Get the free revenue-statistics-africa-eswatini.pdf - tax-to-GDP ratio

Show details

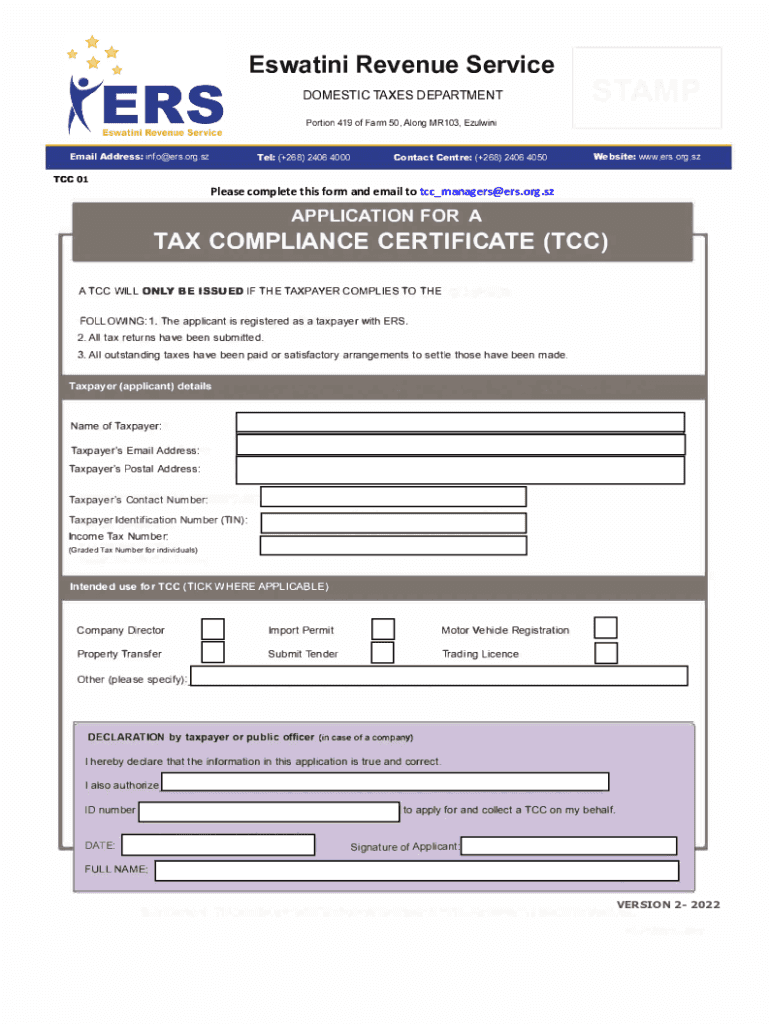

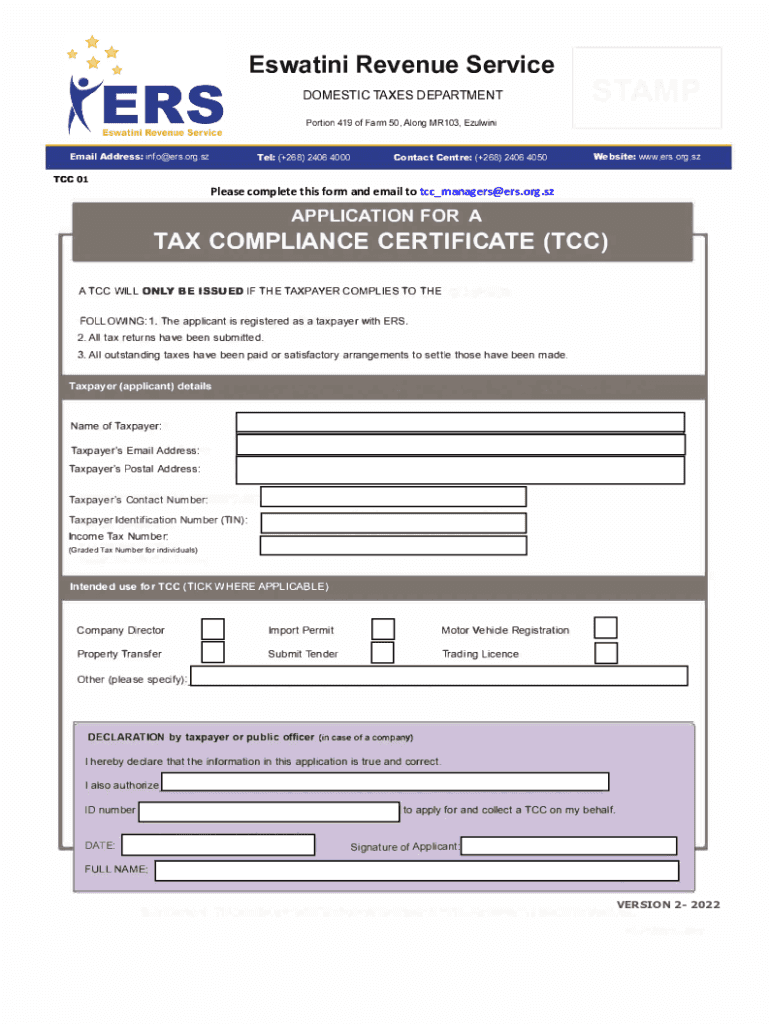

Eswatini Revenue Service DOMESTIC TAXES DEPARTMENT Portion 419 of Farm 50, Along MR103, Exulting Email Address: info@ers.org.sz TCC 01Tel: (+268) 2406 4000Contact Center: (+268) 2406 4050Website:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio

Edit your revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio

How to fill out revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio

01

Obtain the revenue statistics report for Africa, specifically for Eswatini.

02

Locate the section within the report that provides information on the tax-to-GDP ratio.

03

Identify the formula or methodology used to calculate the tax-to-GDP ratio.

04

Input the relevant data points into the formula to calculate the tax-to-GDP ratio.

05

Double-check your calculations to ensure accuracy.

06

Fill out the necessary forms or reports with the calculated tax-to-GDP ratio.

Who needs revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

01

Policymakers and government officials in Eswatini who are responsible for fiscal policy and economic planning.

02

Researchers and analysts studying the economic performance of Eswatini and comparing it to other countries in Africa.

03

International organizations and financial institutions monitoring the fiscal health and stability of Eswatini.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

The tax-to-GDP ratio for revenue-statistics-africa-eswatinipdf is 20%.

Who is required to file revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

All countries within the Eswatini region are required to file the revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio.

How to fill out revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

The revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio can be filled out by entering the total tax revenue and the GDP for the specific year.

What is the purpose of revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

The purpose of the revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio is to measure the effectiveness of taxation policies in relation to the country's economic output.

What information must be reported on revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio?

The information required to be reported on revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio includes total tax revenue and GDP for the specific reporting period.

Fill out your revenue-statistics-africa-eswatinipdf - tax-to-gdp ratio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue-Statistics-Africa-Eswatinipdf - Tax-To-Gdp Ratio is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.