Get the free Property All Risk Claim Form - Vision Insurance

Show details

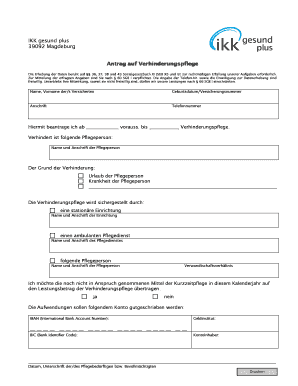

ALL RISK INSURANCE CLAIM FORM Please note that this Claim Form is issued without prejudice to the terms and conditions of the policy and issuance of this form should not be construed as admission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property all risk claim

Edit your property all risk claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property all risk claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property all risk claim online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property all risk claim. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property all risk claim

How to fill out property all risk claim:

01

Gather all necessary documents: Start by collecting all relevant paperwork, such as the insurance policy, any supporting documents related to the claim, and any communication you may have had with the insurance company.

02

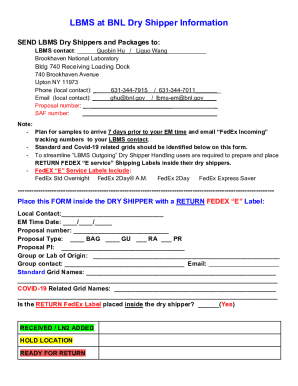

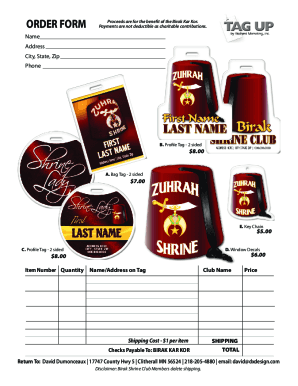

Provide accurate information: Fill out the claim form with accurate and detailed information. Include your contact details, policy number, and the date of the incident. Be specific about the property involved and provide a clear description of the damage or loss.

03

Document the incident: Take photos or videos of the damaged property to provide visual evidence of the loss. Keep any receipts or invoices related to repairs, replacements, or additional expenses incurred.

04

Explain the circumstances: Provide a detailed account of how the damage or loss occurred. Include any relevant timelines, events, or external factors that may have contributed to the incident.

05

Provide supporting evidence: If you have any additional evidence or documentation that supports your claim, such as witness statements, police reports, or expert assessments, include them with your claim.

06

Calculate the value of the claim: Itemize and quantify the damages or losses as accurately as possible. If necessary, seek professional help to determine the value of any high-value items.

07

Submit the claim: Once you have completed the claim form and gathered all the necessary supporting documents, submit them to the insurance company as instructed. Ensure that you keep copies of everything for your records.

Who needs property all risk claim:

01

Homeowners: Property all risk claims are essential for homeowners who want to protect their house and belongings from potential risks such as fire, theft, or natural disasters.

02

Business owners: Business property all risk claims are crucial for safeguarding commercial properties, equipment, inventory, and furniture from various risks like vandalism, water damage, or business interruption.

03

Renters: Tenants can also benefit from property all risk claims as it provides coverage for their personal belongings against risks such as theft, water damage, or accidental fire.

04

Property investors: Individuals or companies who own multiple properties can use property all risk claims to protect their real estate investments from any unexpected damages or losses.

05

Contractors and builders: Property all risk claims are also relevant for contractors and builders, as they cover the property under construction or renovation against unforeseen risks like damage from accidents, theft, or natural disasters.

Overall, property all risk claims are necessary for anyone who wants comprehensive coverage for their property and belongings, ensuring financial protection in case of unexpected events.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property all risk claim?

Property all risk claim is a request made to an insurance company for compensation for damages or losses to property covered under an all-risk insurance policy.

Who is required to file property all risk claim?

The policyholder or the person responsible for the property covered under the all-risk insurance policy is required to file the property all risk claim.

How to fill out property all risk claim?

To fill out a property all risk claim, the policyholder must provide details of the loss or damage, estimated value of the loss, and any other relevant information requested by the insurance company.

What is the purpose of property all risk claim?

The purpose of property all risk claim is to seek compensation for damages or losses to property covered under an all-risk insurance policy.

What information must be reported on property all risk claim?

Information that must be reported on property all risk claim includes details of the loss or damage, estimated value of the loss, date and cause of the loss, and any supporting documentation requested by the insurance company.

Where do I find property all risk claim?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific property all risk claim and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit property all risk claim online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your property all risk claim and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out property all risk claim on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your property all risk claim. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your property all risk claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property All Risk Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.