Get the free Transient Lodging Tax Remittance Form - City of Gladstone

Show details

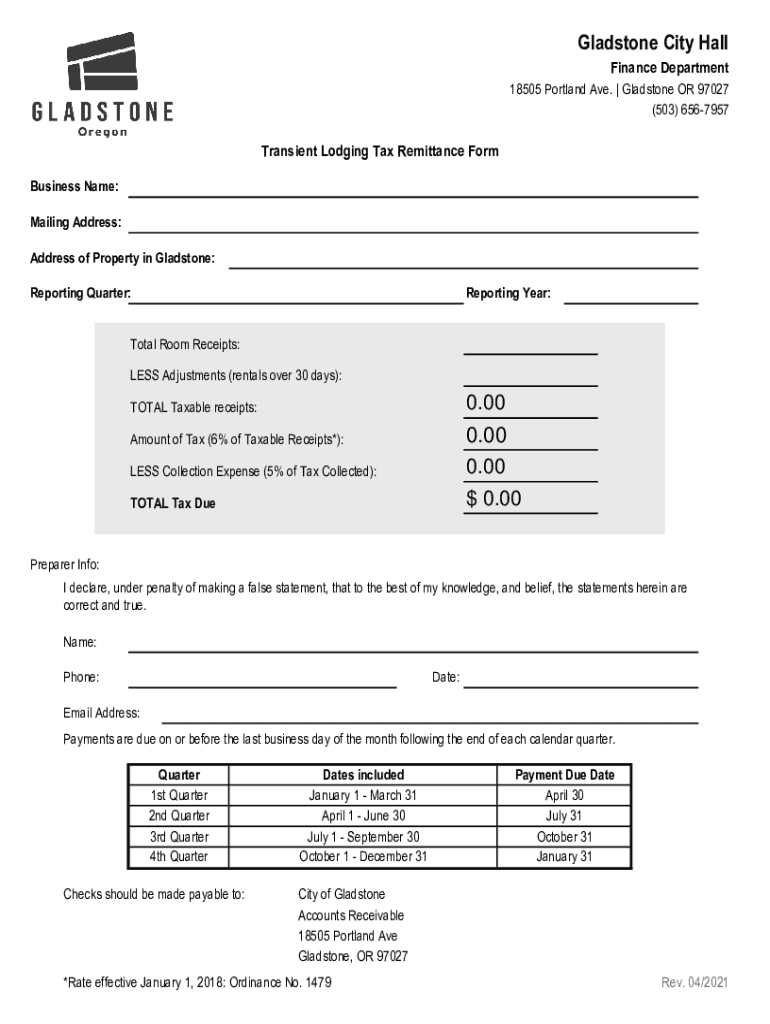

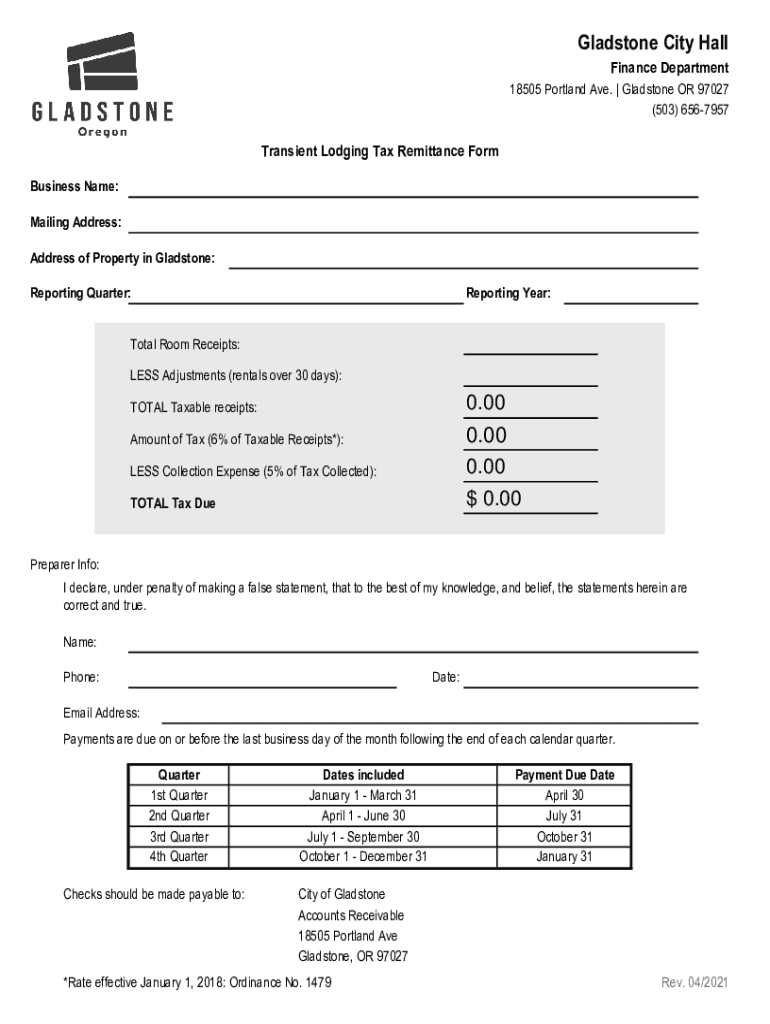

Gladstone City Hall

Finance Department

18505 Portland Ave. | Gladstone OR 97027

(503) 6567957Transient Lodging Tax Remittance Form

Business Name:

Mailing Address:

Address of Property in Gladstone:

Reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transient lodging tax remittance

Edit your transient lodging tax remittance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transient lodging tax remittance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transient lodging tax remittance online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit transient lodging tax remittance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transient lodging tax remittance

How to fill out transient lodging tax remittance

01

Contact the local tax authority to determine the specific requirements for filling out transient lodging tax remittance form.

02

Gather all necessary documentation related to your lodging business, including total room revenue, occupancy rates, and any applicable exemptions.

03

Fill out the remittance form accurately, ensuring that all information provided is correct and up-to-date.

04

Calculate the amount of transient lodging tax owed based on the local tax rate and the revenue generated from lodging services.

05

Submit the completed form along with any required payment to the tax authority by the deadline specified.

Who needs transient lodging tax remittance?

01

Any individual or business that operates a lodging establishment where transient guests stay for a short period of time is required to remit transient lodging tax.

02

This can include hotels, motels, bed and breakfasts, vacation rentals, and other similar establishments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transient lodging tax remittance to be eSigned by others?

Once you are ready to share your transient lodging tax remittance, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in transient lodging tax remittance?

The editing procedure is simple with pdfFiller. Open your transient lodging tax remittance in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit transient lodging tax remittance on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing transient lodging tax remittance right away.

What is transient lodging tax remittance?

Transient lodging tax remittance is a tax collected by lodging establishments on short-term accommodations and then remitted to the appropriate taxing authority.

Who is required to file transient lodging tax remittance?

Lodging establishments such as hotels, motels, bed and breakfasts, and vacation rentals are required to file transient lodging tax remittance.

How to fill out transient lodging tax remittance?

To fill out transient lodging tax remittance, lodging establishments must report the total number of nights stayed by guests, the total amount of revenue generated from lodging, and calculate the tax owed based on the applicable tax rate.

What is the purpose of transient lodging tax remittance?

The purpose of transient lodging tax remittance is to generate revenue for local governments to fund tourism-related programs, infrastructure improvements, and other services that benefit the community.

What information must be reported on transient lodging tax remittance?

Lodging establishments must report the total number of nights stayed by guests, the total amount of revenue generated from lodging, the applicable tax rate, and the calculated tax owed.

Fill out your transient lodging tax remittance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transient Lodging Tax Remittance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.