Get the free Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B - emma msrb

Show details

This document serves as an official statement for the issuance of the Series 2012A and Series 2012B Income Tax Secured Revenue Refunding Bonds by the District of Columbia. It includes bond ratings,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax secured revenue

Edit your income tax secured revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax secured revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

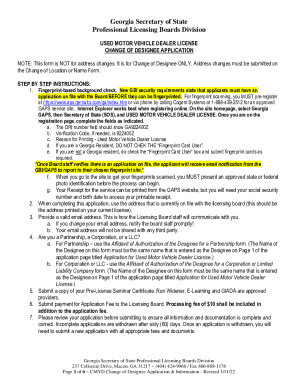

Editing income tax secured revenue online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income tax secured revenue. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax secured revenue

How to fill out Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B

01

Obtain the necessary forms for the Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B.

02

Complete the taxpayer identification section accurately with your name, address, and Social Security number or EIN.

03

Provide detailed information regarding the bonds, including the bond series designation, issuance date, and amounts.

04

Fill out the sections related to income tax reporting, ensuring that you indicate how the interest earned will be reported on your tax return.

05

Review and verify all entries for accuracy before submission.

06

Submit the completed forms to the appropriate tax authority along with any necessary documentation or attachments.

Who needs Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

01

Investors looking for a secure investment option with tax-exempt interest income.

02

Municipalities seeking to refinance existing debt at lower interest rates.

03

Taxpayers who want to diversify their investment portfolios with municipal bonds.

04

Financial institutions and advisors considering options for client investment strategies.

Fill

form

: Try Risk Free

People Also Ask about

Do I get a 1099 for series I Bonds?

Note: You only get a 1099-INT if you actually got the interest on a savings bond. If you are waiting until your EE or I bond matures (finishes its life) to take the interest on it, you will not get a 1099-INT for that bond until we actually pay you the interest.

How are taxes paid on Series I Bonds?

Buying I Bonds for yourself They can pay federal income tax each year on the interest earned or defer the tax bill to the end. Most people choose the latter. They report the interest income on their Form 1040 for the year the bonds mature (generally, 30 years) or when they're cashed in, whichever comes first.

What is the downside of an I bond?

Cons: Rates are variable, there's a lockup period and early withdrawal penalty, and there's a limit to how much you can invest.

How are Series I savings bonds taxed?

I bonds have important tax advantages for owners. Interest earned on I bonds is exempt from state and local taxation. Also, owners can defer federal income tax on the accrued interest for up to 30 years.

How is interest paid on series I savings bonds?

The interest gets added to the bond's value I bonds earn interest from the first day of the month you buy them. Twice a year, we add all the interest the bond earned in the previous 6 months to the main (principal) value of the bond. That gives the bond a new value (old value + interest earned).

Are savings bonds taxed as income or capital gains?

Interest from your bonds goes on your federal income tax return on the same line with other interest income.

What are revenue refunding bonds?

Refunding bonds are issued to refinance a prior issue of bonds at a new lower borrowing rate and/or under a new financing structure. Refunding bonds are typically issued to achieve debt service savings on outstanding bonds.

Can I buy $10,000 worth of I Bonds every year?

I Bonds are a virtually risk-free investment, which makes them very popular in times of market uncertainty such as right now and as inflation devalues your cash. That said, there is a $10,000 limit each year for purchasing them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B are municipal bonds issued by a government entity that are secured by future income tax revenues. These bonds are used to refinance existing debt, providing a way to reduce interest costs and improve financial conditions.

Who is required to file Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

Entities or individuals involved in the issuance, management, or investment in Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B may be required to file relevant financial disclosures and documents with regulatory authorities.

How to fill out Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

To fill out the forms related to Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B, one should provide required information such as issuer details, bond amount, tax identification numbers, interest rates, and dates. It is important to follow the specific guidelines provided by the issuing authority.

What is the purpose of Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

The purpose of these bonds is to refund or refinance existing debt, enabling the issuer to benefit from lower interest rates or improved financial terms, which can help facilitate ongoing governmental projects and services.

What information must be reported on Income Tax Secured Revenue Refunding Bonds, Series 2012A and Series 2012B?

The information that must be reported includes details of the bond issue, including the amount, interest rates, maturity dates, redemption options, and the sources of income tax revenues pledged as security. Additional financial disclosures may also be required.

Fill out your income tax secured revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Secured Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.