Get the free Mergers and Acquisitions: Strategies and Execution

Show details

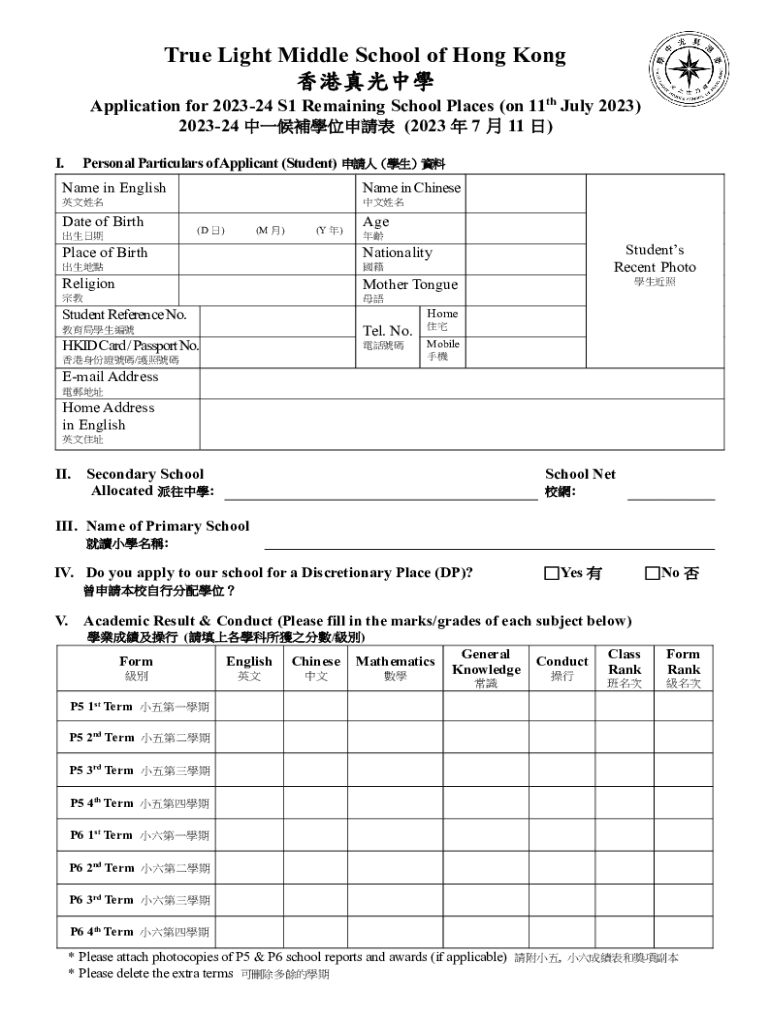

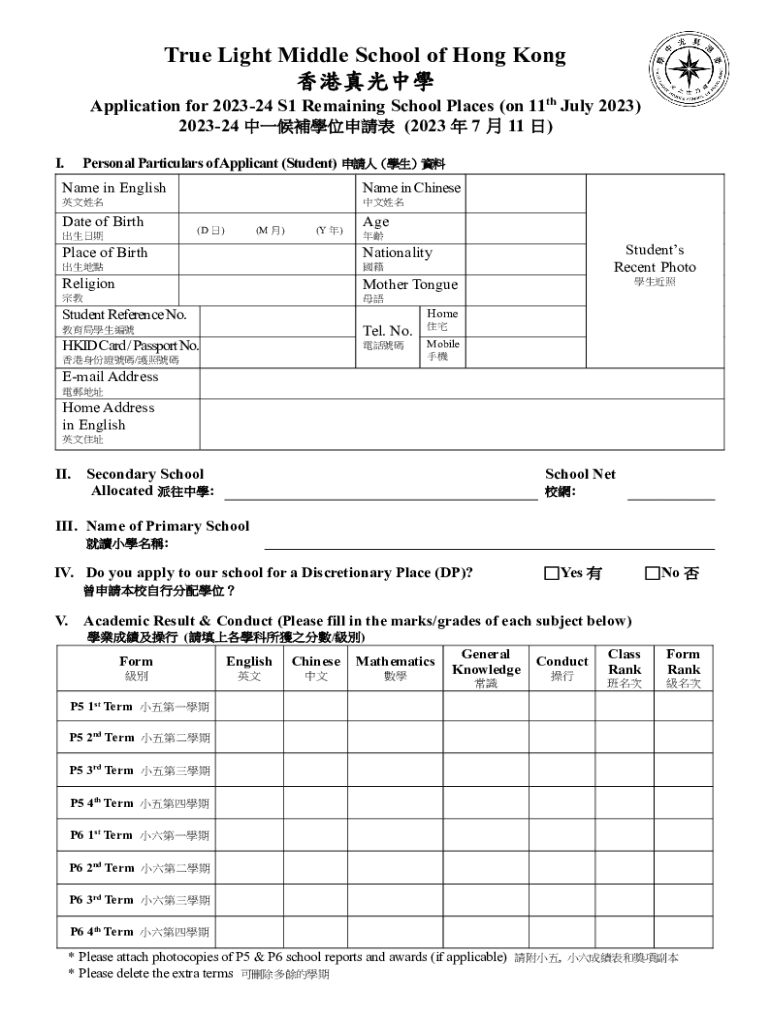

True Light Middle School of Hong Kong

Application for 202324 S1 Remaining School Places (on 11th July 2023)

202324 (2023 7 11)

I. Personal Particulars of Applicant (Student) Name in Englishman in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mergers and acquisitions strategies

Edit your mergers and acquisitions strategies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mergers and acquisitions strategies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mergers and acquisitions strategies online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mergers and acquisitions strategies. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mergers and acquisitions strategies

How to fill out mergers and acquisitions strategies

01

Identify the goals and objectives of the merger or acquisition

02

Conduct thorough research on the potential target company

03

Assess the financial implications and risks involved

04

Develop a detailed integration plan

05

Communicate transparently with all stakeholders throughout the process

Who needs mergers and acquisitions strategies?

01

Companies looking to expand their market presence

02

Businesses aiming to increase their competitive edge

03

Investors seeking to diversify their portfolio

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mergers and acquisitions strategies from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including mergers and acquisitions strategies, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my mergers and acquisitions strategies in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your mergers and acquisitions strategies right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out mergers and acquisitions strategies on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your mergers and acquisitions strategies. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is mergers and acquisitions strategies?

Mergers and acquisitions strategies refer to the plans and methods used by companies to combine or acquire other businesses in order to achieve specific goals or objectives.

Who is required to file mergers and acquisitions strategies?

Companies involved in mergers and acquisitions are required to file strategies with the appropriate regulatory authorities.

How to fill out mergers and acquisitions strategies?

Mergers and acquisitions strategies are typically filled out by providing detailed information about the companies involved, the reasons for the merger or acquisition, and the expected benefits.

What is the purpose of mergers and acquisitions strategies?

The purpose of mergers and acquisitions strategies is to outline the rationale behind the proposed transactions, identify potential risks and benefits, and communicate the overall strategic direction of the companies involved.

What information must be reported on mergers and acquisitions strategies?

Information that must be reported on mergers and acquisitions strategies often includes financial details, market analysis, strategic goals, and integration plans.

Fill out your mergers and acquisitions strategies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mergers And Acquisitions Strategies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

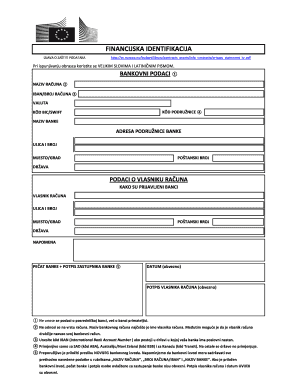

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.