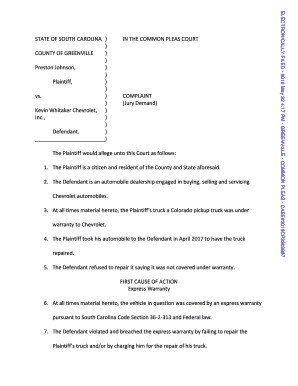

Get the free 2011 Timber Income and Property Tax Workshop Registration Form - timbertax

Show details

Registration form for a workshop aimed at educating forestry professionals and landowners about timber taxation and property tax related to forest resources.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 timber income and

Edit your 2011 timber income and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 timber income and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 timber income and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2011 timber income and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 timber income and

How to fill out 2011 Timber Income and Property Tax Workshop Registration Form

01

Obtain the 2011 Timber Income and Property Tax Workshop Registration Form from the official website or designated office.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Indicate the number of attendees in your group, if applicable.

04

Provide any additional information requested in the designated sections, such as dietary restrictions or special accommodations.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed form via the specified method, whether by mail, email, or online submission.

Who needs 2011 Timber Income and Property Tax Workshop Registration Form?

01

Landowners who manage timber properties.

02

Individuals interested in understanding timber income and related tax obligations.

03

Forestry professionals seeking insights on tax implications of timber sales.

04

Anyone planning to attend the workshop for educational purposes related to timber and property taxes.

Fill

form

: Try Risk Free

People Also Ask about

What form shows property tax paid?

Generally, only the amount that the bank or lender actually pays the tax authority during the years is deductible. This amount is often shown on your Form 1098 where it is reported to you and to the Internal Revenue Service (IRS).

Where can I get printable tax forms?

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the farm tax form?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Check with your state and local governments for more information.

How to report timber income on tax return?

If you held the timber for more than one year before selling it you should report the total amount received for the timber on Form 1040, Schedule D, Part II, column (d). You may be able to recover your cost basis in the timber sold, also referred to as a depletion allowance.

How do you handle timber sales on a tax return?

How to report sale of lumber using Capital Gains - Schedule D: You may receive income by cutting timber and opting to treat that cutting as a sale, or by disposing of standing timber, which is known as stumpage. In this case the income is treated as a Capital Gain and is reported by the taxpayer on their Schedule D.

Can timber sales be reported on Schedule F?

Use Form 1040 Schedule F to report farming income and expenses, including minor sales of logs, firewood, or pulpwood if timber is a minor part of your farming operation.

Where to report timber royalties on 1040?

If you held the timber for more than one year before selling it you should report the total amount received for the timber on Form 1040, Schedule D, Part II, column (d). You may be able to recover your cost basis in the timber sold, also referred to as a depletion allowance.

Does selling timber count as income?

The taxation of the gain or loss on a timber sale also depends on whether the seller held the timber as a capital asset. If the timber was held as a capital asset, the gain or loss is taxed as a capital gain or loss. If the timber was held for sale to customers, the gain or loss is taxed as ordinary income.

What is the extended due date for form 1065?

To do this, you simply need to complete the Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, with the IRS. By filing this automatic extension, your partnership can extend the deadline for filing Form 1065 until September 15, 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Timber Income and Property Tax Workshop Registration Form?

The 2011 Timber Income and Property Tax Workshop Registration Form is a document used to register participants for workshops aimed at educating individuals about the tax implications and income handling related to timber sales and property taxes.

Who is required to file 2011 Timber Income and Property Tax Workshop Registration Form?

Individuals and businesses involved in timber production, including landowners, loggers, and forestry professionals, who wish to attend the workshop are required to file this registration form.

How to fill out 2011 Timber Income and Property Tax Workshop Registration Form?

To fill out the form, participants should provide their personal information, including name, contact details, and relevant business information, along with any specific workshop preferences or topics of interest.

What is the purpose of 2011 Timber Income and Property Tax Workshop Registration Form?

The purpose of the form is to facilitate the registration process for participants wishing to attend the workshop, ensuring they receive important information and materials related to timber income and property tax.

What information must be reported on 2011 Timber Income and Property Tax Workshop Registration Form?

Participants must report their name, address, contact information, the number of attendees, and any specific topics they are interested in covering during the workshop.

Fill out your 2011 timber income and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Timber Income And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.