Get the free Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuitie...

Show details

This document provides detailed information on the options available for retirement plan distributions, tax consequences, and rollover choices for individuals navigating life changes such as retirement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign distribution options for defined

Edit your distribution options for defined form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your distribution options for defined form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing distribution options for defined online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit distribution options for defined. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out distribution options for defined

How to fill out Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities

01

Review the plan document to understand the distribution options available for your defined contribution and 403(b) plans.

02

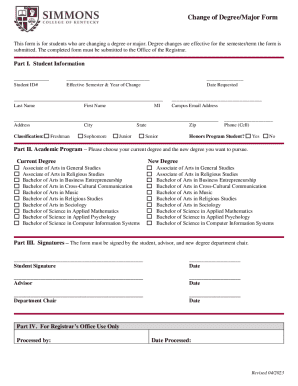

Gather necessary personal information, including social security number, employment details, and account numbers.

03

Decide on the type of distribution you wish to choose, such as a lump sum or periodic payments, ensuring it aligns with your financial goals.

04

Complete the distribution request form, providing accurate information about your account and selected distribution method.

05

Specify any tax withholding preferences or strategies for your distribution.

06

Submit the completed form to your plan administrator or the financial institution managing your account.

07

Keep a copy of the submitted form for your records and follow up to confirm the processing of your distribution.

Who needs Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

01

Participants in defined contribution plans and 403(b) plans who wish to withdraw their funds without opting for life annuities.

02

Individuals nearing retirement or those facing financial emergencies who need to access their retirement savings.

03

Employees transitioning to new employment who need to manage their retirement accounts and distributions effectively.

Fill

form

: Try Risk Free

People Also Ask about

What are the options for 403b distribution?

Total Withdrawal: You may withdraw your entire account balance and pay regular income taxes on the distribution. Declining Balance Withdrawal: You can choose to have your account balance paid to you over a specific period of time. You must be under 72 to select this option.

What is a defined contribution plan and 403b?

A 403(b) Retirement Savings Plan allows you to save and invest money for retirement with tax benefits. The value of the account depends on the amount of money you contribute and its investment performance over time.

How do I report a 403b distribution on my taxes?

Distributions are reported on Form 1099-R. This form reports the total amount of the distributions and any federal or state income tax withheld. Form 1099-R is mailed by January 31 of the year following the distribution, and the information is also reported electronically to the IRS.

What is the difference between a defined contribution plan and a 403b?

Overview. In a defined contribution plan, contributions are paid into an individual account by employers and employees. The contributions are then invested, for example in the stock market, and the returns on the investment (which may be positive or negative) are credited to the individual's account.

What is a defined contribution plan and how does it work?

One is that the employee may not have as much money available for retirement as they would have if the company had chosen to offer a defined benefit plan. Another disadvantage is that the employee may be responsible for making investment decisions, which can be risky.

How can I withdraw from my 403b without penalty?

As with all tax-advantaged retirement accounts, you cannot take distributions from a 403(b) until you either turn 59 ½ years old or become legally disabled, though there are a few exceptions. The IRS also allows you to take penalty-free distributions if you leave your job during the year you turn 55 or later.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

Distribution Options for Defined Contribution and 403(b) Plans Without Life Annuities refers to the various ways in which participants can withdraw or transfer funds from their defined contribution plans or 403(b) plans when they reach retirement age or terminate employment, without opting for a life annuity.

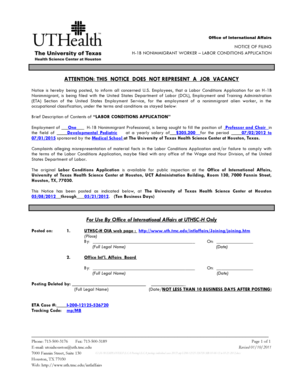

Who is required to file Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

Employers and plan administrators of defined contribution and 403(b) plans are typically required to file information regarding distribution options, particularly if they offer multiple distribution choices that do not include life annuities.

How to fill out Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

To fill out the form, plan administrators must provide information on the types of distribution options available to participants, including lump sum distributions, rollovers, and any restrictions on withdrawals, as well as ensure all required fields are accurately completed.

What is the purpose of Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

The purpose of this document is to inform participants of their distribution options upon retirement or plan termination and to comply with regulatory requirements ensuring transparency in how benefits can be accessed.

What information must be reported on Distribution Options For Defined Contribution and 403(b) Plans Without Life Annuities?

Information that must be reported includes the types of distributions available, conditions or restrictions regarding those distributions, and any relevant deadlines or procedures participants need to follow to access their benefits.

Fill out your distribution options for defined online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distribution Options For Defined is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.