WI WEA Member Benefits IRA 3449-292 2023 free printable template

Show details

P.O. Box 7893 Madison, WI 537077893

18002794030

Fax: (608) 2372529IRA Qualified Charitable Distribution Form

By completing this form, the participant verifies that the receiving organization is a

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI WEA Member Benefits IRA 3449-292

Edit your WI WEA Member Benefits IRA 3449-292 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI WEA Member Benefits IRA 3449-292 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI WEA Member Benefits IRA 3449-292 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI WEA Member Benefits IRA 3449-292. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI WEA Member Benefits IRA 3449-292 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI WEA Member Benefits IRA 3449-292

How to fill out WI WEA Member Benefits IRA 3449-292

01

Obtain the WI WEA Member Benefits IRA 3449-292 form from the official website or your local WEA office.

02

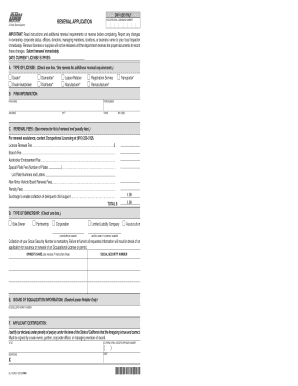

Fill out your personal information at the top of the form, including your name, address, and contact information.

03

Select the type of IRA you are applying for (Traditional IRA or Roth IRA) and check the appropriate box.

04

Complete the beneficiary information section by providing the name(s) and contact information for your chosen beneficiaries.

05

Indicate your initial contribution amount and the method of funding (e.g., check, transfer from another IRA).

06

Review the contributions limits and ensure your application adheres to IRS guidelines.

07

Sign and date the form to certify the information provided is accurate.

08

Submit the completed form to the address listed in the application instructions.

Who needs WI WEA Member Benefits IRA 3449-292?

01

Individuals who are members of the Wisconsin Education Association (WEA) seeking to establish an Individual Retirement Account (IRA).

02

Teachers and educational professionals looking for retirement savings options specifically tailored for WEA members.

03

Anyone interested in tax-advantaged retirement savings who meets eligibility requirements as outlined by WEA.

Fill

form

: Try Risk Free

People Also Ask about

How do I make a QCD from my IRA?

Communicate with your IRA's custodian (where your IRA is held) that you are interested in making a QCD(s). Make the request for a QCD(s) in writing. Specify the dollar amount that you wish to contribute to each individual charity. Request the check be made payable to the charity(ies) but be mailed to you.

What form do I use for qualified charitable distribution?

The QCD will be reported to the IRS on Form 1099-R as a normal distribution (Code 7) based on your age. You must document the tax-free qualification to the Internal Revenue Service “IRS” on your Federal income tax return (Form 1040).

What is a QCD letter?

What is a Qualified Charitable Distribution (QCD)? A QCD is an otherwise taxable distribution from an IRA owned by an individual who is 70½ or older that is paid directly from the IRA to a qualified charity.

How do I fill out a QCD?

Communicate with your IRA's custodian (where your IRA is held) that you are interested in making a QCD(s). Make the request for a QCD(s) in writing. Specify the dollar amount that you wish to contribute to each individual charity. Request the check be made payable to the charity(ies) but be mailed to you.

How do I enter a qualified charitable distribution?

To report a qualified charitable distribution on your Form 1040 tax return, you generally report the full amount of the charitable distribution on the line for IRA distributions. On the line for the taxable amount, enter zero if the full amount was a qualified charitable distribution.

What documentation is required for a QCD?

Ultimately, when a QCD is done, the necessary documentation needed for a tax return includes the amount of the donation, the date of the donation, the name of the charity, and whether the charity provided any goods or services for the donation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI WEA Member Benefits IRA 3449-292 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your WI WEA Member Benefits IRA 3449-292 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the WI WEA Member Benefits IRA 3449-292 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your WI WEA Member Benefits IRA 3449-292 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out WI WEA Member Benefits IRA 3449-292 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your WI WEA Member Benefits IRA 3449-292. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is WI WEA Member Benefits IRA 3449-292?

WI WEA Member Benefits IRA 3449-292 is an Individual Retirement Account (IRA) specific to the Wisconsin Education Association (WEA) that allows members to save for retirement with potential tax benefits.

Who is required to file WI WEA Member Benefits IRA 3449-292?

Members of the Wisconsin Education Association who have an IRA through WEA and need to report contributions, distributions, or tax liabilities related to the account are required to file WI WEA Member Benefits IRA 3449-292.

How to fill out WI WEA Member Benefits IRA 3449-292?

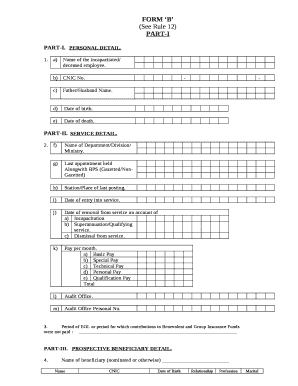

To fill out WI WEA Member Benefits IRA 3449-292, members must provide their personal information, including their name, address, and Social Security number, as well as detail their contributions or distributions made during the tax year.

What is the purpose of WI WEA Member Benefits IRA 3449-292?

The purpose of WI WEA Member Benefits IRA 3449-292 is to facilitate the reporting and management of contributions to the IRA and to ensure compliance with IRS regulations regarding retirement accounts.

What information must be reported on WI WEA Member Benefits IRA 3449-292?

The information that must be reported on WI WEA Member Benefits IRA 3449-292 includes member identification details, the amount of contributions made during the tax year, any distributions taken, and relevant account balances.

Fill out your WI WEA Member Benefits IRA 3449-292 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI WEA Member Benefits IRA 3449-292 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.