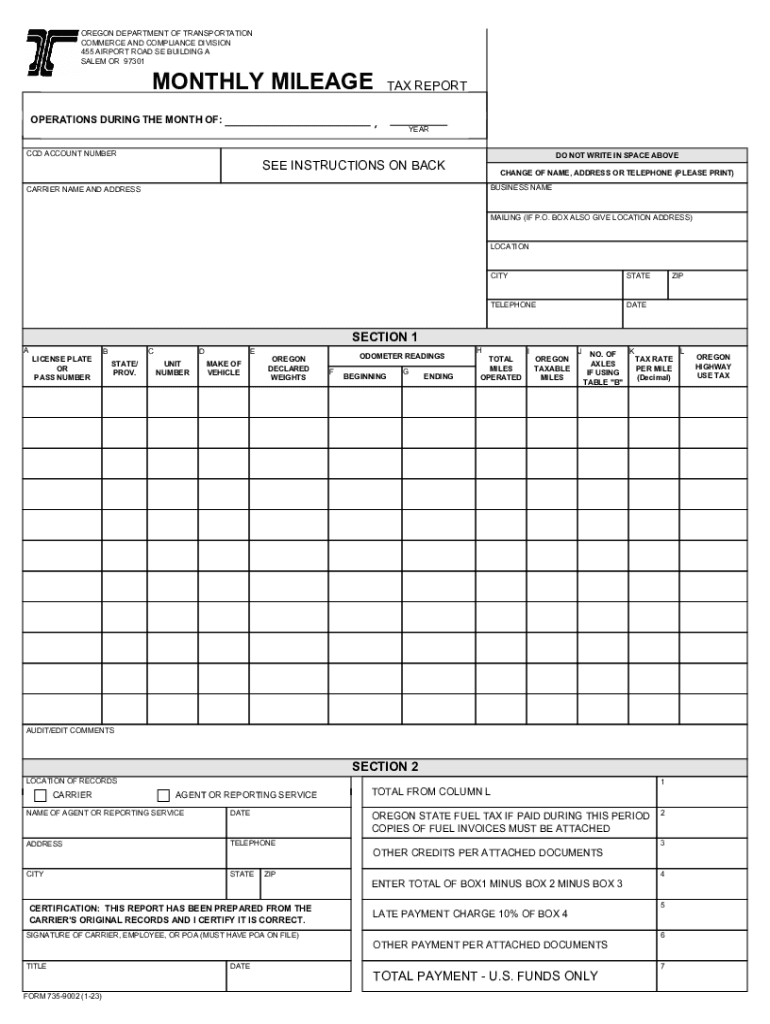

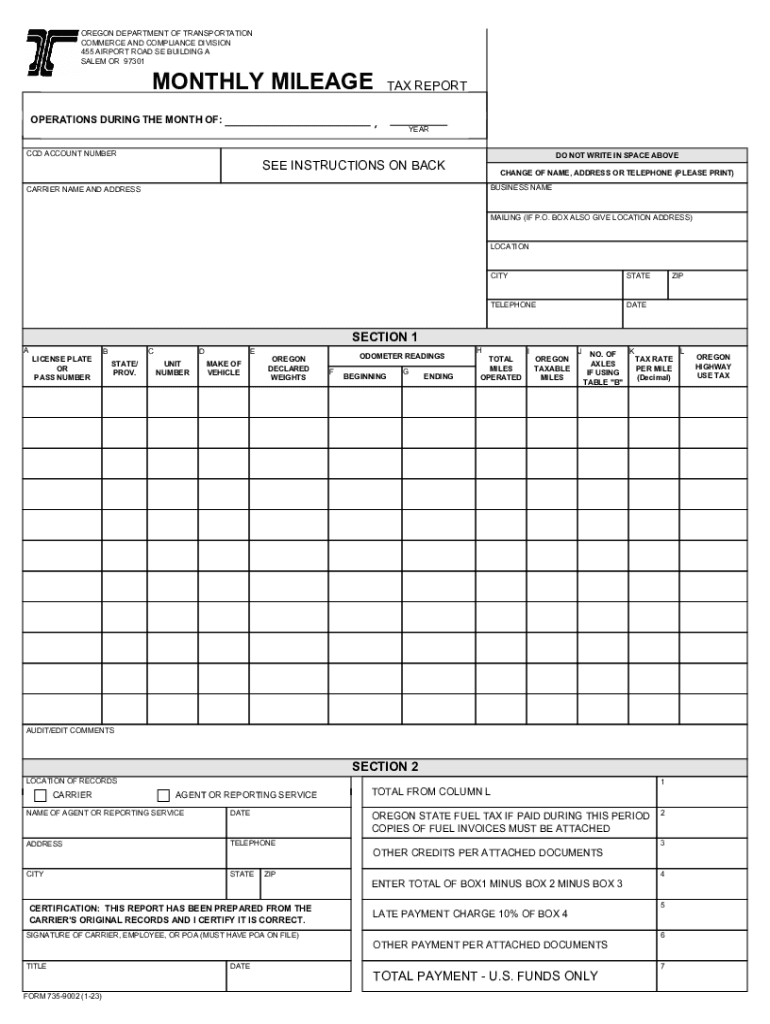

OR 735-9002 2023-2025 free printable template

Get, Create, Make and Sign mileage reimbursement 2023 oregon form

How to edit 7359002 mileage form online

Uncompromising security for your PDF editing and eSignature needs

OR 735-9002 Form Versions

How to fill out 735 9002 form

How to fill out OR 735-9002

Who needs OR 735-9002?

Video instructions and help with filling out and completing oregon mileage reimbursement 2023

Instructions and Help about oregon 7359002 form

We have a funding stream in the gas tax that has been a workhorse for investing in transportation infrastructure we've ridden it hard it's a tired horse right now as you project out and look at the various policies or technology that's changing the composition of the fleet in the complexion of the conversation in terms of how we finance transportation we have to look for other ways in the state of Oregon we think a user fee you pay for the miles you use the infrastructure to ensure that there's a revenue stream that can be infused back into that to build it up to make sure we're creating and delivering safe and efficient infrastructure for the business transactions and the personal transactions that transpire on our transportation network we have a volunteer group of about 5000 individuals that was mandated in the law that we have, so we'll take those individuals there is a hierarchy of fuel efficiencies so cards with fuel efficiencies from 17 to 22 miles an hour make up a certain component of the 5022 and above, so it breaks it down in three tiers to what we're doing now is building the billing platforms working with the private sectors to ensure that we give options to people options in terms of the technology offs and options in terms of conducting business with the public sector or the private sector because these are some of the issues we've heard as we continue to move forward the state of Oregon week innovation pioneering spirit is that worn as a badge of honor I'm very excited about this I think it's something that I say with confidence again that in 1919 we were the first state to put the gas tax on the table the nation soon bottled 2015 will be the first state to put this volunteer user fee that's mileage-based feet on the table my hope is the nation soon falls Oh

People Also Ask about 735 9002 mileage

How do I report Oregon miles?

How does the Oregon mileage tax work?

Does Oregon have a mileage tax?

What is the per mile rate in Oregon?

What is the mileage reimbursement rate for Oregon 2023?

What is a reasonable travel fee per mile?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my monthly mileage form directly from Gmail?

Can I create an electronic signature for the 7359002 form fill in Chrome?

Can I create an electronic signature for signing my oregon 7359002 make in Gmail?

What is OR 735-9002?

Who is required to file OR 735-9002?

How to fill out OR 735-9002?

What is the purpose of OR 735-9002?

What information must be reported on OR 735-9002?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.