Get the Money laundering and tax evasion risks in free ports

Show details

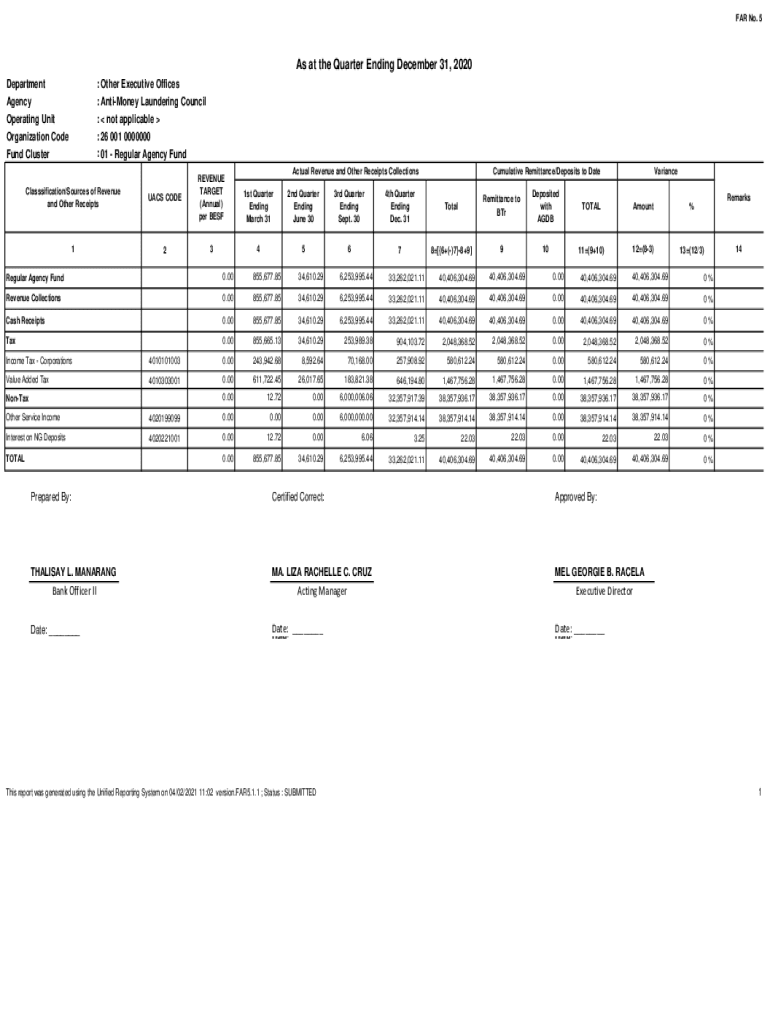

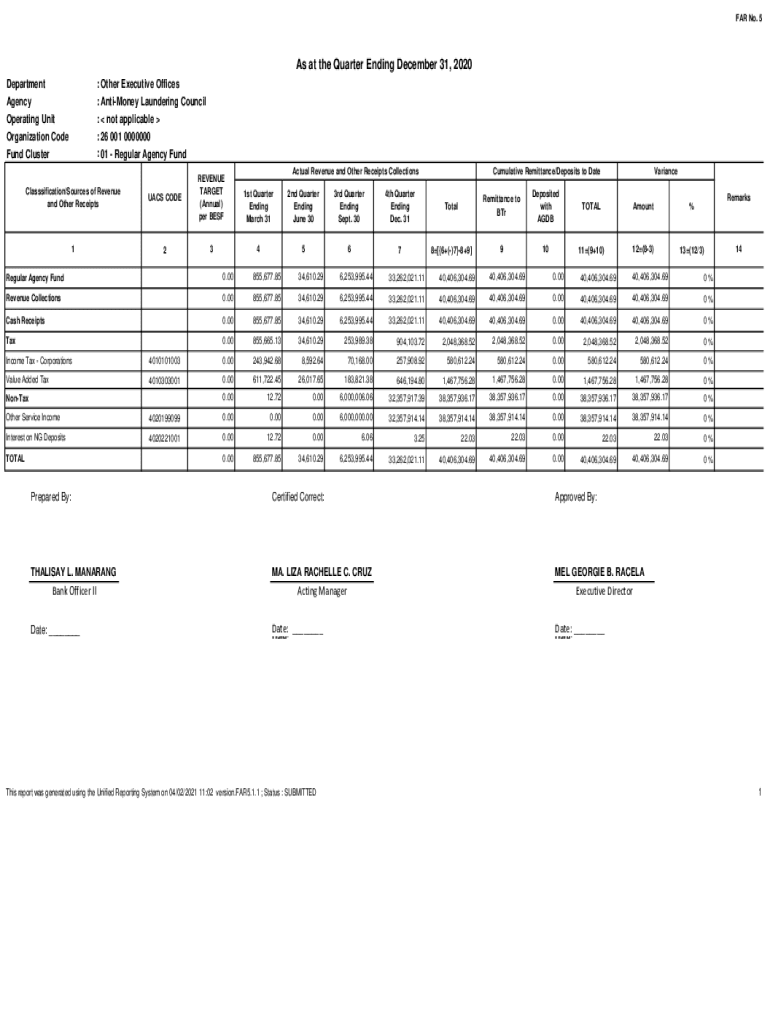

FAR No. 5As at the Quarter Ending December 31, 2020 : Other Executive Offices : Antimony Laundering Council : not applicable : 26 001 0000000 : 01 Regular Agency FundDepartment Agency Operating Unit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money laundering and tax

Edit your money laundering and tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money laundering and tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing money laundering and tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit money laundering and tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money laundering and tax

How to fill out money laundering and tax

01

Gather all financial information including sources of income, expenditures, assets, and liabilities.

02

Look for any suspicious transactions or activities that may indicate money laundering.

03

Fill out the necessary forms provided by the financial institution or tax authorities accurately and truthfully.

04

Keep records of all financial transactions and documents for future reference or audit.

Who needs money laundering and tax?

01

Money launderers need money laundering to conceal the origins of illegally obtained funds and integrate them into the legitimate financial system.

02

Tax evaders may use fraudulent means to avoid paying taxes, which is illegal and detrimental to the economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my money laundering and tax directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your money laundering and tax and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send money laundering and tax for eSignature?

money laundering and tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out money laundering and tax using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign money laundering and tax and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is money laundering and tax?

Money laundering is the illegal process of making large amounts of money generated by a criminal activity, such as drug trafficking or terrorist funding, appear to have come from a legitimate source. Tax is a mandatory financial charge imposed by the government on individuals or businesses to fund public expenditure.

Who is required to file money laundering and tax?

Individuals and businesses who meet certain criteria set by the government are required to file money laundering reports and pay taxes.

How to fill out money laundering and tax?

Money laundering reports and tax forms can be filled out online or submitted in paper form to the relevant government agency.

What is the purpose of money laundering and tax?

The purpose of money laundering reporting is to track and deter illegal financial activities, while the purpose of taxes is to fund public expenditure and services.

What information must be reported on money laundering and tax?

Details of financial transactions, sources of income, and other relevant information must be reported on money laundering reports and tax forms.

Fill out your money laundering and tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Laundering And Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.