Get the free U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs

Show details

This document outlines the U.S. Treasury's Capital Purchase Program (CPP) under TARP for Mutual Banks and Multi-Tier Holding Companies (MHCs), detailing the investment structures, eligibility requirements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treasurys capital purchase

Edit your us treasurys capital purchase form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treasurys capital purchase form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us treasurys capital purchase online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit us treasurys capital purchase. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us treasurys capital purchase

How to fill out U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs

01

Gather necessary documentation, including financial statements and organizational structure.

02

Review eligibility criteria to ensure your mutual bank or MHC qualifies for the program.

03

Complete the application form provided by the U.S. Treasury, ensuring all information is accurate.

04

Provide a detailed business plan explaining how the capital will be used to support the institution's operations.

05

Submit the application along with all required documents to the U.S. Treasury for review.

06

Await response from the U.S. Treasury regarding the approval status of your application.

Who needs U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

01

Mutual banks seeking additional capital to enhance their financial stability.

02

Mutual holding companies (MHCs) concerned about maintaining adequate capital levels.

03

Financial institutions looking for federal assistance to support lending and financial operations.

Fill

form

: Try Risk Free

People Also Ask about

What is the US treasury backed by?

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending, in addition to taxation.

What program allowed the Treasury to inject funds into commercial banks in return for stock in the banks?

The Capital Purchase Program (CPP) was launched to stabilize the financial system by providing capital to viable financial institutions of all sizes throughout the nation.

Who is the issuer of U.S. Treasury?

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States.

Which bank does the US treasury use?

Daily Treasury Statement (DTS) This statement summarizes the United States Treasury's cash and debt operations for the Federal Government. Treasury's operating cash is maintained in an account at the Federal Reserve Bank of New York and in Tax and Loan accounts at commercial banks.

What is the capital purchase program tarp?

The Capital Purchase Program or CPP is an American government preferred stock and equity warrant purchase program conducted by the US Treasury Office of Financial Stability as part of Troubled Asset Relief Program (aka, TARP) that was launched in 2008.

What bank is the US treasury with?

The Troubled Asset Relief Program (TARP) was instituted by the U.S. Treasury following the 2008 financial crisis. TARP stabilized the financial system by having the government buy mortgage-backed securities and bank stocks. From 2008 to 2010, TARP invested $426.4 billion in firms and recouped $441.7 billion in return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

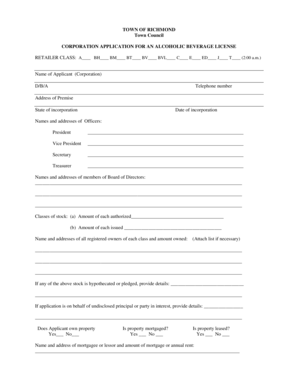

What is U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

The U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs is a financial initiative aimed at providing capital to distressed mutual banks and mutual holding companies to strengthen their capital positions during financial instability.

Who is required to file U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

Mutual banks and mutual holding companies seeking to participate in the Capital Purchase Program are required to file for it with the U.S. Treasury.

How to fill out U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

To fill out the application for the Capital Purchase Program, mutual banks and MHCs must complete the required forms provided by the U.S. Treasury, including financial statements, business plans, and other relevant documentation detailing their capital needs.

What is the purpose of U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

The purpose of the Capital Purchase Program is to provide financial support to eligible mutual banks and MHCs to promote stability in the banking system, ensure liquidity, and facilitate recovery during economic downturns.

What information must be reported on U.S. Treasury’s Capital Purchase Program for Mutual Banks and MHCs?

Participants must report information that includes their financial condition, use of the capital provided, compliance with program terms, and ongoing performance metrics to ensure transparency and accountability in the use of funds.

Fill out your us treasurys capital purchase online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treasurys Capital Purchase is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.