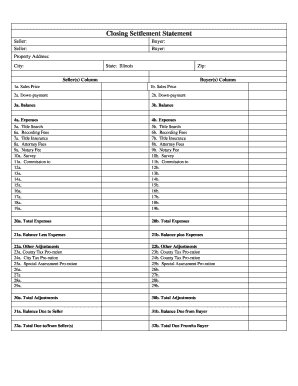

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Get the free Minnesota Closing Statement

Show details

Closing Settlement Statement Seller: Buyer: Seller: Buyer: Property Address: City: State: Minnesota Zip: Seller(s) Column 1a. Sales Price Buyer(s) Column 1b. Sales Price 2a. Down-payment 2b. Down-payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign minnesota closing statement

Edit your minnesota closing statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minnesota closing statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit minnesota closing statement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit minnesota closing statement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minnesota closing statement

How to fill out minnesota closing statement?

01

Gather all necessary documents and information: You will need to collect all relevant financial documents, such as bank statements, mortgage statements, and tax returns. Additionally, gather information about the property being sold, including the address, sale price, and any liens or encumbrances.

02

Complete the seller's portion of the closing statement form: This typically includes providing your personal information, such as your name, address, and contact details. You will also need to disclose any outstanding debts or obligations related to the property.

03

Review the buyer's portion of the closing statement form: The buyer's information should already be filled out by the buyer or their agent. Make sure all details are accurate, including the purchase price and any requested adjustments or credits.

04

Calculate prorations and adjustments: Prorations and adjustments are used to divide expenses and fees between the buyer and seller. These may include property taxes, utilities, and other expenses that are shared until the date of closing. Ensure that you accurately calculate these amounts and indicate them on the closing statement.

05

Determine the seller's proceeds: Subtract any outstanding debts, fees, and commissions from the sale price to determine the seller's net proceeds. Clearly state this amount on the closing statement.

06

Obtain signatures and notarization: Both the buyer and seller will need to sign the closing statement to acknowledge its accuracy. In some cases, it may be required to have the signatures notarized for legal purposes.

07

Submit the completed closing statement: Provide the completed and signed closing statement to the appropriate party, typically the closing agent or the buyer's attorney.

Who needs minnesota closing statement?

01

Sellers: Anyone who is selling a property in Minnesota will need to complete a closing statement. This document is used to detail the financial aspects of the sale and ensure that all parties involved are aware of their rights and obligations.

02

Buyers: While buyers are not typically responsible for completing the closing statement, they should still review and understand its contents. This document outlines their financial obligations and provides transparency regarding the transaction.

03

Real estate agents and attorneys: Professionals involved in the sale, such as real estate agents and attorneys, may need the closing statement to accurately represent their clients' interests. It helps them understand the financial aspects of the transaction and ensure a smooth closing process.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to close an estate in Minnesota?

Probate proceedings in Minnesota may be either formal or informal and generally must be initiated within three years after the decedent's death. The services of an attorney may be needed in order to correctly probate an estate.

What is the difference between formal and informal probate in Minnesota?

Unlike with formal probate, the party seeking appointment of a personal representative for informal probate must file an application with a probate registrar, not the court, though probate registrars are often located at the courthouse and work with the court.

Who is the executor of the estate in Minnesota?

Personal Representative Formerly known in MN as the “executor,” the person who is appointed by the court to be responsible for administering the estate of a person who has died. Being named as a personal representative in a Will does not mean that you are one.

How do I close probate in Minnesota?

Oftentimes, closing probate is as simple as filing a statement with the court. Provided that everything has been done correctly and the accounts are in order, the court will typically approve the request to close probate rather quickly. Once probate is closed, the estate is essentially considered settled.

How long does an executor have to settle an estate in MN?

While there's no formal deadline, the actual time varies widely based on the complications within the estate. In some situations, Minnesota probate may take no more than four months to conclude from commencement; in others, more than a year.

How do I close an estate in MN?

Steps in estate settlement Locating the will or trust document. Consult an attorney. Secure copies of the death certificate. Inventory assets. Payment of claims and bills. Life insurance. Tax implications. Convert assets to cash.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit minnesota closing statement online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your minnesota closing statement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the minnesota closing statement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your minnesota closing statement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out minnesota closing statement on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your minnesota closing statement, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is minnesota closing statement?

Minnesota closing statement is a legal document that summarizes the financial transactions and details of a real estate transaction in the state of Minnesota.

Who is required to file minnesota closing statement?

The seller of the property is usually required to file the Minnesota closing statement.

How to fill out minnesota closing statement?

To fill out the Minnesota closing statement, you need to provide accurate information about the financial transactions, such as purchase price, prorated taxes, and any other relevant costs or credits.

What is the purpose of minnesota closing statement?

The purpose of the Minnesota closing statement is to provide a detailed record of the financial aspects of a real estate transaction and ensure that all parties involved are aware of the financial obligations and credits.

What information must be reported on minnesota closing statement?

The Minnesota closing statement should include information about the purchase price, prorated taxes, title insurance, closing costs, loan details, and any other financial aspects of the transaction.

Fill out your minnesota closing statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minnesota Closing Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.