Get the free Community Revitalization Tax Relief Application (per RSA ...

Show details

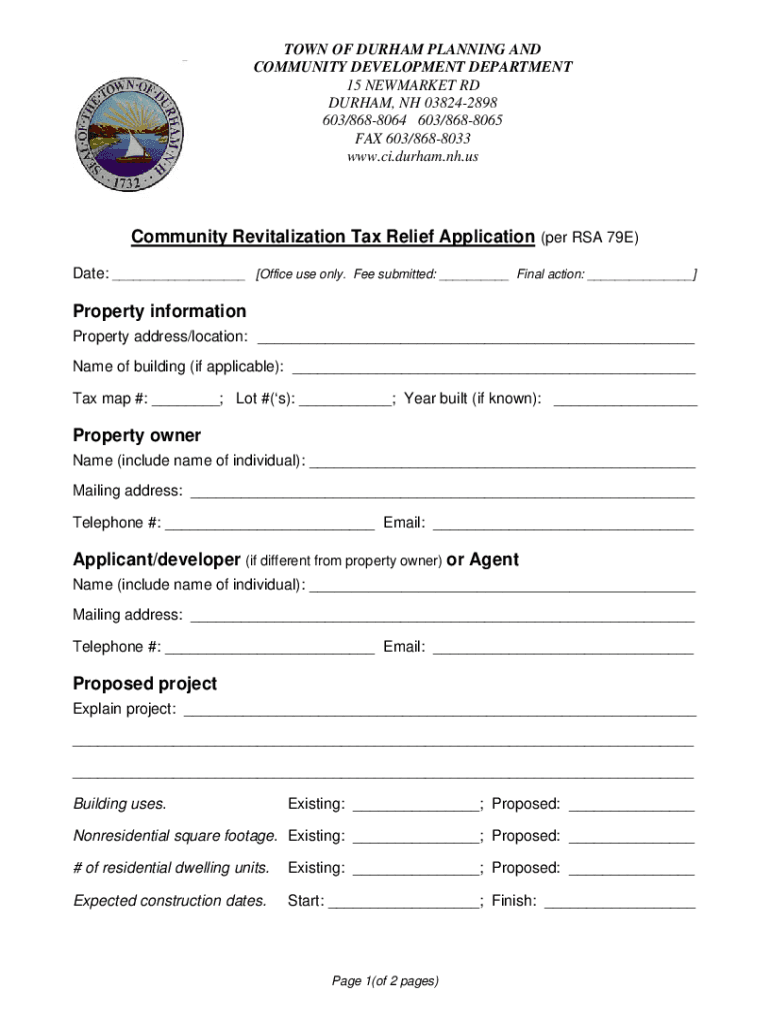

TOWN OF DURHAM PLANNING AND COMMUNITY DEVELOPMENT DEPARTMENT 15 NEWMARKET RD DURHAM, NH 038242898 603/8688064 603/8688065 FAX 603/8688033 www.ci.durham.nh.usCommunity Revitalization Tax Relief Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community revitalization tax relief

Edit your community revitalization tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community revitalization tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit community revitalization tax relief online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit community revitalization tax relief. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community revitalization tax relief

How to fill out community revitalization tax relief

01

Obtain the necessary form for community revitalization tax relief from your local tax office or online.

02

Fill out the form completely and accurately, providing all required information such as property details, income verification, and proof of renovation or improvement expenses.

03

Submit the completed form along with any supporting documents to the appropriate tax office by the specified deadline.

04

Await approval or denial of your application for community revitalization tax relief.

Who needs community revitalization tax relief?

01

Property owners who are looking to revitalize underdeveloped or blighted areas in their community.

02

Individuals or businesses who have made significant investments in improving properties in designated community revitalization zones.

03

Low-income individuals or families who could benefit from property tax relief in order to afford to remain in their homes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get community revitalization tax relief?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific community revitalization tax relief and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete community revitalization tax relief online?

Filling out and eSigning community revitalization tax relief is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in community revitalization tax relief?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your community revitalization tax relief and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is community revitalization tax relief?

Community revitalization tax relief is a program that provides tax incentives to property owners who invest in the improvement or redevelopment of properties in designated revitalization areas.

Who is required to file community revitalization tax relief?

Property owners who want to take advantage of the tax incentives for investing in properties in designated revitalization areas are required to file for community revitalization tax relief.

How to fill out community revitalization tax relief?

To fill out community revitalization tax relief, property owners need to provide information about the property being improved or redeveloped, the amount of investment made, and any other required documentation specified by the local tax authority.

What is the purpose of community revitalization tax relief?

The purpose of community revitalization tax relief is to encourage investment in properties in designated revitalization areas, which can help improve neighborhoods, create jobs, and stimulate economic growth.

What information must be reported on community revitalization tax relief?

Property owners must report information such as the address of the property, details of the improvements or redevelopment projects, the amount invested, and any other information requested by the local tax authority.

Fill out your community revitalization tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Revitalization Tax Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.