Get the free Treasury Grants for Energy Property in Lieu of Tax Credits

Show details

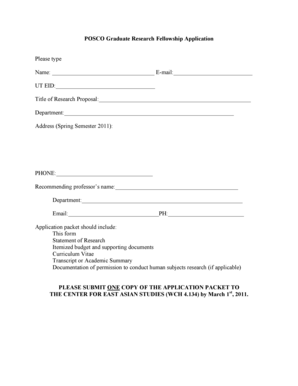

Document detailing the application procedures and requirements for receiving grants in lieu of tax credits for specified energy properties under the American Recovery and Reinvestment Act of 2009.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign treasury grants for energy

Edit your treasury grants for energy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your treasury grants for energy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit treasury grants for energy online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit treasury grants for energy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out treasury grants for energy

How to fill out Treasury Grants for Energy Property in Lieu of Tax Credits

01

Gather all necessary documentation related to the energy property, including costs, invoices, and specifications.

02

Review the eligibility requirements for the Treasury Grants to ensure your project qualifies.

03

Complete the application form provided by the Treasury, making sure to fill in all required fields accurately.

04

Provide detailed descriptions of the energy property, including its location, purpose, and the benefits it offers.

05

Attach supporting documents, such as proof of ownership, and any environmental assessments if required.

06

Submit the application by the designated deadline, following any specific submission guidelines outlined by the Treasury.

07

Monitor the application's status and be prepared to provide additional information if requested.

Who needs Treasury Grants for Energy Property in Lieu of Tax Credits?

01

Businesses and organizations investing in renewable energy projects.

02

Nonprofits involved in energy efficiency improvements.

03

Municipalities planning to develop energy property for public benefit.

04

Individuals implementing eligible energy property improvements in their residences.

Fill

form

: Try Risk Free

People Also Ask about

Why am I not getting my solar tax credit?

Check with your state energy office or solar company to confirm if you applied correctly. If the IRS denied the credit because your system wasn't operational, you may need to claim it on your 2024 tax return instead. If it was a state rebate, follow up with the solar company or the agency handling the rebate.

How do renewable energy credits work?

Like any financial instrument, RECs can be bought and sold. If an energy customer wants to use renewable energy, they buy a REC for each MWh of renewable energy they consume. Large corporate customers can buy multiple RECs. For smaller businesses or individual customers, it is possible to buy a fraction of a REC.

What is energy property credit?

More In Credits & Deductions Beginning Jan. 1, 2023, the credit equals 30% of certain qualified expenses, including: Qualified energy efficiency improvements installed during the taxable year. Residential energy property. Home energy audits.

How do I claim $7500 EV tax credit?

You will need to file Form 8936, Clean Vehicle Credits when you file your tax return for the year in which you took delivery of the vehicle. You must file the form whether you transferred the credit at the time of sale or you're claiming the credit on your return.

What documents do I need to claim solar tax credit?

To claim the solar tax credit, you'll need all the receipts from your solar installation, as well as IRS form 1040 and form 5695 and instructions for both of those forms.

What is the alternative energy tax credit?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

What is the 1603 grant program?

Purpose. The purpose of payments made from the Section 1603 program were to reimburse grant recipients for a portion of the cost they incurred to certain types of energy systems at business locations. Payments were made after the energy systems were installed.

How do I claim my renewable energy credit?

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes. You can download a copy of Form 5695 (PDF) on the IRS website. The form is updated every year, so make sure you use the most recent version available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Treasury Grants for Energy Property in Lieu of Tax Credits?

Treasury Grants for Energy Property in Lieu of Tax Credits are financial grants provided by the U.S. Department of the Treasury to assist taxpayers in the construction or purchase of renewable energy facilities, allowing them to receive direct cash payments instead of tax credits for the energy-related property.

Who is required to file Treasury Grants for Energy Property in Lieu of Tax Credits?

Taxpayers who have placed in service qualified energy property and are seeking to claim a grant instead of tax credits are required to file for Treasury Grants for Energy Property in Lieu of Tax Credits.

How to fill out Treasury Grants for Energy Property in Lieu of Tax Credits?

To fill out the application for Treasury Grants for Energy Property in Lieu of Tax Credits, taxpayers must complete the appropriate forms provided by the IRS, including detailed descriptions of the energy property, its costs, and the eligibility criteria, along with any required supporting documentation.

What is the purpose of Treasury Grants for Energy Property in Lieu of Tax Credits?

The purpose of Treasury Grants for Energy Property in Lieu of Tax Credits is to incentivize the development and investment in renewable energy technologies, providing a financial boost to projects that may otherwise struggle to secure funding.

What information must be reported on Treasury Grants for Energy Property in Lieu of Tax Credits?

The information that must be reported includes the type of energy property, the date it was placed in service, the total amount of qualified investments, and documentation showing compliance with all applicable laws and regulations.

Fill out your treasury grants for energy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury Grants For Energy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.