Get the free Beneficiary andor ContingentSuccessor Owner or

Show details

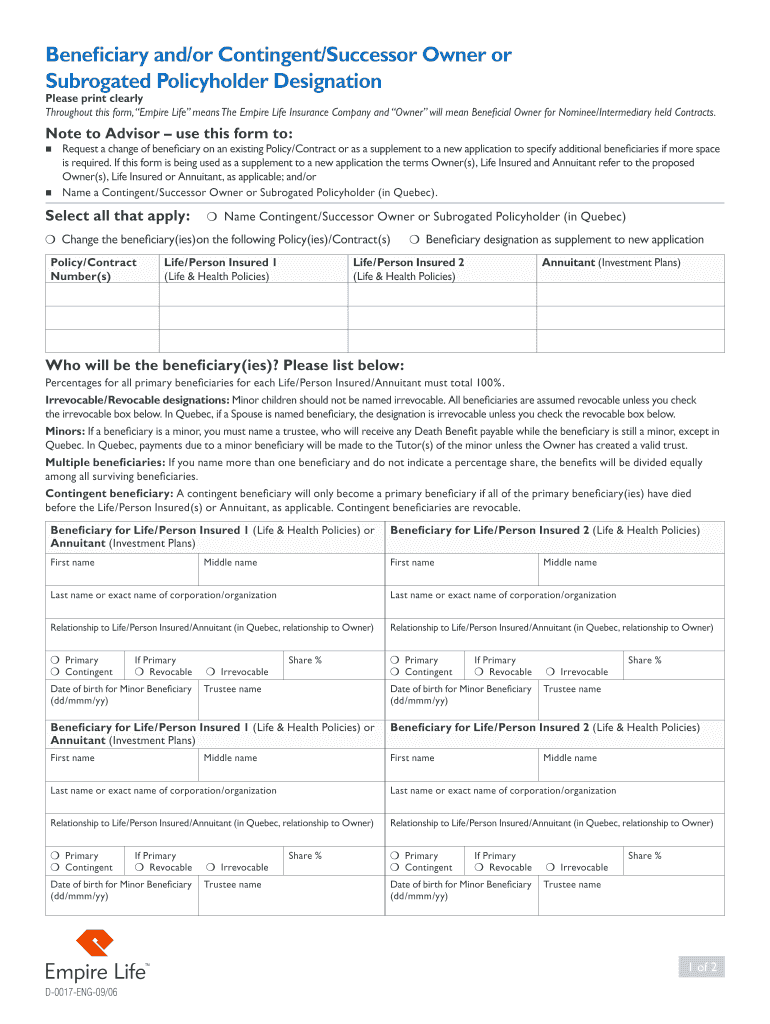

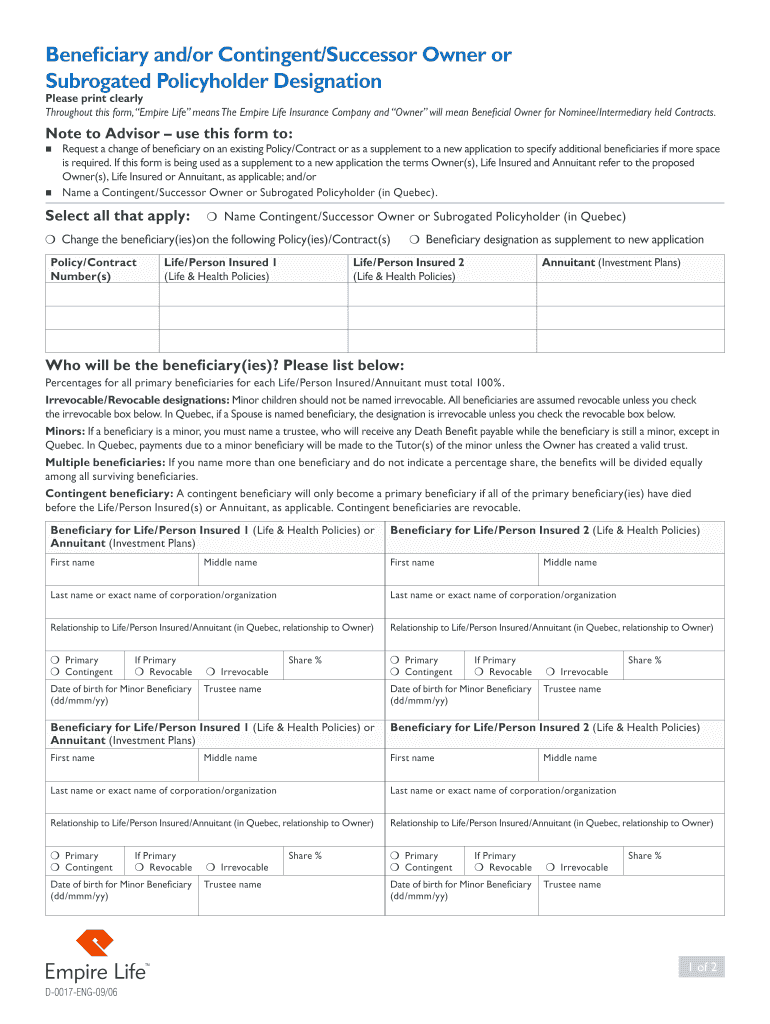

Beneficiary and/or Contingent/Successor Owner or Surrogate Policyholder Designation Please print clearly Throughout this form, Empire Life means The Empire Life Insurance Company and Owner will mean

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficiary andor contingentsuccessor owner

Edit your beneficiary andor contingentsuccessor owner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary andor contingentsuccessor owner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficiary andor contingentsuccessor owner online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit beneficiary andor contingentsuccessor owner. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary andor contingentsuccessor owner

How to fill out beneficiary and/or contingent/successor owner:

Begin by gathering the necessary information:

01

You will need the full name, date of birth, and social security number of the primary beneficiary.

02

If you want to designate a contingent or successor owner, you will need their contact information as well.

03

It is important to double-check the accuracy of the information provided.

Determine the type of beneficiary designation form:

01

Each financial institution or insurance company may have its own specific form for designating beneficiaries.

02

Obtain the appropriate form from the institution involved, either online or by contacting them directly.

Clearly indicate the primary beneficiary:

01

On the form, clearly write the full name and relationship of the primary beneficiary.

02

Include their social security number and date of birth for identification purposes.

Specify contingent or successor owners:

01

If you want to designate a contingent beneficiary, write their full name and relationship on the form.

02

In the case of a successor owner, indicate their contact information and relationship to the primary beneficiary.

Provide any additional requested information:

01

Some forms may require additional details, such as the percentage of assets to be allocated to each beneficiary.

02

Fill out these sections accurately and carefully, adhering to the instructions provided.

Review and sign the form:

01

Before submitting the form, review all the information entered to ensure accuracy.

02

Sign the form and date it according to the instructions provided.

Submit the form:

01

Follow the instructions given by the institution on how to submit the beneficiary designation form.

02

This may involve mailing it or submitting it online through their designated platform.

03

Keep a copy of the completed form for your records.

Who needs beneficiary and/or contingent/successor owner?

01

Anyone who wants to ensure that their assets or insurance benefits are distributed according to their wishes after their passing may need to designate beneficiaries.

02

A contingent owner is important to have in case the primary beneficiary predeceases the account owner or policyholder.

03

A successor owner is typically designated for specific types of accounts, such as retirement accounts or annuities, to ensure a smooth transfer of ownership in the event of the account owner's death.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is beneficiary and/or contingent successor owner?

Beneficiary and/or contingent successor owner refers to an individual or entity who may receive the assets or benefits of a particular account or policy in the event of the original owner's death.

Who is required to file beneficiary and/or contingent successor owner?

The original account or policy owner is required to file beneficiary and/or contingent successor owner information with the financial institution or insurance company.

How to fill out beneficiary and/or contingent successor owner?

To fill out beneficiary and/or contingent successor owner information, the account or policy owner must provide the full name, contact information, and relationship to the owner for each beneficiary or contingent successor.

What is the purpose of beneficiary and/or contingent successor owner?

The purpose of beneficiary and/or contingent successor owner is to ensure that the assets or benefits of the account or policy are transferred to the intended recipient upon the owner's death.

What information must be reported on beneficiary and/or contingent successor owner?

The information that must be reported on beneficiary and/or contingent successor owner includes the full name, contact information, and relationship to the owner for each beneficiary or contingent successor.

How do I execute beneficiary andor contingentsuccessor owner online?

Easy online beneficiary andor contingentsuccessor owner completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in beneficiary andor contingentsuccessor owner without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing beneficiary andor contingentsuccessor owner and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the beneficiary andor contingentsuccessor owner in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your beneficiary andor contingentsuccessor owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Andor Contingentsuccessor Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.