Get the free Federal Perkins Loan Deferment Application

Show details

This document serves as an application form for borrowers seeking to defer repayment of their Federal Perkins Loan under various qualifying circumstances. The form requires certification by an appropriate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal perkins loan deferment

Edit your federal perkins loan deferment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal perkins loan deferment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal perkins loan deferment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal perkins loan deferment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal perkins loan deferment

How to fill out Federal Perkins Loan Deferment Application

01

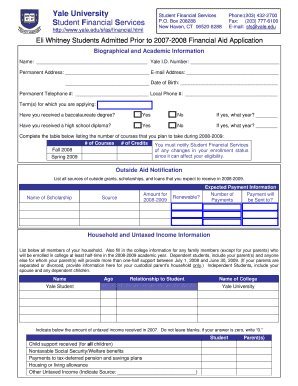

Obtain the Federal Perkins Loan Deferment Application form from your school's financial aid office or the lender's website.

02

Fill in your personal information, including your name, address, and loan details.

03

Specify the reasons for your deferment request, such as continuing education, unemployment, or economic hardship.

04

Provide documentation to support your deferment request, if required (e.g., proof of enrollment, unemployment letter).

05

Review the completed application for accuracy and completeness.

06

Sign and date the application.

07

Submit the application to your school's financial aid office or the lender as instructed, ensuring that you keep a copy for your records.

Who needs Federal Perkins Loan Deferment Application?

01

Borrowers who are experiencing financial hardship and need temporary relief from loan payments.

02

Students who are enrolled at least half-time in an eligible course of study.

03

Individuals who are unemployed and seeking work.

04

Those who are in active military service or serving in a recognized volunteer program.

Fill

form

: Try Risk Free

People Also Ask about

Do federal Perkins loans qualify for forgiveness?

The Perkins Loan Decline With private loans becoming more prevalent, as well as the rising popularity of other government loan programs, the Perkins Loan is generally seen as obsolete, especially its fixed interest rate, which is higher than direct loans of the same type for undergrads.

Why was the Perkins Loan discontinued?

Key takeaways. Deferment allows qualified borrowers to pause student loans repayment — and, in some cases, suspend interest — for up to three years. Forbearance doesn't allow you to save on interest but has broader criteria and no limit to the number of times you can do this.

What qualifies you for loan deferment?

You're eligible for this automatic deferment if you're enrolled at least half-time at an eligible college or career school. If you're a graduate or professional student who received a Direct PLUS Loan, you qualify for an additional six months of deferment after you cease to be enrolled at least half-time.

Does deferring a loan hurt your credit?

Both deferment and forbearance allow you to temporarily postpone or reduce your federal student loan payments. The difference has to do with interest accrual (accumulation). During a deferment, interest doesn't accrue on some types of Direct Loans. During a forbearance, interest accrues on all types of Direct Loans.

How to request loan deferment?

If you received a Perkins Loan, you might be eligible to have it forgiven – as long as you work in certain public service fields, such as education or law enforcement, and apply for forgiveness through your school or student loan servicer.

Is it better to defer or forbearance?

Contact your lender: The first step is reaching out to your lender and explaining your situation. Deferment can be a useful tool if you're experiencing financial hardship due to a reduction of hours or job loss or economic hardship due to medical reasons or a life-changing event.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Perkins Loan Deferment Application?

The Federal Perkins Loan Deferment Application is a form that allows borrowers to request a temporary suspension of their loan payments due to specific circumstances, such as returning to school or experiencing economic hardship.

Who is required to file Federal Perkins Loan Deferment Application?

Borrowers of Federal Perkins Loans who wish to defer their loan payments due to qualifying circumstances, such as full-time enrollment at an eligible school or financial hardship, are required to file the application.

How to fill out Federal Perkins Loan Deferment Application?

To fill out the Federal Perkins Loan Deferment Application, borrowers need to complete the required personal information, provide documentation supporting their deferment request, and submit the application to their loan servicer or school.

What is the purpose of Federal Perkins Loan Deferment Application?

The purpose of the Federal Perkins Loan Deferment Application is to allow borrowers to temporarily halt their loan payments without accruing additional interest during the deferment period, thus providing financial relief.

What information must be reported on Federal Perkins Loan Deferment Application?

The information that must be reported includes the borrower's personal and contact details, loan information, the reason for requesting deferment, and any necessary supporting documentation, such as enrollment verification or proof of financial hardship.

Fill out your federal perkins loan deferment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Perkins Loan Deferment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.