Get the free Indian Audit and Accounts Department International Centre ...

Show details

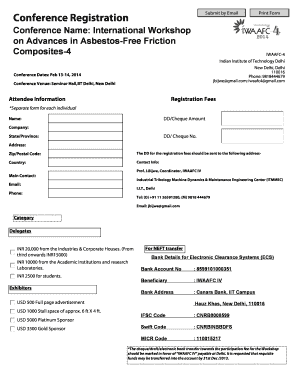

Indian Audit and Accounts Department International Center for Environment Audit and Sustainable Development (iced), Jaipur (Comptroller and Auditor General of India) Date 07.03.2022 Jaipur Subject:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian audit and accounts

Edit your indian audit and accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian audit and accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indian audit and accounts online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indian audit and accounts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian audit and accounts

How to fill out indian audit and accounts

01

Step 1: Gather all necessary financial information and documents such as income statements, balance sheets, and cash flow statements.

02

Step 2: Review the auditing standards set by the Institute of Chartered Accountants of India (ICAI) to ensure compliance.

03

Step 3: Prepare and organize the financial data in a systematic manner for auditing.

04

Step 4: Conduct an internal audit to identify any discrepancies or errors in the financial records.

05

Step 5: Hire a qualified auditor in India to perform the official audit of the accounts.

06

Step 6: Compile the audit report and submit it to the appropriate authorities.

07

Step 7: Follow up on any recommendations or findings from the audit to improve financial processes and transparency.

Who needs indian audit and accounts?

01

Businesses operating in India that are required by law to undergo a financial audit and maintain accurate accounts.

02

Investors and stakeholders who rely on audited financial statements to make informed decisions about the company's financial health.

03

Government agencies and regulatory bodies that use audit reports to ensure compliance with financial regulations and tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete indian audit and accounts online?

With pdfFiller, you may easily complete and sign indian audit and accounts online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the indian audit and accounts form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign indian audit and accounts and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out indian audit and accounts on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your indian audit and accounts. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is indian audit and accounts?

Indian Audit and Accounts refers to the audit and accounting practices followed in India by government departments, public sector undertakings, and other entities.

Who is required to file indian audit and accounts?

Entities that fall under the purview of the Indian Audit and Accounts regulations are required to file these reports.

How to fill out indian audit and accounts?

Indian audit and accounts can be filled out by following the prescribed format and guidelines provided by the Indian government.

What is the purpose of indian audit and accounts?

The purpose of Indian audit and accounts is to ensure transparency, accountability, and proper financial management in public and private entities.

What information must be reported on indian audit and accounts?

Indian audit and accounts must include financial statements, revenue and expenditure details, audit findings, and other relevant financial information.

Fill out your indian audit and accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Audit And Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.