Get the free Competitive Liquidity Provider Registration Application

Show details

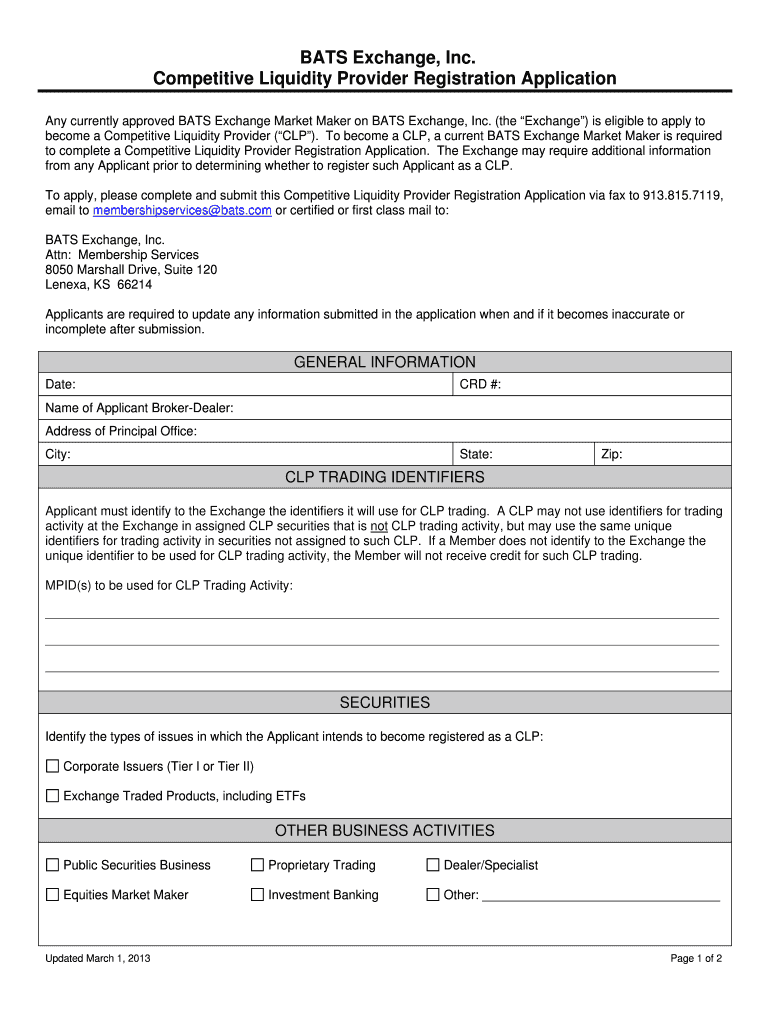

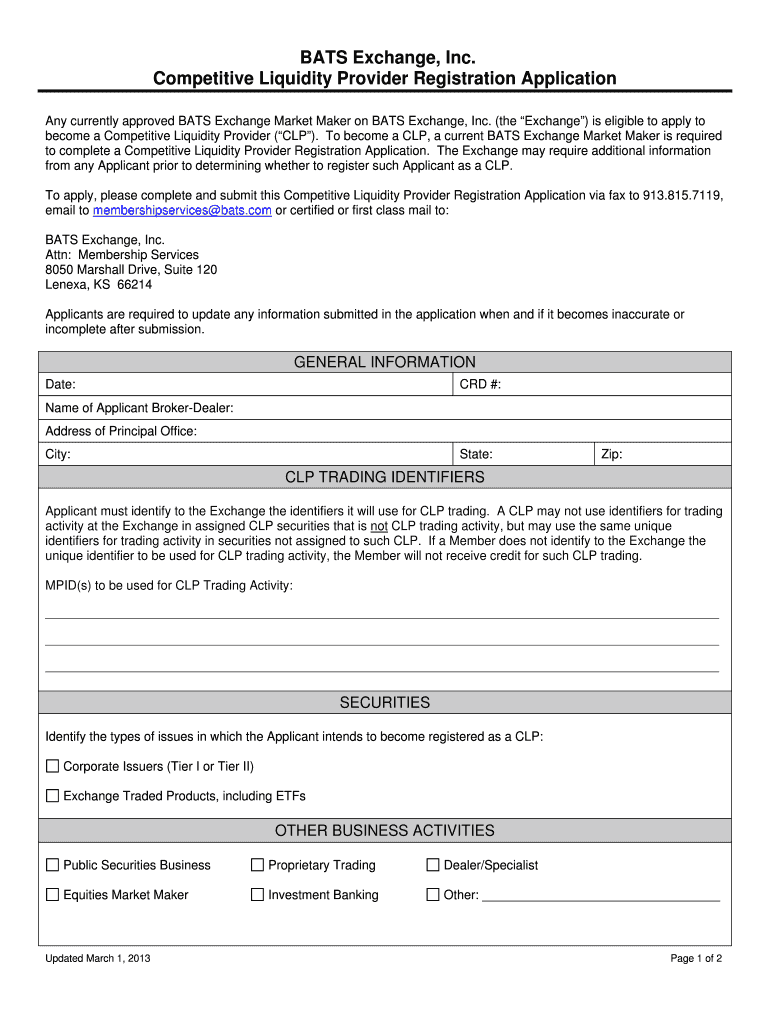

This document serves as an application for current BATS Exchange Market Makers to register as Competitive Liquidity Providers, detailing required information for trading identifiers, business activities,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign competitive liquidity provider registration

Edit your competitive liquidity provider registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your competitive liquidity provider registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing competitive liquidity provider registration online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit competitive liquidity provider registration. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out competitive liquidity provider registration

How to fill out Competitive Liquidity Provider Registration Application

01

Gather required personal and business information.

02

Fill in the applicant's name and contact details.

03

Provide business structure information including entity type, ownership details, and registration number.

04

Describe the trading strategies and financial products the firm will offer.

05

Include details about risk management practices and compliance procedures.

06

Disclose financial statements or capital commitments as required.

07

Review the application for completeness and accuracy.

08

Submit the application through the designated regulatory platform.

Who needs Competitive Liquidity Provider Registration Application?

01

Financial firms involved in market-making activities.

02

Entities that provide liquidity to financial markets.

03

Organizations seeking to operate under a Competitive Liquidity Provider framework.

04

Firms aiming to enhance their trading capabilities and market participation.

Fill

form

: Try Risk Free

People Also Ask about

Do liquidity providers make money?

Final Thoughts. Liquidity providers are integral to the functionality and efficiency of cryptocurrency markets. By supplying assets to liquidity pools, they facilitate seamless trading, contribute to market stability, and earn rewards in return.

Who is the biggest liquidity provider?

Liquidity Providers Advanced Markets. Advanced Markets is a leading provider of prime-of-prime liquidity, offering credit and technology solutions to brokers and asset managers worldwide. Ausprime. LMAX. Swissquote. IS Prime FX. Tel-Aviv Stock Exchange. IG. FXCM Pro.

Do liquidity providers lose money?

Two significant risks that liquidity providers face are impermanent loss and slippage. This blog post delves into the concepts of impermanent loss and slippage, offering insights on how they impact traders and liquidity providers.

What is the difference between ECN and liquidity provider?

Liquidity providers supply ECNs with buy and sell orders to fill investor orders. If an investor wishes to buy a stock, the ECN must have a sell order to match it. The liquidity provider will then offer sell orders to match the buy order. Liquidity providers help ECN investors trade securities faster.

How do liquidity providers make money?

Therefore, liquidity providers receive more from fees to cover their impermanent loss. However, in case of a considerable price difference, your fee compensation might not cover the loss. In this case, you would have gained more value if you held the assets instead of providing liquidity.

What are the risks of liquidity provider?

Cryptocurrency liquidity pools make money by charging transaction fees on any trades made on the exchange. Fees are applied by the smart contract and are immutable. For example, suppose a decentralised exchange charges 1% for every transaction made on the platform via a smart contract.

How do you become a liquidity provider?

Each Uniswap smart contract, or pair, manages a liquidity pool made up of reserves of two ERC-20 s. Anyone can become a liquidity provider (LP) for a pool by depositing an equivalent value of each underlying in return for pool s.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Competitive Liquidity Provider Registration Application?

The Competitive Liquidity Provider Registration Application is a formal document that firms must submit to register as liquidity providers in competitive markets. It ensures compliance with regulatory standards and facilitates participation in liquidity provision.

Who is required to file Competitive Liquidity Provider Registration Application?

Entities or firms that intend to operate as competitive liquidity providers in financial markets are required to file this application. This includes brokers, dealers, and other financial institutions engaged in providing liquidity.

How to fill out Competitive Liquidity Provider Registration Application?

To fill out the Competitive Liquidity Provider Registration Application, applicants must gather necessary financial and operational information, complete all required sections of the form accurately, and submit supporting documentation as per the regulatory requirements.

What is the purpose of Competitive Liquidity Provider Registration Application?

The purpose of the Competitive Liquidity Provider Registration Application is to establish a regulatory framework for liquidity providers, ensuring they meet market standards, enhance market efficiency, and maintain fair trading practices.

What information must be reported on Competitive Liquidity Provider Registration Application?

The application must report information such as the applicant's business structure, financial condition, relevant experience, compliance history, and any affiliations with other financial entities, along with any disclosure required by the regulatory body.

Fill out your competitive liquidity provider registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Competitive Liquidity Provider Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.