Get the free Voluntary Petition

Show details

This document initiates a bankruptcy case for Branciforte Creek, LLC, detailing debtor information, types of debts, and related financial details associated with Chapter 11 bankruptcy proceedings.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary petition

Edit your voluntary petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary petition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary petition online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit voluntary petition. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary petition

How to fill out Voluntary Petition

01

Begin by downloading the Voluntary Petition form from the appropriate court's website or obtaining it directly from the court.

02

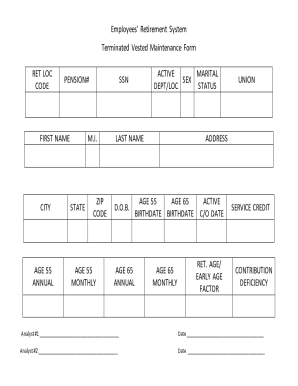

Fill out the 'Debtor Information' section with your personal details, including your name, address, and social security number.

03

Complete the 'Case Type' section by selecting the appropriate chapter under which you are filing.

04

Detail your assets and liabilities in the designated sections, including the property you own and any debts you owe.

05

Provide information regarding your income, expenses, and financial affairs in the sections provided.

06

Attach any required supporting documents, such as pay stubs, tax returns, and bank statements.

07

Review your completed petition for accuracy and completeness and sign it at the required locations.

08

File the petition with the court and pay any associated filing fees.

Who needs Voluntary Petition?

01

Individuals or businesses seeking relief from overwhelming debt may require a Voluntary Petition.

02

Those considering bankruptcy as an option to reorganize or eliminate their debts are the primary candidates for filing.

03

Creditors or service providers in disputes over unpaid bills may also need to initiate involuntary petitions against debtors.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a voluntary petition and an involuntary petition?

A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements.

Who can file an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

What is an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

What is a voluntary petition in Chapter 7?

A voluntary petition is a more common filing and allows the debtor to choose the type of bankruptcy and the applicable chapter. In contrast, an involuntary petition is filed when the debtor is unable to pay its debts, and its creditors seek to force the debtor into bankruptcy. Overview of Bankruptcy Chapters.

What is the difference between voluntary and involuntary petition?

Voluntary bankruptcy is a bankruptcy proceeding commenced by the debtor ; bankruptcy instituted by an adjudication upon a debtor's petition. Involuntary bankruptcy, on the other hand, is a bankruptcy case initiated by a debtor's creditors .

What is the difference between a voluntary petition and an involuntary petition?

Voluntary Petition vs. Involuntary Petition A voluntary petition is a bankruptcy filing initiated by the debtor, while an involuntary petition is filed by the debtor's creditors. A voluntary petition is a more common filing and allows the debtor to choose the type of bankruptcy and the applicable chapter.

Why would an unsecured creditor want to file an involuntary petition against a debtor?

This is typically initiated when creditors have determined that the debtor is unable to meet their financial obligations in repaying the debts to the creditors, and bankruptcy is the best option to recover those debts.

What is an involuntary proceeding?

When a creditor has made several attempts to collect a debt, but there has been no response from the debtor, they may have no choice but to sue them into bankruptcy.

What is a voluntary petition?

A Voluntary Petition is a document that initiates the filing of a bankruptcy proceeding, setting forth basic information regarding the debtor(s), including name(s), address(es), chapter under which the case is filed, and estimated amount of assets and liabilities.

Who can file an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary Petition?

A Voluntary Petition is a legal document filed by an individual or business to begin the process of bankruptcy. It expresses the debtor's intention to seek relief under the bankruptcy laws.

Who is required to file Voluntary Petition?

Any individual or business entity that is unable to pay its debts can file a Voluntary Petition. In most cases, it is the debtor who initiates the filing.

How to fill out Voluntary Petition?

To fill out a Voluntary Petition, the debtor needs to provide detailed financial information including assets, liabilities, income, and expenses, as well as other required information based on the type of bankruptcy being filed.

What is the purpose of Voluntary Petition?

The purpose of a Voluntary Petition is to formally begin the bankruptcy process, allowing the debtor to request a legal discharge of certain debts while providing protection against creditor actions.

What information must be reported on Voluntary Petition?

The Voluntary Petition must include the debtor's name, address, Social Security number, information regarding creditors, a list of assets and liabilities, and a statement of the debtor's financial affairs.

Fill out your voluntary petition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Petition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.