the company.

What information must be reported on Code of Conduct for Prohibition of Insider Trading?

Individuals must report any material non-public information they possess, details of their trading activities in the company's securities, and any changes in their personal holdings or relationships that may affect their insider status.

Fill out your code of conduct for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Code Of Conduct For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.