CA Business License Tax Application - City of Turlock 2021-2025 free printable template

Show details

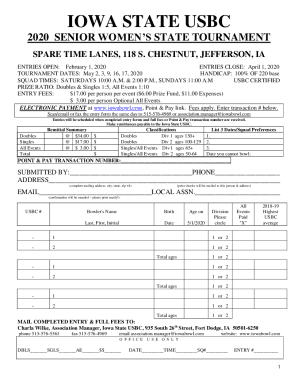

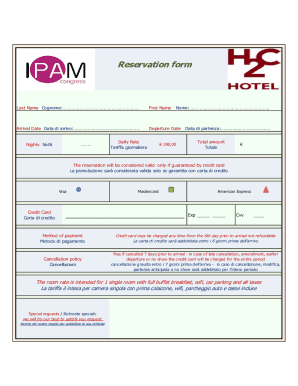

CITY OF TURLOCK BUSINESS LICENSE TAX APPLICATION Phone # (209) 6685570 Fax # (209) 6685565 TDD # (800) 7352929OFFICE USE ONLY BL#: ___ Ck # ___ Cash Date: ___ Initial: ___ Amount Paid: ___PLEASE FILL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca business license tax

Edit your ca business license tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca business license tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca business license tax online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ca business license tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca business license tax

How to fill out CA Business License Tax Application - City

01

Visit the official city website to download the CA Business License Tax Application form.

02

Fill out the application form with accurate business information, including business name, address, and ownership details.

03

Provide necessary identification and tax identification numbers, such as your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

04

Select the appropriate business license category that applies to your business type.

05

Calculate the fee based on your business type and size, as indicated in the application instructions.

06

Attach any required documents or certifications that may be needed for your business type.

07

Review the completed application for accuracy and completeness.

08

Submit the application form along with the required payment to the designated city office or online portal.

09

Keep a copy of the application and payment confirmation for your records.

Who needs CA Business License Tax Application - City?

01

Any individual or entity planning to operate a business within the city limits.

02

Startups and new businesses seeking to legally establish their operations in the city.

03

Existing businesses that need to renew their business license or update business information.

04

Businesses that require specific licenses or permits related to their industry or services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ca business license tax to be eSigned by others?

Once your ca business license tax is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get ca business license tax?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ca business license tax and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete ca business license tax online?

With pdfFiller, you may easily complete and sign ca business license tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is CA Business License Tax Application - City?

The CA Business License Tax Application - City is a document that businesses must submit to local government authorities to obtain a license to operate within a specific city in California. This application is part of the regulatory framework that allows cities to collect business taxes.

Who is required to file CA Business License Tax Application - City?

Any business that operates within a city in California and generates revenue typically needs to file a CA Business License Tax Application - City. This applies to all types of businesses, including sole proprietorships, partnerships, and corporations.

How to fill out CA Business License Tax Application - City?

To fill out the CA Business License Tax Application - City, you will need to provide necessary information such as your business name, address, owner's information, type of business, estimated annual revenue, and any other specifics required by the city. Instructions are typically provided with the application form, and it's important to follow them carefully.

What is the purpose of CA Business License Tax Application - City?

The purpose of the CA Business License Tax Application - City is to ensure that all businesses operating within a city are properly registered and that the city can collect appropriate business taxes. It helps local authorities regulate businesses and maintain accountability.

What information must be reported on CA Business License Tax Application - City?

The information that must be reported on the CA Business License Tax Application - City generally includes the business name, business address, owner's name and contact information, type of business, nature of services provided, estimated gross receipts, and any additional information as required by the local city regulations.

Fill out your ca business license tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Business License Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.